- Technically, AUD/USD is ripening for bullish prospects on the 15-min chart.

- Longer-term, there is a bearish topping formation on the weekly chart.

- Fundamentally, the AUD remains balanced with a focus on offshore yields and equities.

At the time of writing, AUD/USD is trading at 0.7651 between a low of 0.7602 and a high of 0.7660, higher by some 0.52%.

The AUD struggled mid-week in choppy trading as markets digested a move higher in yields and softer commodities but there was a shift in sentiment following the Federal Open Market Committee minutes.

DXY traded yesterday at the lowest level since March 23 before finding support just above the 92 areas.

This goes to underpin the notion that near-term risks for the AUD remain balanced with a focus on offshore yields and equities.

Overall, for the week, the US dollar has struggled, losing around 1.6% as measured against a basket of currencies in the DXY since last week’s highs. AUD/USD has gained almost 2%.

Since the FOMC minutes, key US equities ticked up as the Fed reiterated that conditions for tapering won’t be met for some time. This weighed on the greenback and lifted both the commodity complex and the Aussie.

”Increasingly, growth and inflation dynamics in the US will encourage the market to challenge the Fed on the timing of rate rises,” analysts at ANZ Bank explained.

”Whilst current guidance can temper the rise in bond yields near term, sustained above-trend growth may require updated guidance, especially if renewed public sector investment underpins higher productivity growth.”

Meanwhile, analysts at Brown Brothers Harriman continue to think that this week’s dollar weakness is technical in nature, with the rally to resume on the red hot US economic outlook. ”US long yields have stabilized for now but should move higher in the coming weeks.”

Eyes on Chinese growth

Looking ahead to next week, China is one of the first Asian countries to release its 1Q21 GDP reports.

China was impacted by the Covid-19 virus and a subsequent economic slump that dented its GDP growth by -6.8% year-on-year in the first quarter of 2020.

That low base effect positioned it for a strong bounce in yearly growth in the first quarter of this year which would be expected to be supportive of AUD.

Casting minds back, AUD performed extremely well on the basis of its decoupling from other developed nation’s spread of the virus and the economy was expected to outperform.

AUD/USD technical analysis

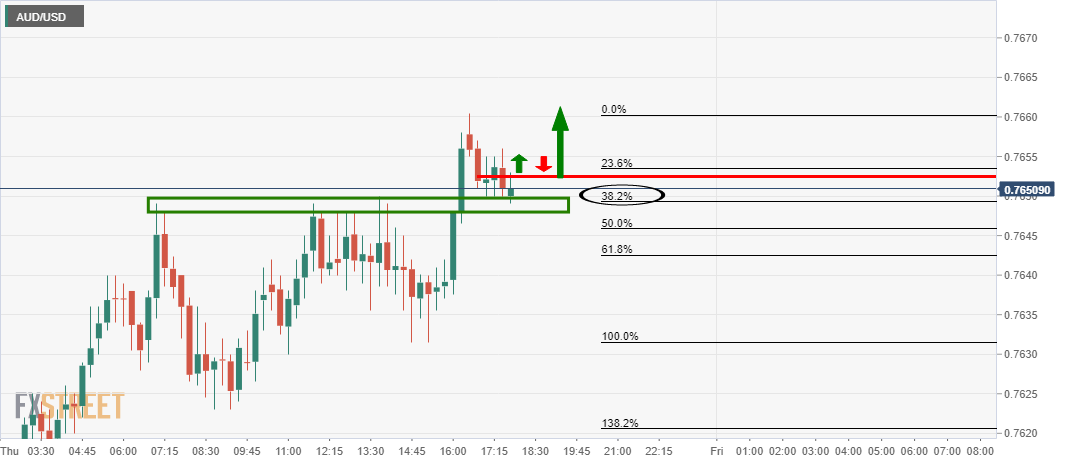

From a short term perspective, there are prospects for a continuation higher given the strong bullish impulse and a significant correction on the 15-min chart as follows:

Bulls will wat to see the resistance broken and for the same area to act as support on a possible retest which would be expected to result in a bullish continuation in a fresh bullish impulse.

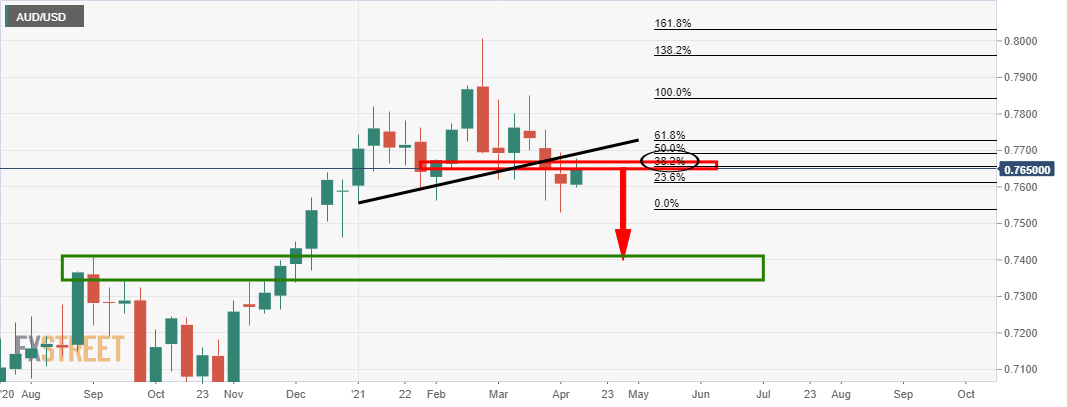

From a longer-term outlook, there is a bearish topping pattern on the weekly chart in the form of a head and shoulders as follows:

The price has already corrected to a 38.2% Fibonacci of the latest weekly bearish impulse which resides below the neckline of the H&S.

Therefore, there is still room for a 50% mean reversion as well that has a confluence with the counter trendline resistance (or the neck-line).