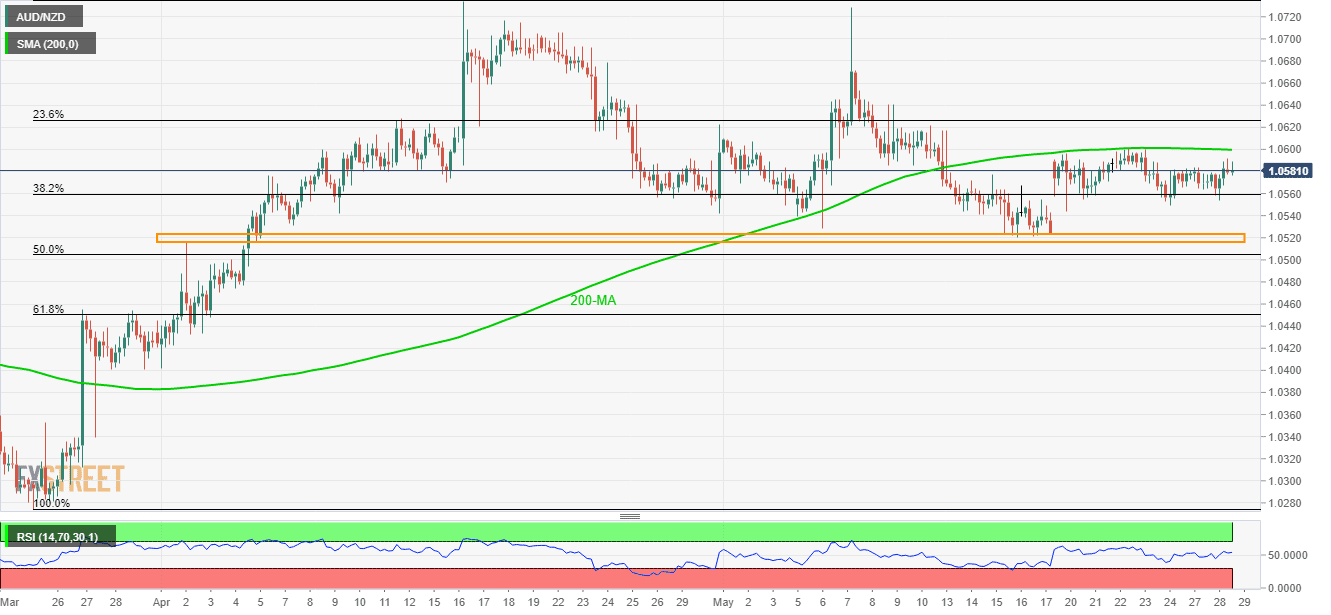

- 200 bar moving average limits the upside with 1.0535/25 acting as strong downside support.

- The limited upside prevails on the MA break compared to a larger gap on the down if breaking 1.0525.

Sustained trading beneath 200-bar simple moving average on the 4-hour chart (4H 200MA) presently drags the AUD/NZD pair towards 1.0580 during early Wednesday.

As a result, the quote is likely to revisit the 1.0555 immediate support while 1.0525/35 horizontal area comprising early April high and latest lows can question sellers afterward.

In a case where prices slip under 1.0525, 61.8% Fibonacci retracement of March – April rise near 1.0450 could quickly flash on bears’ radar.

On the flipside, 4H 200 MA level of 1.0600 acts as near-term important resistance as a break of which can trigger the pair’s advances to 1.0625 and 1.0670 numbers to the north.

Should there be increased buying past-1.0670, April month top surrounding 1.0735 could be on the bulls’ list.

AUD/NZD 4-Hour chart

Trend: Pullback expected