- AUD/USD pushed slightly higher after Governor Lowe’s hawkish comments.

- The pair is being weighed down by falling iron ore prices.

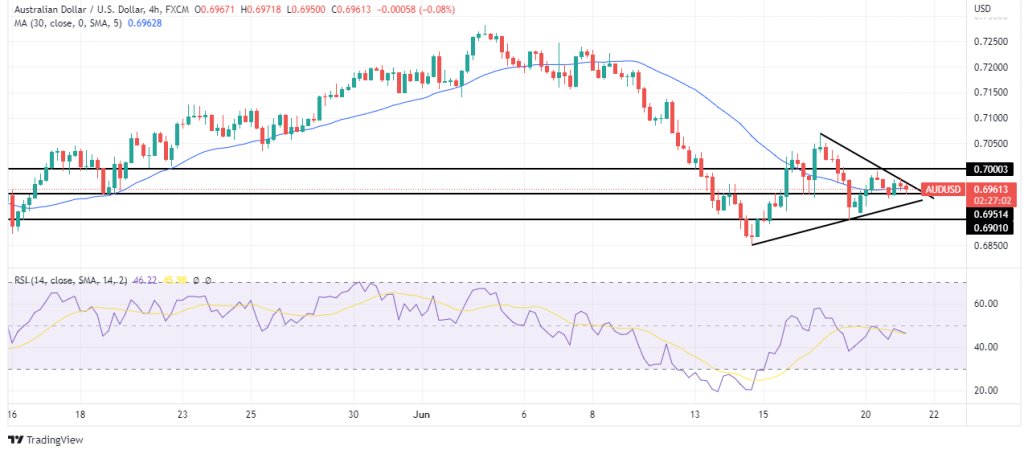

- In the charts, AUD/USD is caught in a triangle and could break out to the lower side.

The AUD/USD forecast remains neutral as the pair closed Monday on a bullish candle, pushing slightly higher today after hawkish statements from Reserve Bank of Australia Governor Philip Lowe. He said that interest rates were still relatively low and that it was paramount for the central bank to control inflation expectations. The pair pushed up by 0.3% to 0.69675 after this statement.

-Are you interested in learning about forex live calendar? Click here for details-

The pair, which is sensitive to commodity prices, is at the same time facing pressure from dropping iron ore prices. Analysts at CBA said that these dropping prices would weigh on the pair in the short term, while the pair would suffer due to slowed global growth in the long term.

“We forecast AUD/USD will spend most of the next twelve months in a 0.60?0.70 range,” they said in a note.

Higher risk sentiment in the broader markets with US equities pushing higher also supported the Australian dollar against the US dollar.

AUD/USD key events today

Investors do not expect significant news releases from Australia today, so all focus will be on the US, which is expected to release existing home sales data. This data measures the number of existing residential buildings sold in May. It is an indicator of economic strength, mainly in the housing market.

For May, investors expect a drop from 5.61M to 5.39M, indicating a contraction in the housing market. A lower-than-expected value could push AUD/USD higher, while a larger-than-expected value could push the pair lower.

AUD/USD technical forecast: Bears strong within the triangle

Looking at the 4-hour chart, we see the price is caught within a triangle and is moving sideways. The price is chopping through the 30-SMA, showing it lacks direction. This triangle comes after a solid bearish leg and could be a continuation pattern. If that is the case, we might see the price break out of the lower side of the triangle.

-Are you interested in learning about forex signals? Click here for details-

The RSI is trading below the 50 level showing that bears are strong inside the triangle. We could see the price push to 0.69000 and lower if they maintain this strength.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money