- AUD/USD recovers slightly after the trade balance data.

- Stable US bonds yields and S&P500 futures can weigh on the Aussie.

- Rising COVID cases can trigger the risk-on sentiment and support the Greenback.

- A further fresh stimulus will be provided by the US NFP.

The AUD/USD analysis is bearish at the moment as it sharply reversed gains after Clarida’s hawkish comments. After crashing early Thursday to 0.7373, AUD/USD rebounded up 0.08% on the day. Despite mixed concerns, the Aussie is struggling to reverse the previous day’s decline.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

Recently released data for the Australian trade balance for June – 10.496 billion, compared with an expected 10.450 billion and 9.681 billion the month before, has inspired a rebound in the Australian dollar. Although the lower export and import rates of around 4.0% and 1.0% respectively, versus 6.0% and 3.0%, pose a challenge to the bulls.

Furthermore, as the yields on US Treasury bonds remain stable and S&P 500 futures, the AUD/USD seems to be in trouble. The Australian ASX 200 is down 0.15% at the time of publication, while the Japanese Nikkei 225 is down 0.15%.

Various factors drive these moves, including traders’ hesitation about the Fed’s next move, concerns over the Coronavirus, and hopes for stimulus and geopolitics. Richard Clarida, Fed vice president and former Secretary of the Treasury, raised concerns about tapering by 2021. At the end of next year, Treasury Secretary Yellen tones down monetary policy hints in an interview with PBS Newshour. Reuters reports that a Fed spokesman reiterated that the central bank could reduce spending by the end of the year or early next year.

COVID-19 issues are at the center of US Treasury bond yields and signal for monetary policy adjustments. According to the latest updates, Texas has seen its largest one-day increase in coronavirus infections since early February, while Japan reported a record number of daily infections on Wednesday. Additionally, Australia is reporting its highest daily infection rate since August 2020, and recent virus data from China is similarly depressing.

In addition, the US dollar’s appeal as a safe haven has been heightened by the confrontation between the US and China and Iran.

Meanwhile, the claim that US policymakers are getting closer to further stimulus and that there is no major obstacle to a global economic recovery so far appears to support some equity gauges. However, market moves are being held back by the cautious sentiment ahead of the major US non-farm employment report.

Looking ahead, risk catalysts remain key in predicting short-term AUD/USD moves ahead of a major US employment report due out Friday.

–Are you interested to learn more about forex signals? Check our detailed guide-

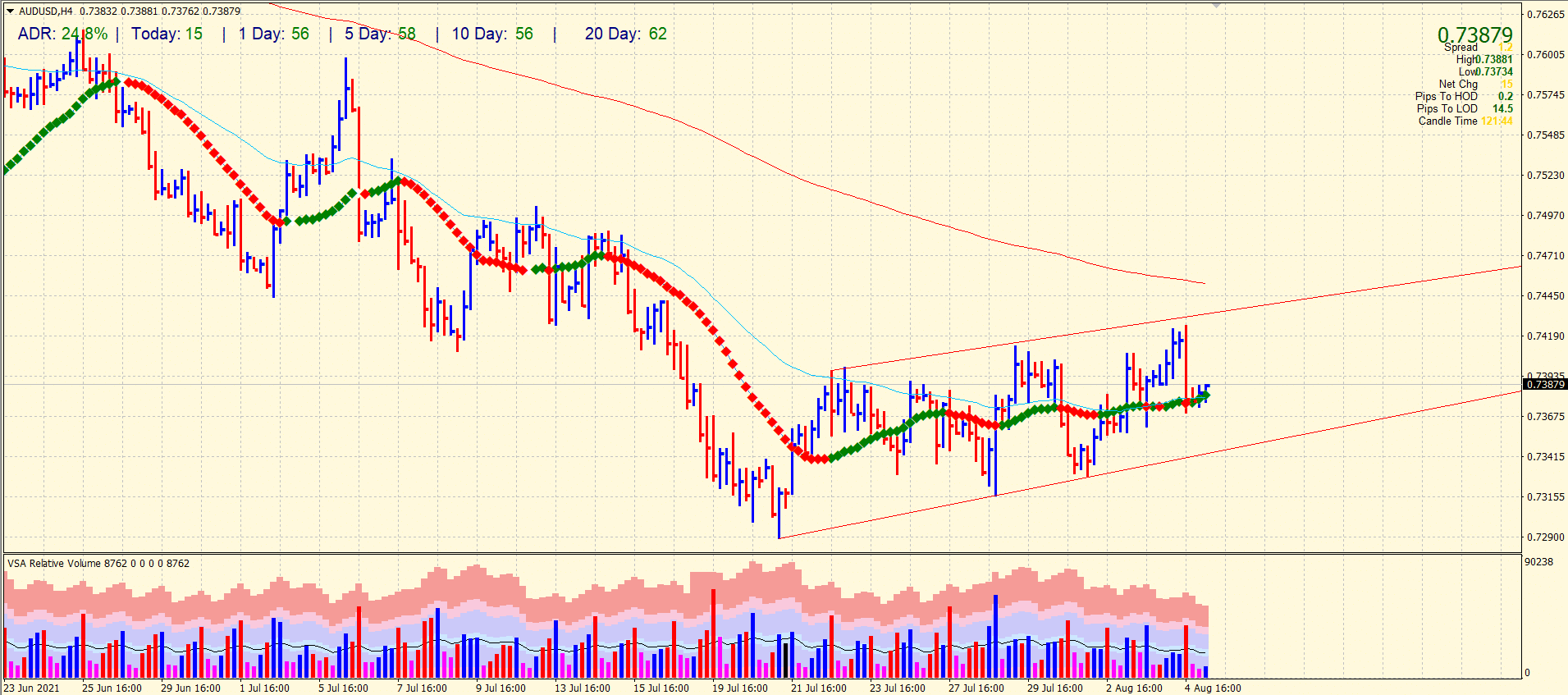

AUD/USD technical analysis: Can bears break the channel support?

The AUD/USD reversed yesterday’s gains and fell back below the 0.7400 handle. The pair found resistance near the bullish channel’s upper boundary. The price decline found support around the congestion of 20 and 50 SMAs on the 4-hour chart. However, the price is now consolidating the losses with declining volume, which is natural after a widespread down bar with ultra-high volume. Hence, the technical picture seems more bear centric, and the price may target the lower boundary of the bullish channel. If the price breaks channel support, we can assume deeper dive towards 0.7300.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.