- The AUD/USD has risen for the fourth week and is on track to set new 2022 highs.

- The Australian dollar was mostly unaffected by the Ukraine-Russia issue.

- The road ahead for Aussie is littered with various potential stumbling blocks.

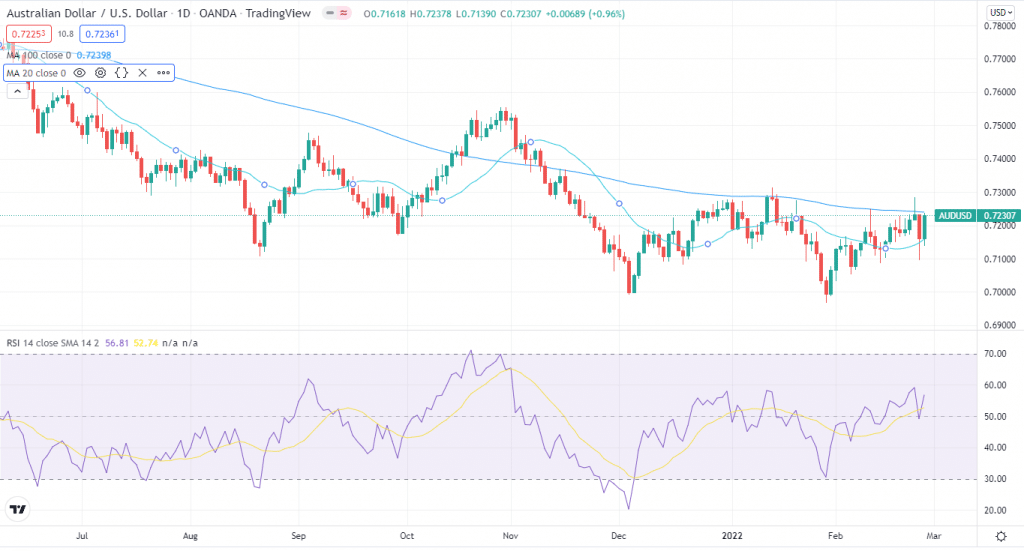

The AUD/USD weekly forecast remains positive as the Aussie has been the strongest currency among its peers during the poor risk sentiment. For the fourth week in a row, the Australian dollar outperformed its American counterpart, trading at near 0.7230 at the end of the week. Despite the ongoing risk-off mindset, the commodity-linked currency rose to 0.7283, its highest level since mid-January.

–Are you interested in learning more about managed forex accounts? Check our detailed guide-

The Ukrainian debacle

The market’s mood shifted throughout the week in response to stories about the Ukraine-Russia issue.

The latter invaded the former, claiming that Kyiv’s alliance with NATO was a security risk.

The news aided stock markets in regaining some of the ground lost on Thursday, which supported the Australian dollar.

However, the improved market sentiment weighed on gold prices, which cut weekly gains and now trades around $1,900 per troy ounce after peaking at $1,974.40 per troy ounce, a multi-month high.

Key data for AUD/USD next week

Next week, Australia’s economic docket is jam-packed with events that will provide more insight into local growth and potential monetary policy moves. On Monday, the country will release February TD Securities Inflation and January Retail Sales, followed by the official PMIs.

Later this week, the government will release its Q4 Gross Domestic Product, which is expected to grow by 0.5 percent year over year, and the January Trade Balance. Finally, the RBA will meet on Tuesday, although no changes to the present policy are envisaged at this time.

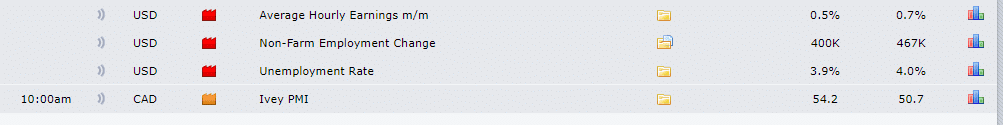

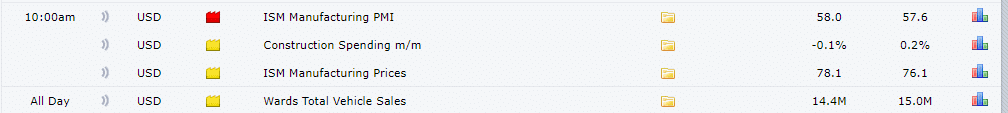

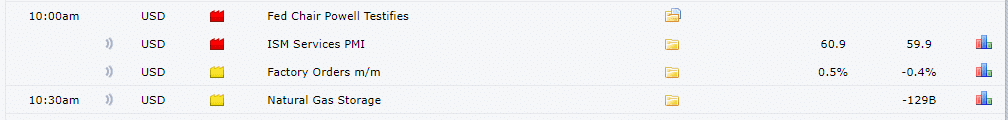

The ISM PMIs and February employment data will be released in the coming days in the United States. After losing 301K jobs in the previous month, the ADP report is expected to reveal that the private sector has restored 328K jobs.

The government will release its Nonfarm Payrolls data on Friday, likely to reveal that the country added 400K new jobs in the month.

AUD/USD weekly forecast: Mixed among the crowd

On the daily chart, the pair has finished the week trading above a modestly bullish 20 SMA while trading below a bearish 100 SMA. Meanwhile, technical indicators have crept upward within positive levels but are still below their weekly highs, indicating that another run north is unlikely.

–Are you interested in learning more about crypto brokers? Check our detailed guide-

Breaking through the 0.7310 price zone can move to a test of 0.7400, with a break over that level pointing to 0.7470. The 0.7150 level is the immediate support region, supported by the 0.7090 level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money