- The AUD/NZD dropped sharply recently after GDP data from Australia and then trimmed losses modestly.

- It bottomed at 1.0357, the lowest level intraday level since January 3 (mini-flash crash) and is headed to the weakest close in two years.

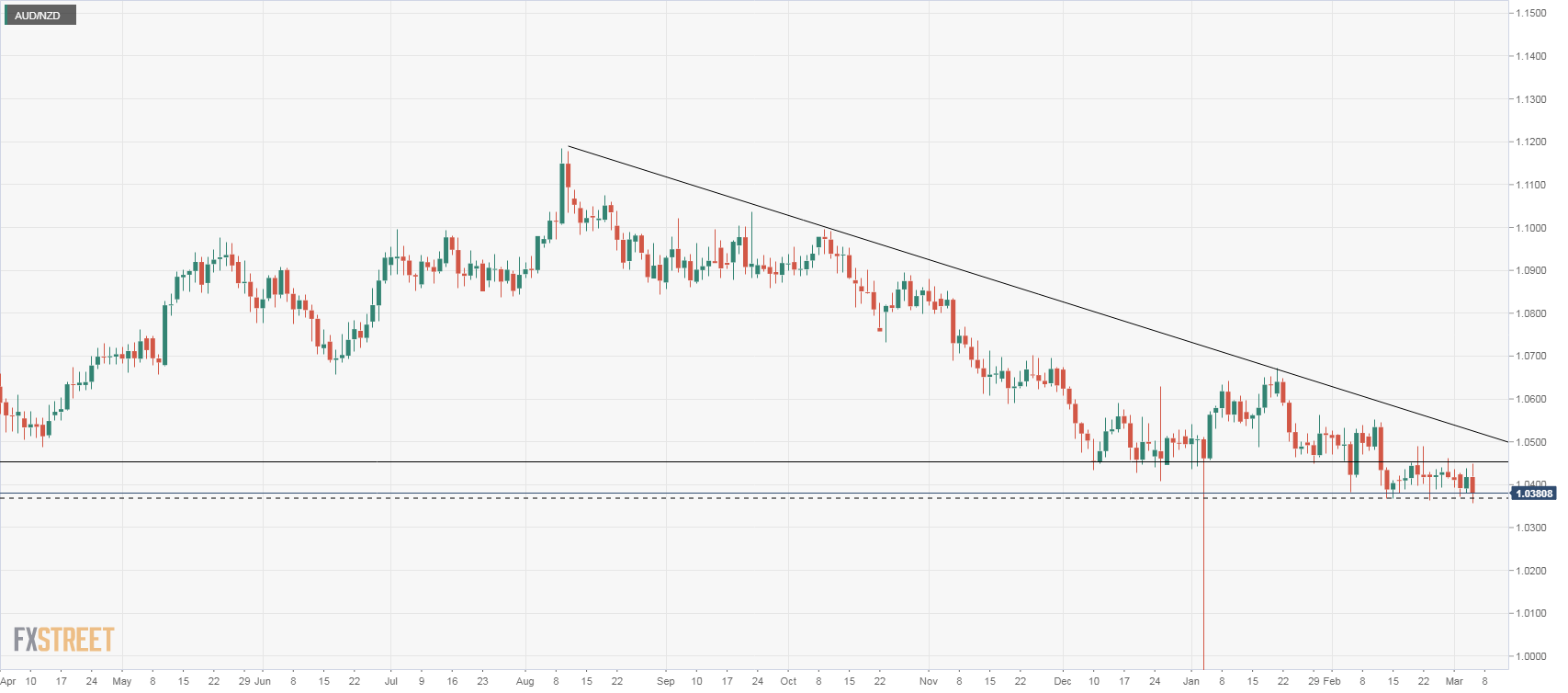

- The consolidation back below 1.0400 shows that the bearish bias remains intact and points to further losses. Below 1.0360, the next targets might be located at 1.0310/20 (July 2016 / January 2017 low) and 1.0280 (July 2017 low).

- The bearish pressure should ease with a recovery back above 1.0400. The next strong resistance is seen around 1.0450.

- The critical level comes at 1.0520/30, a downtrend line that if broken should clear the way to more gains for the Australian dollar.

AUD/NZD Daily chart

AUD/NZD

Overview:

Today Last Price: 1.038

Today Daily change %: -0.36%

Today Daily Open: 1.0418

Trends:

Daily SMA20: 1.0435

Daily SMA50: 1.0497

Daily SMA100: 1.0581

Daily SMA200: 1.0742

Levels:

Previous Daily High: 1.0438

Previous Daily Low: 1.0381

Previous Weekly High: 1.0462

Previous Weekly Low: 1.0362

Previous Monthly High: 1.0551

Previous Monthly Low: 1.0362

Daily Fibonacci 38.2%: 1.0416

Daily Fibonacci 61.8%: 1.0403

Daily Pivot Point S1: 1.0387

Daily Pivot Point S2: 1.0356

Daily Pivot Point S3: 1.033

Daily Pivot Point R1: 1.0443

Daily Pivot Point R2: 1.0469

Daily Pivot Point R3: 1.05