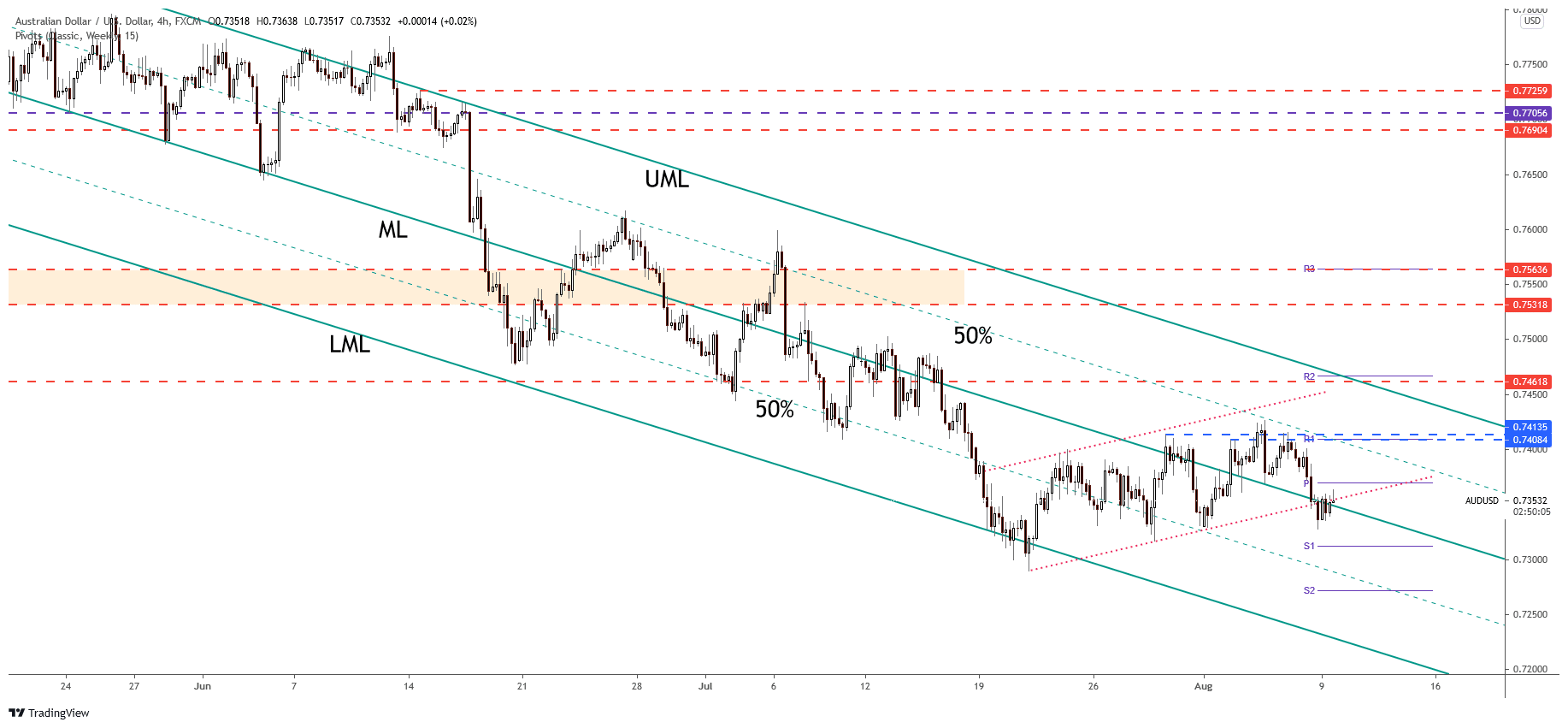

- AUD/USD escaped from a continuation pattern as the DXY has managed to jump higher again.

- The descending pitchfork’s lower median line (LML) is seen as a potential downside target.

- Failing to stabilize above the median line (ML) signaled strong sellers and a potential downside movement.

The AUD/USD price is trading in the red at 0.7346 below 0.7363 today’s high. However, the pair have escaped from a continuation pattern, so the further drop is favored. Also, the Dollar Index has managed to increase in the last hours, erasing some of the short-term losses.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

DXY’s growth signals that the USD may increase versus its rivals. On the other hand, AUD/USD maintains a bearish bias, so a further decline could be natural if the DXY reaches new highs. Still, technically, we need confirmation before considering going short on this pair.

The US JOLTS Job Openings has increased from 9.48M to 10.07M, even if the specialists have expected to decrease to 9.27. The Australian NAB Business Confidence will be released tomorrow, but I’m not expecting this to have an impact.

The traders are waiting for the US inflation data to be published on Wednesday before taking action. So, you should be careful around these economic figures as AUD/USD could move in both directions.

