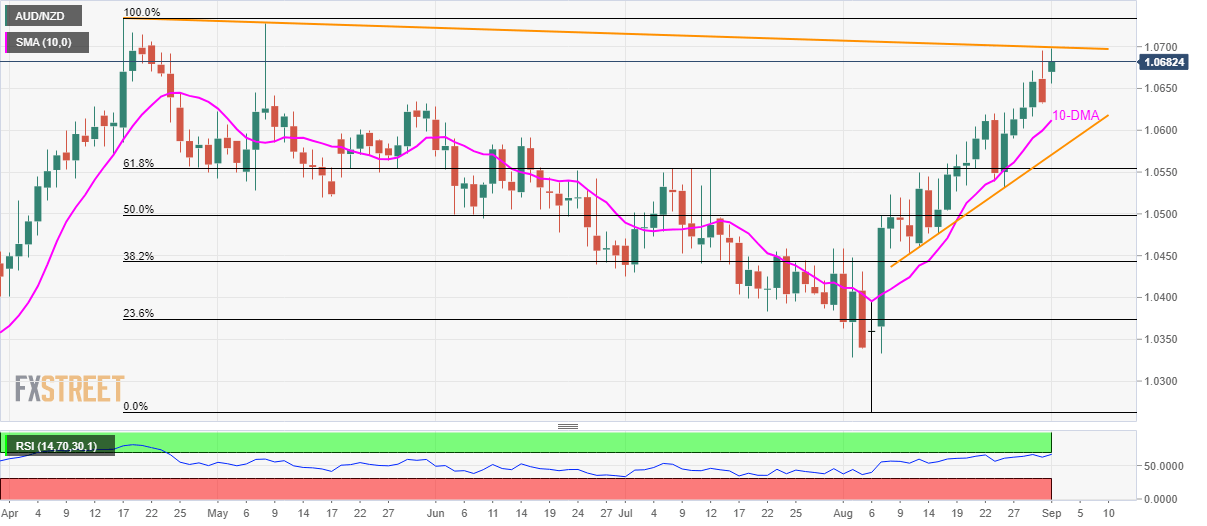

- AUD/NZD struggles to cross 4.5-month-old resistance-line amid overbought RSI.

- China’s August month Caixin Manufacturing PMI is in the spotlight.

AUD/NZD fails to clear a falling trend-line since April 17 as it makes the rounds to 1.0680 during Asian session on Monday.

In addition to the near-term key resistance-line, overbought condition of 14-bar relative strength index (RSI) and traders’ cautious mood ahead of China’s Caixin Manufacturing purchasing managers’ index (PMI) data also limit the pair’s upside.

Should prices take a U-turn, which is a highly likely scenario considering 49.8 forecasts for China’s data versus 49.9 prior, May-end top surrounding 1.0634 and 10-day simple moving average (DMA) level of 1.0612 can entertain sellers ahead of pushing them to three-week-long support-line of 1.0570.

Meanwhile, a positive surprise can quickly fuel prices beyond 1.0700 resistance-line to April month high of 1.0734 and then in the direction to early November 2018 high surrounding 1.0770.

AUD/NZD daily chart

Trend: pullback expected