- AUD/USD remains resilient above 0.7400 area.

- Traders await US NFP to find a catalyst for further price action.

- Delta variant is spreading in Australia that may hinder the bullish momentum.

The AUD/USD pair analysis reveals a strong bullish scenario as the Greenback remains weak despite better unemployment claims figures.

The AUD/USD pair is trading at 0.7407, up 0.17% at the time of writing.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

As the week’s trading comes close, the risk-sensitive Australian dollar climbs for a second straight week. US dollar depreciated during Wall Street’s trading session on Thursday after a positive performance report. US initial jobless claims declined to 340,000 in the week ended Aug. 28 from the previous week, beating analysts’ expectations. Hopefully, this will allay some concerns about Covid delaying the recovery.

The nonfarm payrolls report (NFP) on Friday will be closely monitored to inform the Fed on its policy course. This number is projected to hit +750,000, slightly lower than the July figure of 943,000. As a result, this month’s NFP number will be the last before the meeting of the Federal Reserve. However, as the inflation target has been achieved, jobs will remain crucial.

Some data today could affect the market, although it is unlikely that market direction will change before today’s report on the US labor market. This morning, the Ai Group’s construction index stood at 38.4, up from 48.7 in July. In August, Markit Economics’ PMI report contracted for the second straight month. Retail sales for July will be reported at the end of the week. In addition, the Caixin Services PMI for August will be watched by traders.

As a result of the Covid Delta variant, the prime ministers implemented restrictive isolation measures in Victoria and New South Wales (NSW), causing the Australian dollar to fall in the summer months. Economic growth may slow down as a result of these restrictions, according to some economists. However, with Australia’s vaccination campaign, massive bans may become obsolete in the not too distant future. Therefore, AUD/USD prices may already be reflecting an unfavorable scenario, which could result in further upward movement after growth stops in some cases.

–Are you interested to learn more about forex signals? Check our detailed guide-

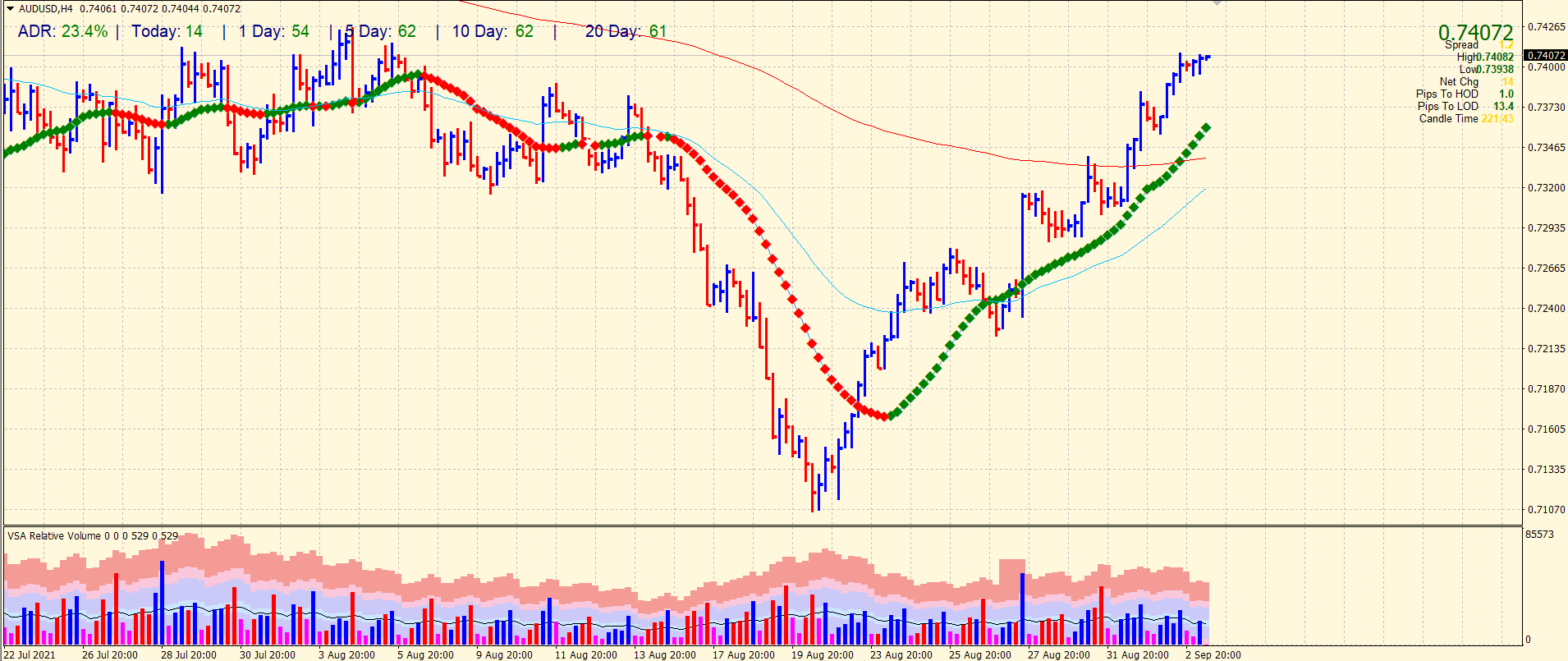

AUD/USD price technical analysis: Swing highs in view

The AUD/USD price remains positive near the 0.7400 area. The next target for the bulls lies at 0.7430 (swing highs), where profit taking is expected. After that, the price may retrace from the resistance. However, if the resistance breaks, the probability of testing 0.7460 and 0.7500 will be quite high. On the flip side, the pair may find support near 0.7360 ahead of 0.7300.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.