The Australian dollar is still trading in the 0.72 handle, trying to get a grip on what’s going on in China.

The team at National Australia Bank sees upside risks for AUD:

Here is their view, courtesy of eFXnews:

“While next week’s RBA Board meeting outcome looms increasingly large (NAB does not expect the RBA to act) there is plenty of central bank event risk between now and then that will have implications for the AUD.

The statement accompanying what will almost certainly be Fed policy inaction on Wednesdaynight will move the big dollar (more likely down than up we’d suggest, if the choice of words pulls markets further away from expecting a December move). If the Fed instead conveys the impression it is getting closer to ‘lift-off’ (unlikely) market scepticism is likely to limit upside risk for USD and which would otherwise pull AUD/USD lower.

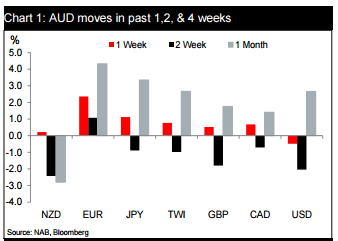

The RBNZ’s policy decision (two hours after the Fed) is going to move AUD/NZD one way or another and with that AUD/USD. We see it is as a line-ball call, but since the market will be more surprised by a cut than inaction, there is more upside risk for AUD/NZD on a cut than fresh downside if the RBNZ stands pat. And then on Friday, we’ll see if the BoJ wants to surprise us, as the ECB did last week and they themselves did a year ago this week. AUD/JPY is susceptible to a complete reversal of the late week run-up if the BoJ does nothing.

Big upside risk from RBA inaction on 3 November. It’s highly doubtful that the past fortnight’s AUD/USD range will hold post RBA. A cut, which will certainly surprise us and most of the market, brings 0.70 back into play. NAB’s views is that the RBA will at least want evidence the economy may be spluttering, whether or not as a result of these out-of-cycle rate rises.

On inaction, then in the context of latest ECB signals and diminishing perceived risk of Fed 2015 lift-off, AUD is susceptible to gains. This is likely both from renewed short covering and likely revival of interest in being long AUD assets as a carry trade amid declining market volatility.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.