- The AUD/USD pair fell to its lowest level in two weeks, erasing its biggest gain.

- March saw a 4.9% increase in consumer inflation expectations.

- Concerns over Russia-Ukraine talks cause yields on US Treasury and S&P 500 futures to fall.

- It will be interesting to see what the US CPI for February looks like as inflation expectations decline from record highs.

As the market sentiment turns cautious during Thursday’s Asia session, the AUD/USD forecast accepts bids to recover an intraday low near 0.7315.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

The Australian dollar had broken out of a two-day downtrend the day before after headlines suggested a diplomatic solution to the Ukraine-Russia crisis. However, due to its role as a risk barometer, the AUD/USD has been pressured by recent mixed headlines and market fears of a major event.

Consequently, AUD/USD ignores optimistic expectations for consumer inflation in Australia in March, which is expected to be 4.9% versus 4.6% previously.

Although Ukraine has shown a willingness to compromise if Russia does the same, Moscow has stated that it will not give anything up. This followed comments from the White House (WH) rejecting claims that chemical weapons had been used in Ukraine.

According to the St. Louis Federal Reserve, inflation expectations in the US are high based on the 10-year breakeven inflation rate. This is amid fears of the US Federal Reserve’s 0.50% rate hike. The inflation indicator recently returned to 2.84% after hitting an all-time high of 2.90% the day before.

Due to the East Coast natural disaster, the Chatter market, on which Prime Minister Scott Morrison plans to spend A$38 billion to bolster the military, has been largely ignored at home.

The S&P 500 futures and 10-year Treasury yields failed to extend gains from the previous day until the news release.

However, before any significant dates or events, AUD/USD rates are likely to remain under pressure. A major factor for the pair’s resumption of upward momentum is progress on the peace talks. In addition, the rise in the US CPI for February, which is expected to reach 7.9% from 7.5%, could favor pairs sellers.

AUD/USD price technical forecast: Directionless below 20-SMA

The AUD/USD price is wobbling between 20-period and 50-period SMAs on the 4-hour chart. The volume shows a bearish bias. However, the price remains supported by Tuesday’s lows of 0.7240. The upside may find resistance around 0.7350 ahead of 0.7400 and multi-month highs of 0.7440.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

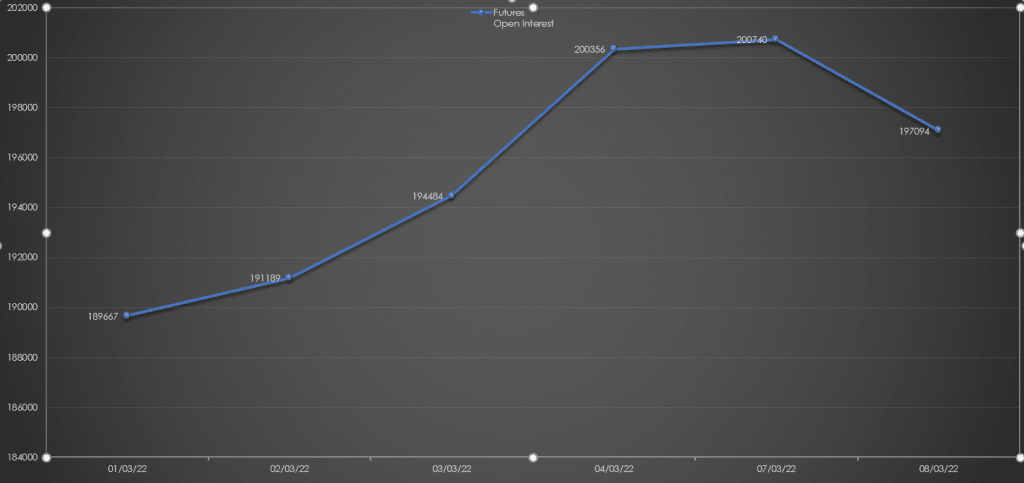

AUD/USD forecast via daily open interest

Although we have seen some gain in the last trading session, this is due to profit-taking while the net long positions have not been added. This is clear from the declining open interest values.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money