- Spot recedes from recent tops and returns near 0.7100.

- Renewed USD-buying prompted the current knee-jerk.

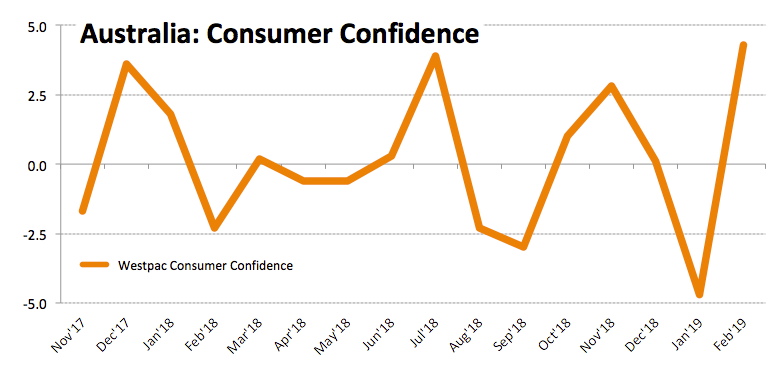

- Westpac Consumer Sentiment improved to 4.3% in February.

The Aussie Dollar is prolonging the upside momentum so far this week and has lifted AUD/USD to the vicinity of the 0.7140 area, just to lose some vigour afterwards.

AUD/USD in 5-day peaks

Despite the ongoing correction, the pair manages well to keep the bid tone intact and trade in the area of multi-day highs beyond 0.7100 the figure amidst some recovery in the greenback.

Earlier in the session, AUD met some extra oxygen following the auspicious print from the Consumer Confidence tracked by Westpac, advancing 4.3% for the current month vs. January’s 4.7% drop.

Looking ahead, the pair should stay under pressure via USD-dynamics in light of the publication of inflation figures for the month of January gauged by the CPI along with speeches by FOMC’s Bostic, Mester and Harker.

What to look for around AUD

The recent renewed sentiment in the risk-associated complex has been sustaining the up move in the pair to levels beyond 0.7100 the figure, partially reverting last week’s sell-off. Additionally, optimism around the US-China trade talks continue to lend support to AUD demand. However, the fresh neutral stance from the RBA should limit occasional bullish attempts in the near term. In addition, it is worth recalling that the central bank cut its growth projections on the potential slowdown in China, the correction in the domestic house sector and potential trade jitters.

AUD/USD levels to watch

At the moment the pair is up 0.29% at 0.7115 and a breakout of 0.7135 (high Feb.13) would aim for 0.7157 (21-day SMA) and then 0.7279 (200-day SMA). On the downside, the next support lines up at 0.7075 (low Jan.25) seconded by 0.7054 (low Feb.12) and finally 0.7076 (low Jan.25) and finally 0.7021 (monthly low Oct.26 2018).