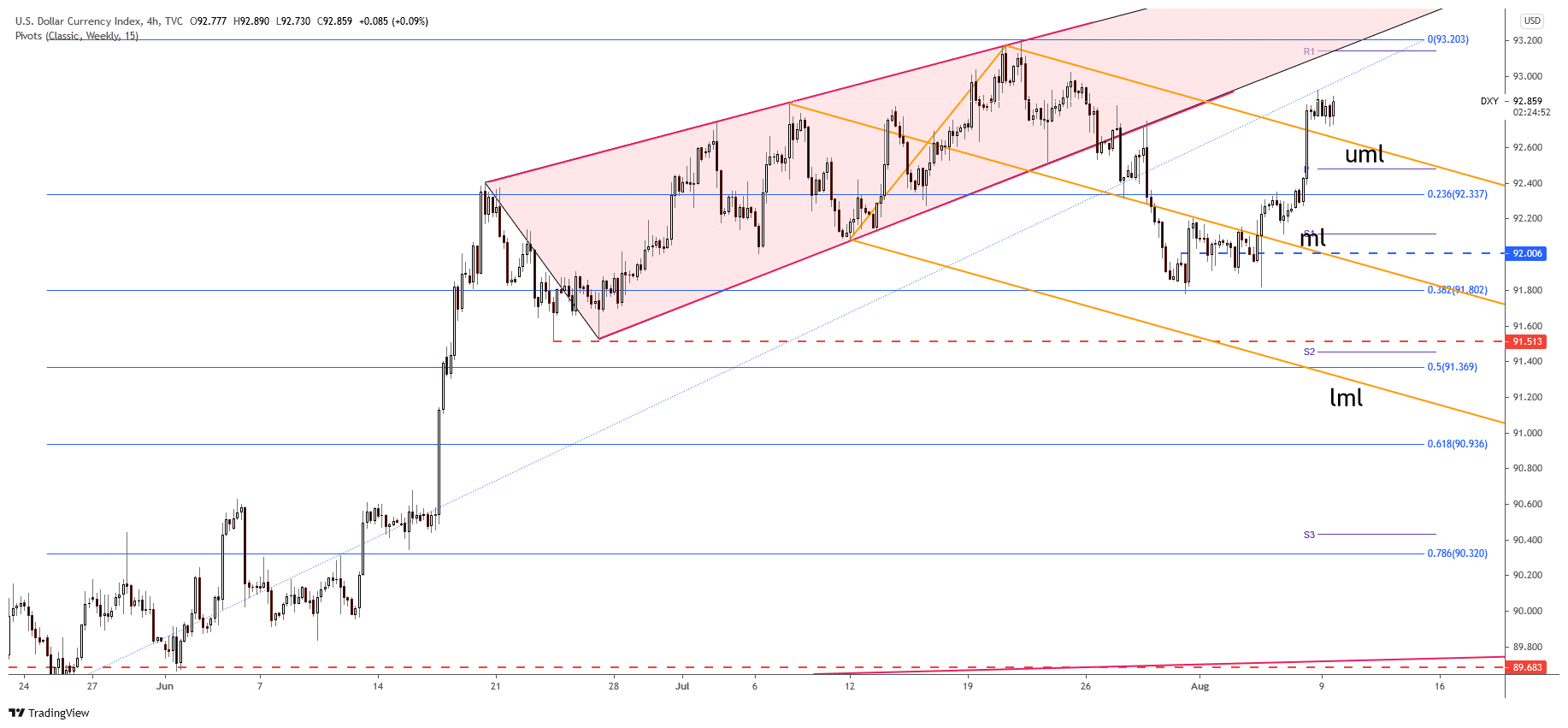

DXY price technical analysis

The Dollar Index is located above the broken upper median line (UML). Failing to reach and retest the broken dynamic resistance may signal further growth. Only a temporary decline towards the upper median line (UML) could signal that the AUD/USD pair may increase slightly.

DXY has ended its correction after failing to close below the 38.2% and after coming back far above the 23.6% level.

AUD/USD price technical analysis: Downtrend to prevail

The AUD/USD price has increased slightly within the up-channel body, but now it has dropped below the downside line, under the uptrend line. Stabilizing below it and under the descending pitchfork’s median line (ML) may announce a deeper decline.

–Are you interested to learn more about forex signals? Check our detailed guide-

It has found resistance at 0.7413 level and now is traded far below 0.7369 weekly pivot point. The next downside target, obstacle, is seen at the S1 (0.7312) level. Technically, the major downside target is at the descending pitchfork’s lower median line (LML).

Also, 0.7289 lower low is seen as a potential downside target if AUD/USD continues to drop in the short term. However, only a valid breakout above the weekly pivot point (0.7369) could invalidate the downside movement.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.