- AUD/USD was flat on Monday as traders await Tuesday’s RBA rate decision.

- The bank is expected to keep policy setting on hold but indicate a more upbeat economic outlook.

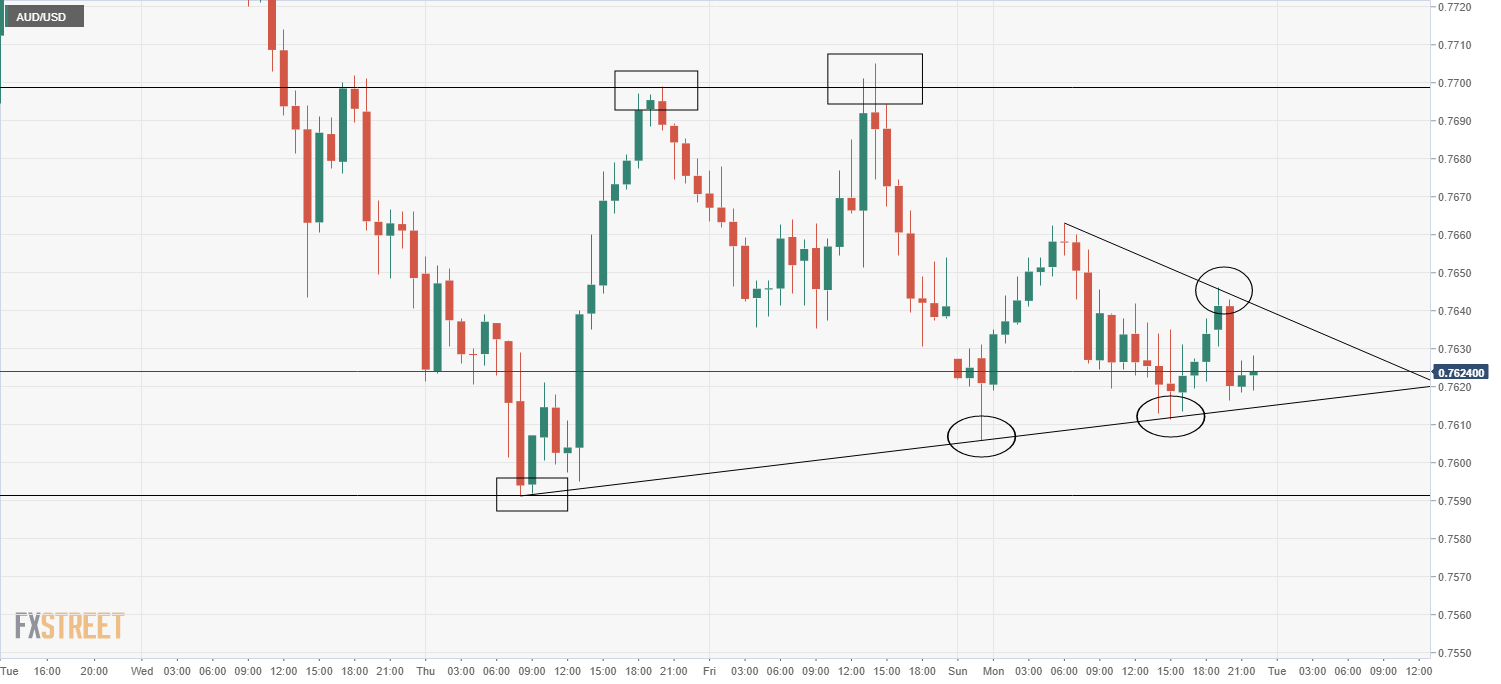

- AUD/USD has formed a short-term pennant subject to breakout.

AUD/USD performer well compared to other G10/USD major pairings on Monday, finishing the day flat close to 0.7620 in contrast to its risk-sensitive G10 peers such as CAD and NZD which both succumbed to US dollar strength. No specific news or theme was acting in support of the Australian dollar on Monday, with traders citing tentativeness ahead of Tuesday’s RBA meeting as a reason not to overly commit one way or the other in the pair.

The impact on the currency from commodities was mixed; crude oil prices were higher on Tuesday, buoyed by strong OPEC+ compliance and stimulus hopes, Iron ore prices fell amid disappointing PMI data out of China and copper struggled amid a stronger US dollar. Gold, meanwhile, gained on the day but failed to break out of recent ranges and keep pace with silver, which continues to attract massive retail interest.

Reserve Bank of Australia meeting incoming

The vast majority of analysts expected the Reserve Bank of Australia (RBA) to keep monetary policy settings on hold at Tuesday’s 03:30GMT monetary policy decision; thus, the cash rate target is expected to be held at 0.1%, the bank’s 3-year government bond yield target at 0.1% and the bank’s QE envelope at AUD 100B. New forecasts are also set to be released; most analysts expect the forecasts to show a brighter outlook and particular attention will be paid to the bank’s inflation forecast, as this could inform when they might think about lifting rates again.

ANZ “expected that the Bank will continue to forecast inflation below the target band right out to mid-2023”, which would imply the bank is expecting to hold rates at zero throughout this period. If, however, the bank forecast inflation reaching the target band within the forecast horizon, this might imply that they might be inclined to lift rates perhaps as soon as 2023, which might be bullish for the Aussie dollar. However, if ANZ is right and the bank does not forecast inflation reaching its target band by mid-2023, then the bank will likely reiterate in its statement that “given the outlook, the Board is not expecting to increase the cash rate for at least 3 years.”

ANZ thinks that there is a chance the RBA will either announce the extension of QE or strongly hint at it, although this could be left to RBA Governor Philip Lowe’s speech. “Overall”, concludes ANZ, “we expect the RBA to emphasise that it is still too early to think about reducing the level of monetary policy support for the economy”. Most analysts suspect that the negative effects of this dovish message on AUD is likely to be offset by the bank’s more optimistic outlook for the economy.

Pre-RBA pennant

Tuesday’s RBA meeting could be the fundamental catalyst needed to spur a breakout from a pennant that AUD/USD has formed over the past few days. Since last Thursday, an uptrend has been supporting the price action and has been respected very. A dovish RBA outcome (or further USD strength or risk-off) could see a downside break below this uptrend; this would expose the 0.7600 level and 2021 lows around 0.7590. An upside break above a downtrend former on Monday would open the door to a retest of last Thursday and Friday’s double top at 0.7700.

AUD/USD hourly chart