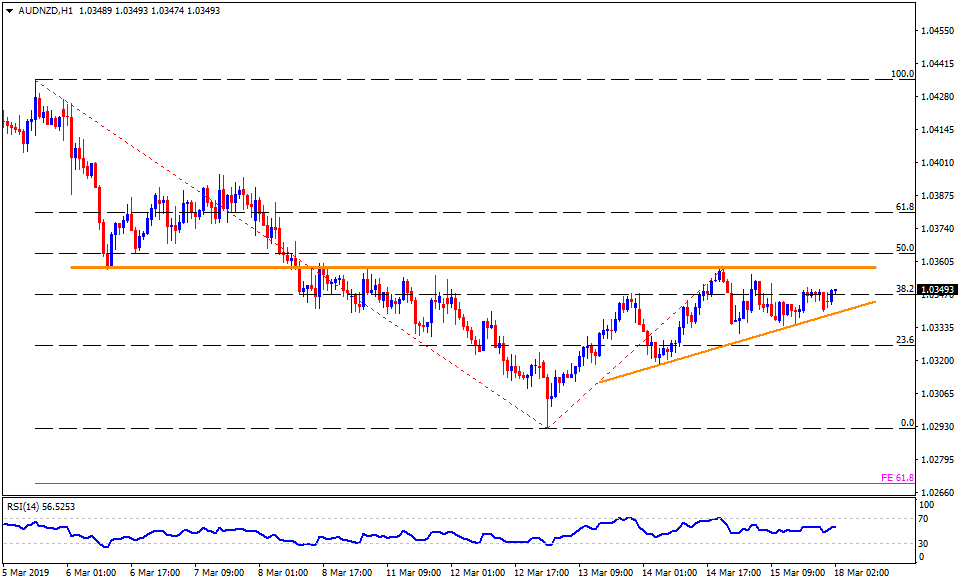

- AUD/NZD is on bid near 1.0350 during early Monday.

- In spite of registering gradual recovery since Wednesday, the quote couldn’t surpass 1.0360 horizontal-resistance nearing March 06 low and highs marked during March 08 and 11.

- However, an upward sloping trend-line connecting Thursday and Friday’s low, at 1.0340, portrays the buyers’ power.

- Should the quote manage to surpass 1.0360, it can quickly rush through 1.0380 in order to aim for 1.0400 resistance.

- Also, sustained advances past-1.0400 may help pair to aim for 1.0420 and 1.0435 north-side numbers.

- On the flipside, pair’s dip beneath 1.0340 support line can recall 1.0320 and 1.03000 levels on the chart whereas 1.0290 could challenge the sellers afterward.

- In a case prices continue sliding under 1.0290, 61.8% Fibonacci expansion of its moves from March 05 to 14, at 1.0270, can please bears.

AUD/NZD hourly chart

Additional important levels:

Overview:

Today Last Price: 1.0352

Today Daily change: 1 pips

Today Daily change %: 0.01%

Today Daily Open: 1.0351

Trends:

Daily SMA20: 1.0393

Daily SMA50: 1.0473

Daily SMA100: 1.0542

Daily SMA200: 1.0722

Levels:

Previous Daily High: 1.0361

Previous Daily Low: 1.0325

Previous Weekly High: 1.0363

Previous Weekly Low: 1.0293

Previous Monthly High: 1.0551

Previous Monthly Low: 1.0362

Daily Fibonacci 38.2%: 1.0339

Daily Fibonacci 61.8%: 1.0347

Daily Pivot Point S1: 1.0331

Daily Pivot Point S2: 1.031

Daily Pivot Point S3: 1.0295

Daily Pivot Point R1: 1.0367

Daily Pivot Point R2: 1.0382

Daily Pivot Point R3: 1.0402