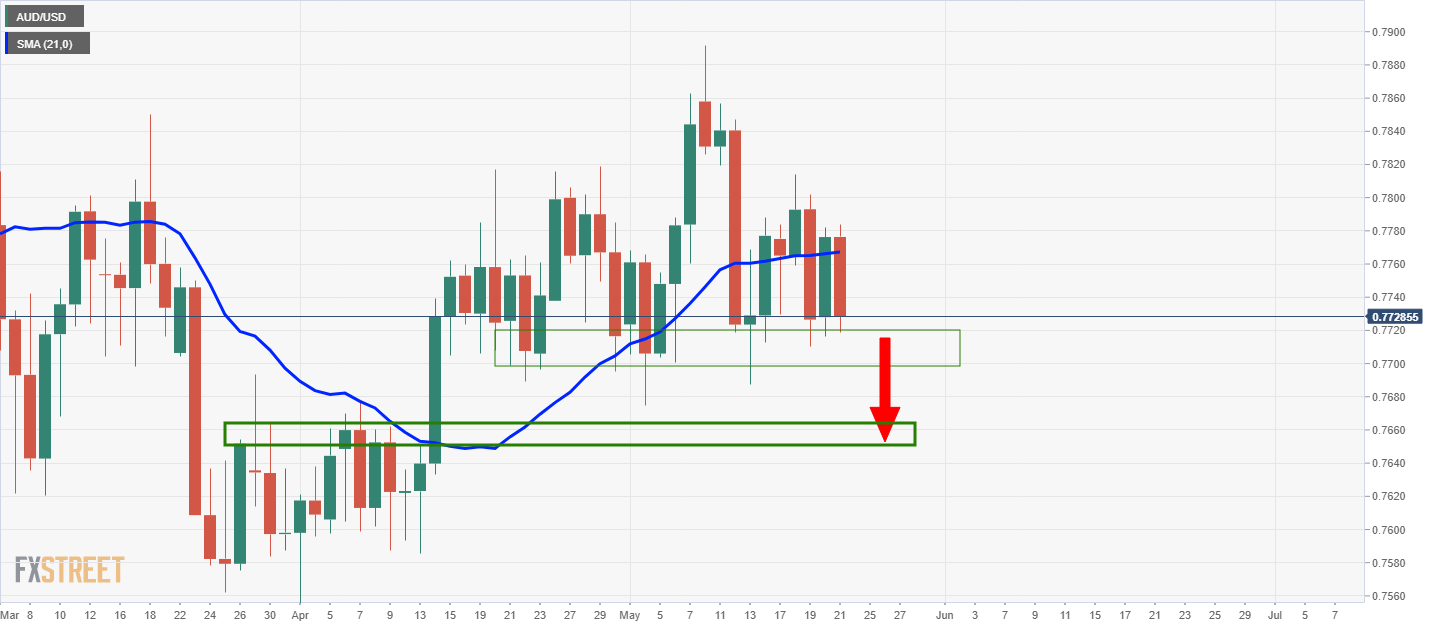

- AUD/USD bears seeking break of the daily support structure.

- Eyes on the daily H&S pattern, commodities and US stocks.

AUD/USD ended lower on Friday, losing 0.59% as the US dollar firmed on strong US data during mixed markets on Wall Street.

AUD, which is a high-beta currency, is closely correlated to the performance of US stocks and commodity prices and had suffered an end of week blow.

US data is proving to be a thorn in the side of the Aussie bulls and the negative correlation between US stock and the US dollar played its role in the bearish outcome in the pair on Friday.

The US preliminary May composite index rose strongly to a record high of 68.1. Both manufacturing and services rose to record highs with the 5.4 point surge in services to 70.1 particularly impressive.

”Owing to vaccination progress, service sector activity is bouncing back sharply,” analysts at ANZ bank explained.

”However, expectations of strong growth are pervasive and equity markets struggled to rally on the data,” the analysts noted which in trend weighed on the Aussie.

Meanwhile, the analysts argue that ”the debate in financial markets is now not so much about how quickly Gross Domestic Produce can recover but rather the shape of recoveries.”

Traders are taking the view that the Federal Reserve will stick to the lower for longer mantra that argues any price increases are transitory.

Meanwhile, from a domestic front, AUD has received mixed signals from both the data and commodity side this week.

In the face of the end of the JobKeeper wage subsidy, the Unemployment Rate fell to 5.5% in March and the outcome of the data was positive despite the drop in the Employment number.

The Reserve Bank of Australia will not be on the schedule for a while yet, but there is the case for a slightly less dovish central bank which is a booster for the Aussie.

In the interim, traders will be keen to watch for developments in the commodities sector.

Iron ore has been in recovery mode of late within tight ranges but any further downside will anchor progress in the Aussie, as will risk related to the developments in the Aussie-China trade relationships.

AUD/USD technical analysis

From a technical perspective, the bearish head and shoulders on the daily chart are compelling for the days ahead: