- AUD/USD bulls expect a dovish outcome and higher cycle highs for the high beta currency.

- Fed expected to be dovish and offer more accommodative QE.

AUD/USD is currently trading at 0.7561 between a low of 0.7545 and 0.7578, virtually flat on the day as The Street gets set for the Fed.

AUD is a proxy to risk and will be highly vulnerable to the market’s take on the outcome of the last Federal Open Market Committee’s meeting for 2020 that started yesterday, concluding with the Federal Reserve’s interest rate decision, monetary policy announcements and statement followed by the Fed’s Chair’s press conference.

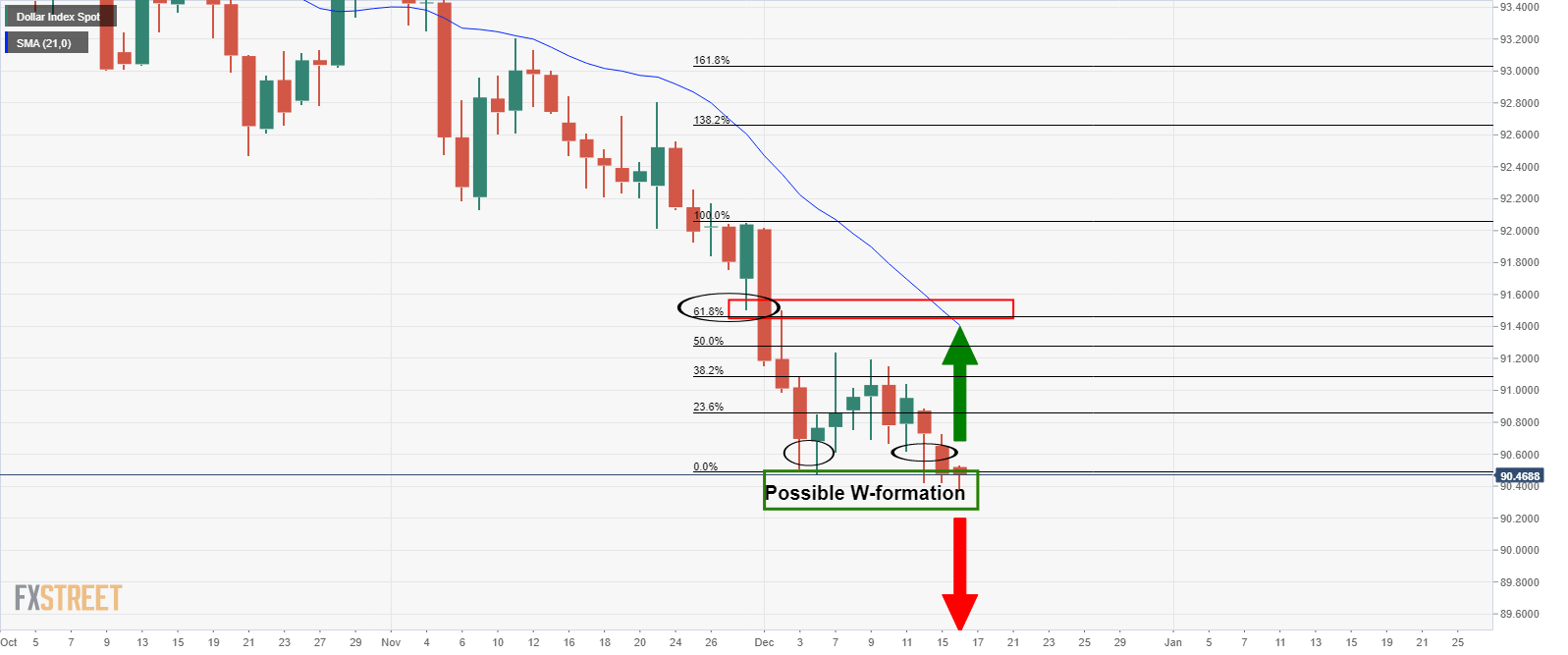

The US dollar is already weak heading into the meeting, and tracking its performance through the DXY, it fell to the lowest levels in 2.5 years following strong European PMI readings.

EUR/USD pushed to a fresh cycle peak above 1.22, its highest level since April 2018. Subsequently, the Aussie also got a boost, rising to match its highest levels since June 2018.

”Our base case for the Fed has us looking for further downside risks for USD that could send EURUSD higher to test 1.2275,” analysts at TD Securities said.

”That said, the analysts also note that the USD’s downtrend is now increasingly mature. ”Stretched positioning & valuation considerations may ultimately be a limiting factor on a dovish outcome.”

DXY chart

What to expect from the Fed?

The FOMC meeting will be the main focus on Wednesday, with markets focused on the statement which is expected to include new forward guidance stating that QE will continue until there is clear-cut progress toward the maximum employment and 2% inflation goals.

There are few economists that expect any changed to the $120bn-per-month pace for total net purchases.

The median dot plot projection is also unlikely to change and will potentially continue to show rate increases through at least the end of 2023.

Investors will also be keenly on the look-out for mention as to whether the Fed will extend the weighted-average maturity of QE, (WAM of QE).

”A WAM extension would bull flatten the curve as the market is only about 25% priced for this dovish outcome,” analysts at TD Securities explained. ”Stopping short of a WAM extension would bear steepen the curve.”

All in all, in an environment marked by expectations that the Fed will continue to use its balance sheet to support the USD economy and depress the USD, the high betas, such as the Aussie can thrive.

”AUD/USD looks set to remain well supported,” analysts at Rabobank argued.

”However, bulls should beware of the potential pitfalls facing the AUD.”

”We suspect upside potential will be tempered. Our 12-month forecast stands not far from current levels at AUD/USD 0.76.”