- AUD/USD remains mildly bearish on the day.

- Australian jobs data couldn’t trigger massive buying.

- Fed’s stance is still dovish.

The AUD/USD forecast remains mildly bearish. Although the pair tried to build a buying momentum in the Asian session but couldn’t retain the gains.

-Are you looking for automated trading? Check our detailed guide-

Data from the Australian labor market was released on Thursday. Even though the overall unemployment rate fell in June to 4.9% from 5.1% in May, the number of people employed in the country’s economy increased by 29.1k, slightly lower than the forecast of 30.0k. The share of the economically active population remained at the May level and amounted to 66.2%, while analysts expected the indicator to increase to 66.3%. In general, the indicators reflected the ongoing recovery of the labor market, and for a complete picture, it remains to wait for the inflation data.

The US Dollar could not get support after yesterday’s speech by the head of the US Federal Reserve, Jerome Powell, in the House of Representatives. Analyzing the significant rise in inflation, the official continued to adhere to his rhetoric and noted that, despite the unexpected persistence of inflation, the Fed does not plan to take action and expects a decrease in the indicator as to the impact of the coronavirus pandemic subsides. However, investors were disappointed by the Fed’s reaction, and the Dollar sell-off began to intensify.

AUD/USD technical forecast: Key levels to watch

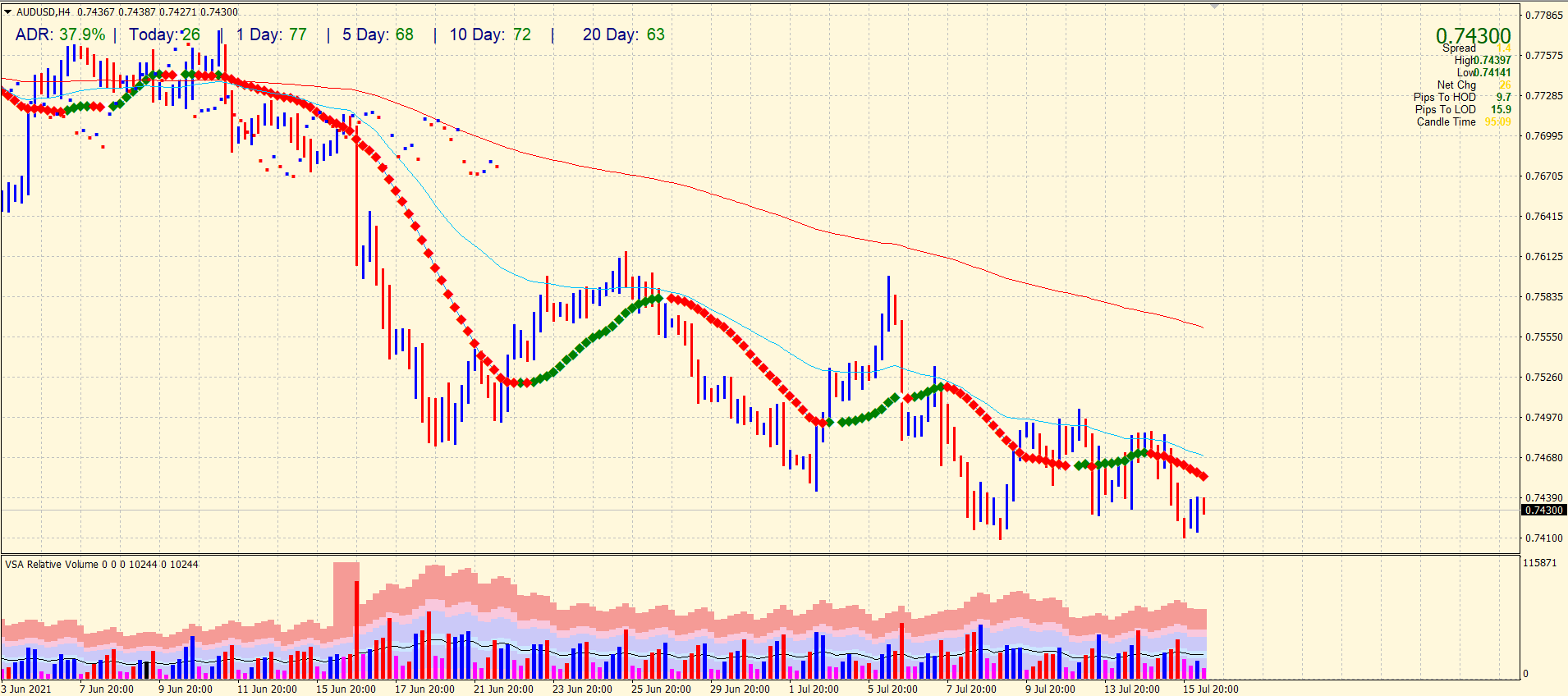

The AUD/USD price continues to form a broad downtrend. Moreover, technical indicators are still giving a sell signal. The 4-hour chart shows that the key 20, 50 and 200 SMAs are pointing downside. The volume of the last three up bars left decreasing volume.

Support levels: 0.7420, 0.7200.

Resistance levels: 0.7520, 0.7655.

AUD/USD trading scenarios

The AUD/USD forex forecast for July 16 remains bearish in case the asset continues to decline, as well as the price fixes below the support level at 0.7420. You can open sell positions with a target of 0.7200 and a stop-loss of 0.7500.

-If you are interested in forex day trading then have a read of our guide to getting started-

In the event of a reversal and rise of the asset and consolidation above the local resistance at 0.7520, you can open a buy position with a target of 0.7655, and a stop-loss of 0.7440 will be relevant.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.