- AUD/USD slides in the Asian session after yesterday’s rise.

- US Dollar finds sellers after US CPI and recent Fed’s comments.

- Covid headlines, US PPI and unemployment claims can provide fresh impetus to the market.

The AUD/USD pair analysis consolidates recent gains in a 25-point range below 0.7390, around 0.7375 in the Asian session on Thursday. The pair previously welcomed a pullback in the US dollar, helped in part by US CPI data. However, Covid fears the bulls are being chased by the bears.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

The US dollar index (DXY) hit its highest level since early April before falling from 93.19 after US consumer price index (CPI) data supported the Federal Reserve System (FRS), saying the surge in inflation was “temporary “. At the same time, the general consumer price index did not change at 5.4% y/y against the forecast of 5.3%, and the basic consumer price index excluding food and energy decreased from 4.5% to 4.3%.

The mixed data and the comments of Fed leaders support the market sentiment and the AUD/USD rates. President Esther George of the Federal Reserve Bank of Kansas City has addressed the need to restore “the old attitude.” She rejects a rise in interest rates but says the normalizing policy will be “long and thorny.”

Though AUD/USD pair buyers are less concerned about tightening and rate hikes, for the time being, the extension of the Melbourne virus restrictions, as well as the absence of an easing of infections in New South Wales (NSW), cast doubt on optimism. However, the US data are also forecasting the death toll to rise in five months, and the China Coronavirus data do not relieve concerns about the resurgence of the virus.

The Senate’s passage of the infrastructure spending plan, however, encourages risk appetite. However, the GOP’s promise to stop Democrats negotiating the budget and debt limit raises doubts. In spite of this, US President Joe Biden said he is not concerned about the US defaulting on its debt.

These events prompted Wall Street to close in a range of directions, and the yield on 10-year Treasury bonds dropped to 1.33%.

Forecasts suggest that consumer inflation in Australia in August will rise from 3.7% to 3.8%, and the trend of that will be critical in determining the direction of trade. In addition, COVID-19 headlines will be in the spotlight ahead of the US Producer Price Index (PPI) and weekly jobless claims data in July.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

AUD/USD technical analysis: 50-SMA to support bulls

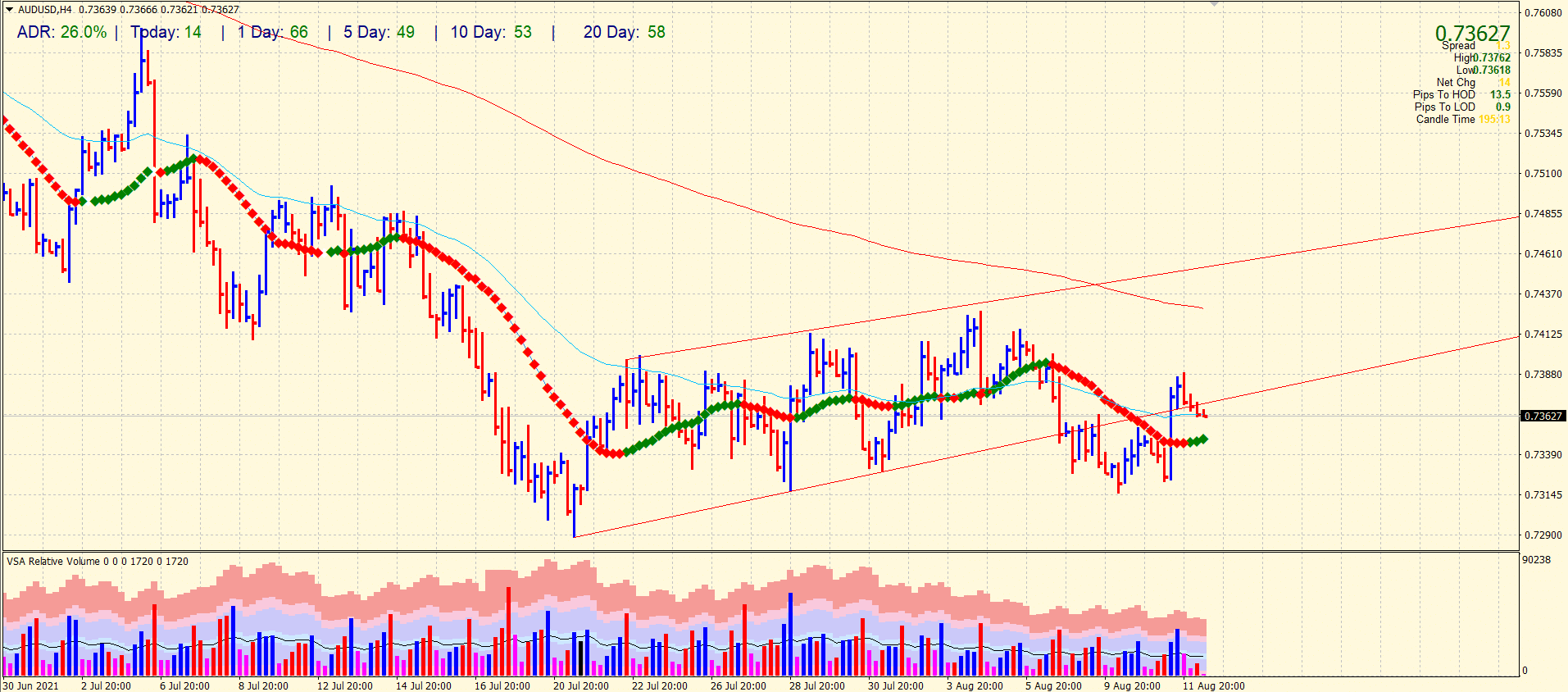

The AUD/USD pair found acceptance above 20-period SMA on the 4-hour chart. The pair is now consolidating yesterday’s gains around the 50-period SMA and previously broken trend channel. The volume during the consolidation phase is quite low, which indicates that the bulls can resume the rally during active market hours.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.