- AUD/USD remains on the back foot amid risk-off mood, technical breakdown.

- PBOC announced no change to its prime lending rates.

- Risk-tone remains sluggish amid fears of a double-dip recession, no agreement at the EU summit.

- 200-HMA offers immediate support but bulls aren’t likely to step back unless witnessing a break below 0.6930.

AUD/USD drops to 0.6980 during Monday’s Asian session. The aussie pair recently reacted to the interest rate decision by the People’s Bank of China (PBOC). The Chinese central bank left the one-year and five year policy rates unchanged.

Read: PBoC Interest Decision: Keeps prime rates unchanged as expected

Also raising bars for the pair’s upside momentum is the coronavirus (COVID-19) resurgence that pushes the global policymakers to announce heavy stimulus. While Australian Treasurer Josh Frydenberg signaled one such move during the early Asian session, European leaders are still jostling among themselves to agree on Euro 750 billion plan. On the other hand, the Financial Times raises worries of a double-dip recession in the US while Axios indicate disappointment in the US Senate Leader McConnell’s upcoming stimulus, likely around $1 trillion versus rumoured $3 trillion.

Market’s risk-tone fades Friday’s recovery moves as stocks in Japan and Australia print mild losses whereas the S&P 500 Futures reverse the previous 0.30% gains with an equal amount of losses while declining to 3,204.60 by the press time. Furthermore, US 10-year Treasury yields remain sluggish around 0.62% with inflation-adjusted bonds flagging red signals on economy.

Looking forward, traders will have to keep close eyes on the headlines concerning stimulus news as well as virus updates amid a lack of major data/evetns.

Technical analysis

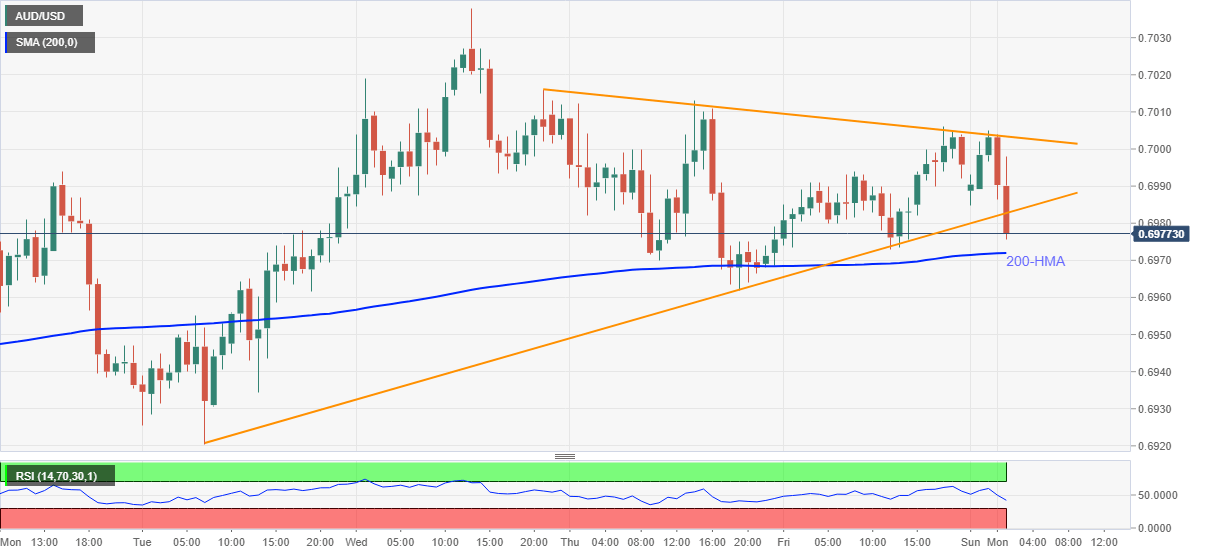

The pair’s sustained break below a four-day-old support line directs it to a 200-HMA level of 0.6971. However, the further downside is likely to be limited unless the quote slips below 0.6930 mark.

Meanwhile, the pair’s rise past-0.7010, comprising a nearby resistance line, could challenge the monthly top near 0.7040 before heading towards the June month’s peak surrounding 0.7065.

Considering the pair’s recently lower high formation on the daily chart, coupled with the break of immediate support line, bears’ return can’t be ruled out.

Trend: Pullback expected