- AUD/NZD retraces from the highest since early-May after Australia’s Building Permits and Private Sector Credit data.

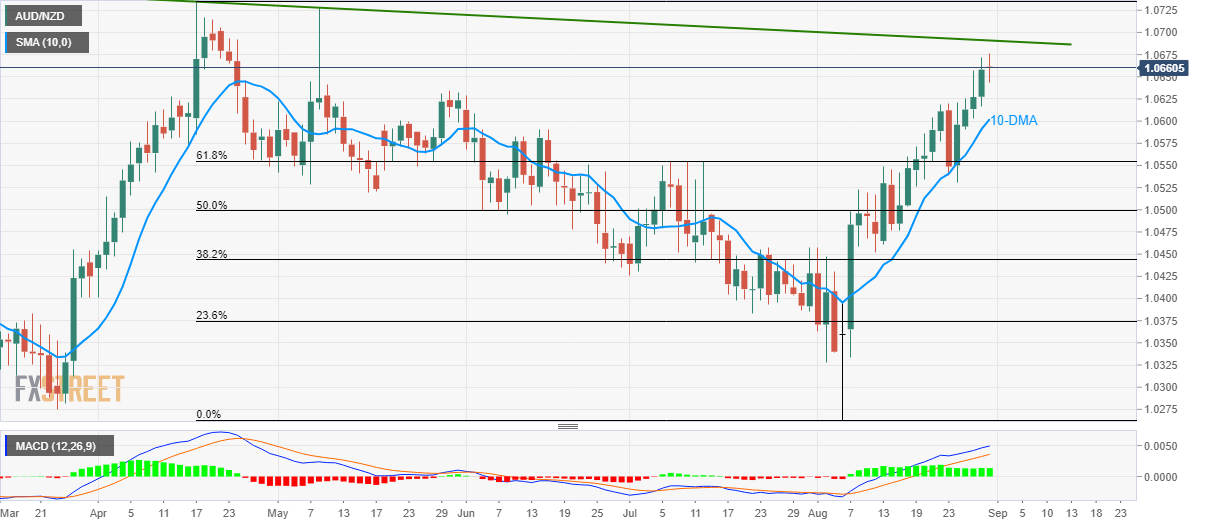

- A downward sloping trend-line since mid-April seems to the key resistance with 1.0630 and 10-DMA acting as nearby supports.

AUD/NZD refrains from extending the previous run-up to four-month high as it trades near 1.0660 by the press time of initial Friday.

Australia’s Private Sector Credit weakened to 3.1% versus 3.3% prior on YoY basis while marking an improvement to 0.2% against 0.1% earlier on a monthly basis in July. Further, Building Permits slumped -28.5% yearly compared to -25.6% previous while also lagging behind 0.0% forecast to a whopping -9.7% on MoM basis during the month of July.

In a reaction to the news, AUD/NZD pulls back from multi-month highs, which in-turn highlight May-end top near 1.0630 as immediate support ahead of diverting sellers to 10-day simple moving average (DMA) level of 1.0600.

However, upside momentum is less likely to be affected unless the quote slips below 61.8% Fibonacci retracement of April-August south-run at 1.0555.

On the upside, a falling trend-line since late-April, at 1.0691 holds the key to pair’s rally towards the yearly high of 1.0734.

AUD/NZD daily chart

Trend: pullback expected