- Australia’s employment unexpectedly decreased in January.

- The unemployment rate in Australia increased to its highest level since last May.

- Retail sales in the US sharply increased in January.

Today’s AUD/USD forecast is slightly bullish. The dollar gave back the previous session’s gains as risk appetite improved. The US Commerce Department said on Wednesday that retail sales in the country sharply increased in January after falling for two consecutive months.

–Are you interested to learn more about forex options trading? Check our detailed guide-

The Australian dollar dropped after data released on Thursday revealed that employment unexpectedly decreased in January for a second consecutive month. The unemployment rate increased to its highest level since last May.

The Australian Bureau of Statistics reported on Thursday that net employment decreased in January by 11,500 compared to December when it decreased by a revised 19,900. Market predictions called for a January increase of 20,000.

Analysts had expected the unemployment rate to remain at 3.5%, but it rose to 3.7%. As a result of more workers than normal taking annual leave in January, hours worked sharply decreased by 2.1%.

If the labor market remains slack, the Reserve Bank of Australia may not feel as much pressure fighting inflation. The RBA forecast that the unemployment rate will only marginally increase to 3.6% by June and 3.8% by year’s end.

In a bid to achieve a soft landing, officials would prefer to keep the unemployment rate around 4.5%, below where it was before the pandemic. Governor Philip Lowe acknowledged on Wednesday that he did not know how high unemployment needed to climb to keep inflation in line.

AUD/USD key events today

Investors will pay attention to several economic releases from the US, including building permits, initial jobless claims, and PPI data.

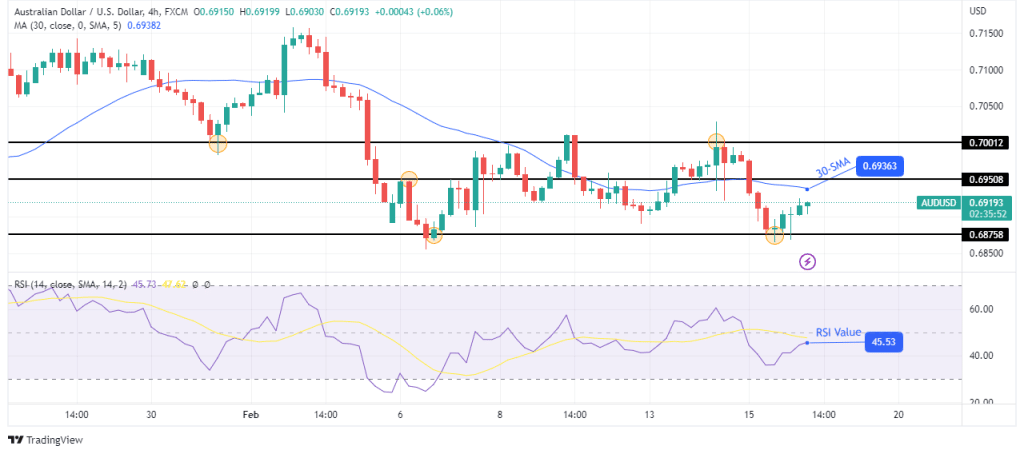

AUD/USD technical forecast: Pullback to the 30-SMA resistance

The 4-hour chart shows AUD/USD trading below the 30-SMA and the RSI supporting bearish momentum below 50. Bears took over at the 0.7001 resistance level and pushed the price below the 30-SMA and the 0.6950 support level.

–Are you interested to learn about forex robots? Check our detailed guide-

However, bears paused again at the 0.6875 support, where bulls returned for a pullback. The market will consolidate if the price stays between the 0.7001 resistance and the 0.6875 support. The price will only pick a side when there is a breakout from this range.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.