- AUD/NZD remains firm above 50-day EMA after Australia’s July month employment data beat estimates.

- 200-day EMA, 61.8% Fibonacci retracement becomes the key upside resistance to watch.

Australia’s upbeat employment statistics propelled additional strength in the AUD/NZD pair that takes the bids around 1.0510 during Thursday’s Asian session.

Australian Employment Change grew past-14.0K forecast to 41.0K with Unemployment Rate being stable at 5.2%. Adding to note is the increase in Participation Rate to 66.1% from 66.0% market consensus and a rise in Fulltime Employment to 34.5K from 21.1K prior.

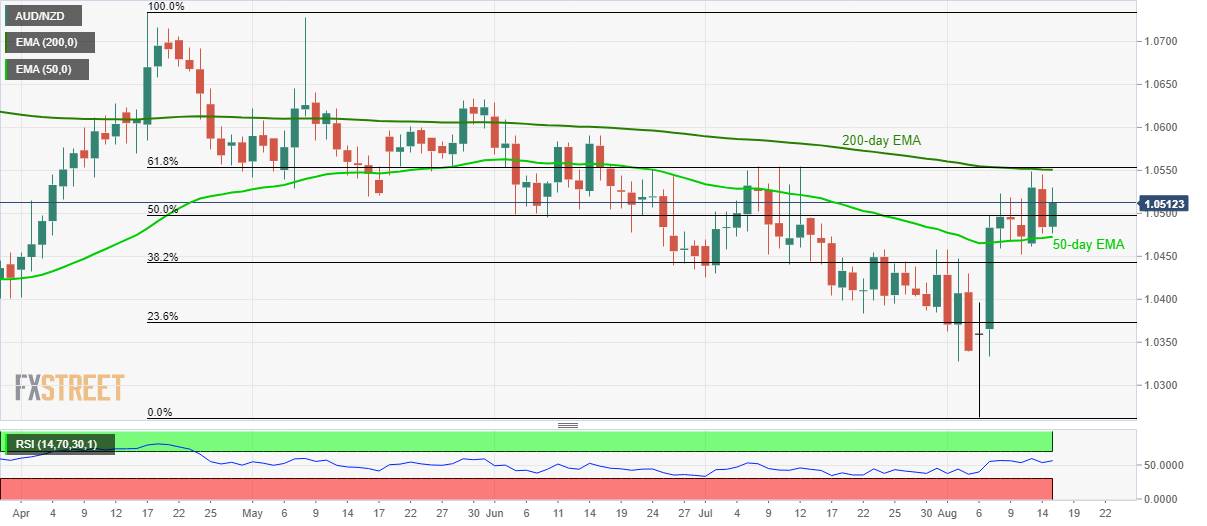

Buyers now look for 1.0550/54 resistance confluence including 61.8% Fibonacci retracement of April – August declines and 200-day exponential moving average (EMA).

If bulls rule beyond 1.0554 on a daily closing basis, mid-June high of 1.0591 will be their next target.

Meanwhile, 50-day EMA level of 1.0473 acts as close support before sellers target July 01 bottom of 1.0425.

AUD/NZD daily chart

Trend: Bullish