- NAB Business Confidence: Tuesday, 1:30. The National Australia Bank index pointed to a sharp drop in confidence in June, with a weak reading of 2 points. This was much lower than the reading of 7 in the previous release.

- Westpac Consumer Sentiment: Wednesday, 0:30. This indicator should be treated as a market-mover, as stronger consumer confidence can translate into an increase in consumer spending. The indicator posted a sharp decline of 4.1% in July. Will we see an improvement in August?

- Wage Price Index: Wednesday, 1:30. Wage growth has been steady, with the index posting two straight gains of 0.5%. No change is expected in the June release.

- MI Inflation Expectations: Thursday, 1:00. Consumer inflation expectations dipped to 3.2% in June, its lowest gain since October 2016. We will now receive the July release.

- Employment Data: Thursday, 1:30. After three excellent gains, job creation slowed to just 0.5 thousand in June. This was shy of the forecast of 9.1 thousand. The markets are expecting a rebound in July, with a forecast of 14.2 thousand. The unemployment rate has been pegged at 5.2% for three successive months. No change is expected in the July release.

*All times are GMT

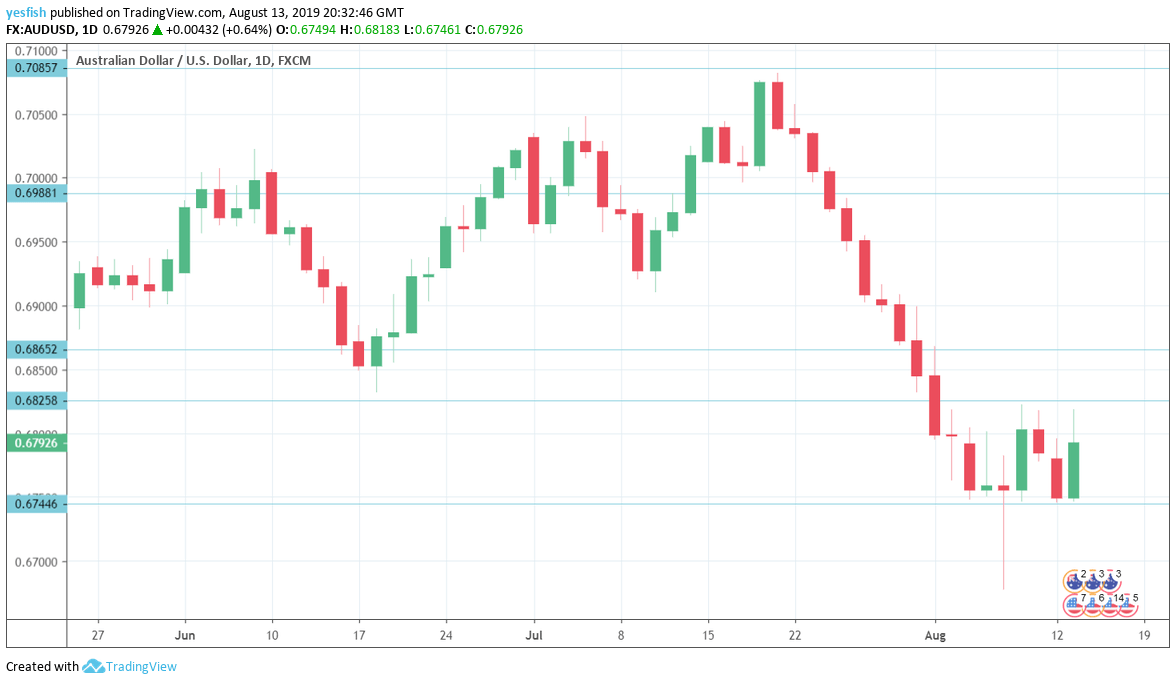

Technical lines from top to bottom:

0.7165 has held in resistance since early April.

0.7085 was a low point in September. 0.7022 is next.

0.6988 marked the low point in April.

0.6865 has some room as resistance as AUD/USD continues to lose ground.

0.6825 (mentioned last week) is in a new role as a resistance line.

0.6744 was tested in support in the middle of the week, but the pair then moved higher.

0.6686 was a cap back in January 2000.

0.6627 has held in support since March 2009. 0.6532 is next.

0.6456 is the final support level for now.

I remain bearish on AUD/USD

Trade tensions have spiked between China and the U.S., which has soured investor risk appetite. Domestically, the economy is struggling, and RBA Governor Lowe’s lukewarm assessment of the economy could weigh on the Aussie.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!