- AUD/USD is trading in a tight range under 0.7350.

- Delta variant continues to weigh on the Australian Dollar.

- The divergence between RBA and Fed policies are giving more room to the bears.

The AUD/USD pair is trading modestly unchanged on Friday, confined to just a narrow range of 15 pips below 0.7350. The AUD/USD analysis is bearish to neutral at the moment.

At the time of writing, Australia’s currency is trading at 0.7340 and is on a course to suffer a small weekly loss as sellers aim to reach the 2021 low at 0.7288.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

As a result of the continuing rise in Delta Covid infections in Australia, New South Wales (NSW), the country’s most populous state, has reported 390 new infections, with more expected in the coming days, placing pressure on the Australian Dollar.

Covid may be the subject of further border control measures when Australia’s cabinet meets later Friday to address the situation.

Investors struggled to forecast the Reserve Bank of Australia (RBA)’s actions amid rising Covid cases, which sent Aussie bulls into a defensive position. On Tuesday, the minutes from the RBA will be released, which will enable traders to get a new perspective on how the central bank views monetary policy.

There is still a divergence between the Federal Reserve and the Reserve Bank of Australia regarding monetary policy. However, US producer price data were positive last week, strengthening the Fed’s position and boosting the US dollar, despite the fact the Dollar was awaiting Michigan consumer sentiment data on today’s National Assembly meeting, which is expected to be a critical release for the Dollar.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

AUD/USD technical analysis: Bears looking for an impetus

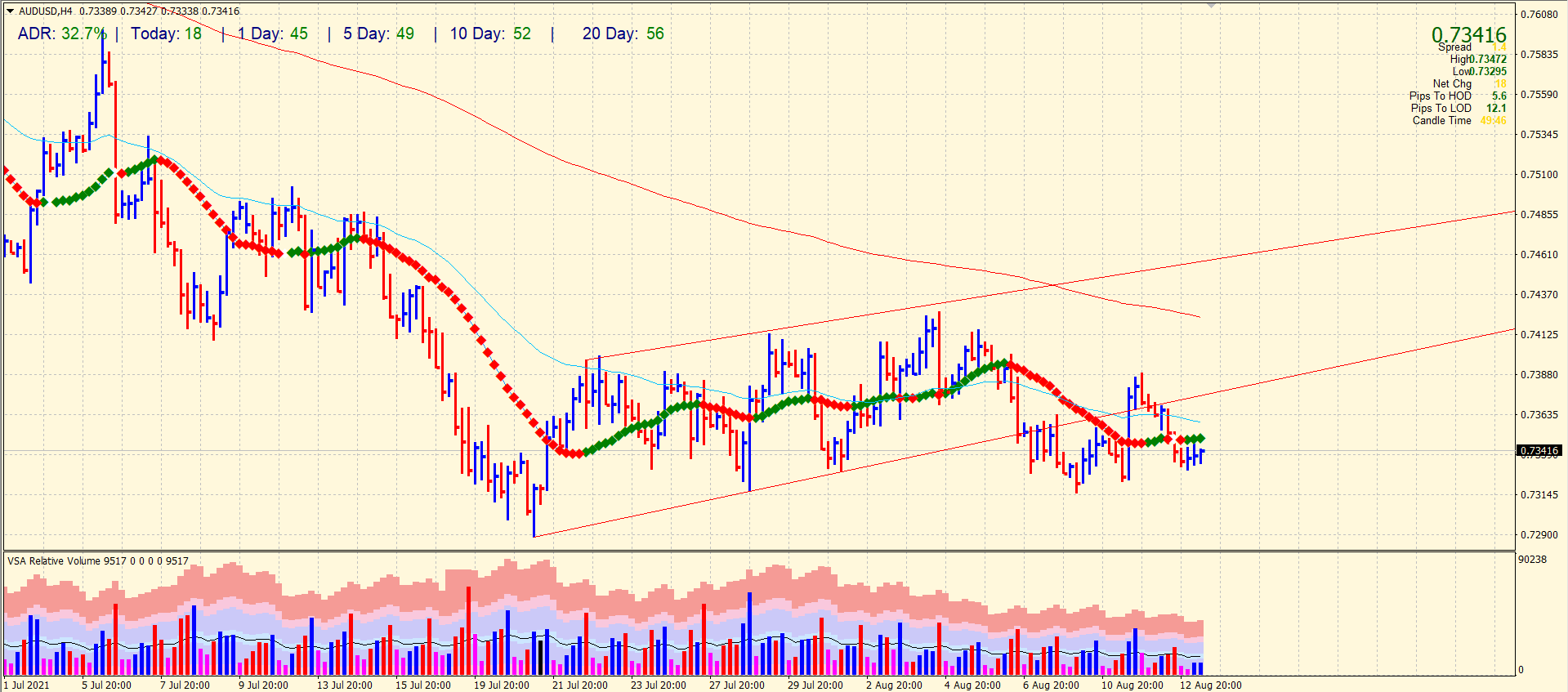

The AUD/USD pair is neutral below the 20-period SMA on the 4-hour chart. The volume is very thin, which indicates no volatility in the market. The 50-period SMA and broken channel’s support turned resistance continue to press the pair. So far, only 32% of the average daily range has been covered. It means that the market is awaiting a catalyst to trigger some volatile move on either side. Greater probability lies on the downside.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.