- RBA’s Kent stated that the central bank would consider financial conditions to make policy decisions.

- The central bank has stated that higher rates will likely be required to reduce inflation.

- Markets are expecting an end to the RBA rate hike cycle.

Today’s AUD/USD forecast is bullish. On Monday, the risk-sensitive Australian dollar surged to a two-week high before pulling back sharply. A prominent official from the Australian central bank stated on Monday that the stress in the global banking system was primarily limited to a small number of poorly run institutions.

–Are you interested in learning more about making money with forex? Check our detailed guide-

The Assistant Governor of Australia’s central bank, Christopher Kent, stated that financial conditions would be one of several variables taken into consideration by the Board at its next policy meeting in April.

The central bank has stated that higher rates will likely be required to reduce inflation. However, markets are betting that the 10-month tightening campaign of the RBA is virtually over due to the constraints in global banking.

According to Kent, the global banking system is in better shape now than it was during the previous financial crises. In a previous address, Kent declared that the Australian banking sector was “unquestionably strong” and that its capital levels were significantly higher than required.

Since last May, the central bank has increased cash rates ten times, bringing them to a decade-high of 3.6%.

Kent acknowledged the strain on the international financial system but downplayed its effects on local banks.

AUD/USD key events today

Investors are not expecting key economic releases from the US or Australia. Therefore, investors will watch out for developments in the global banking sector.

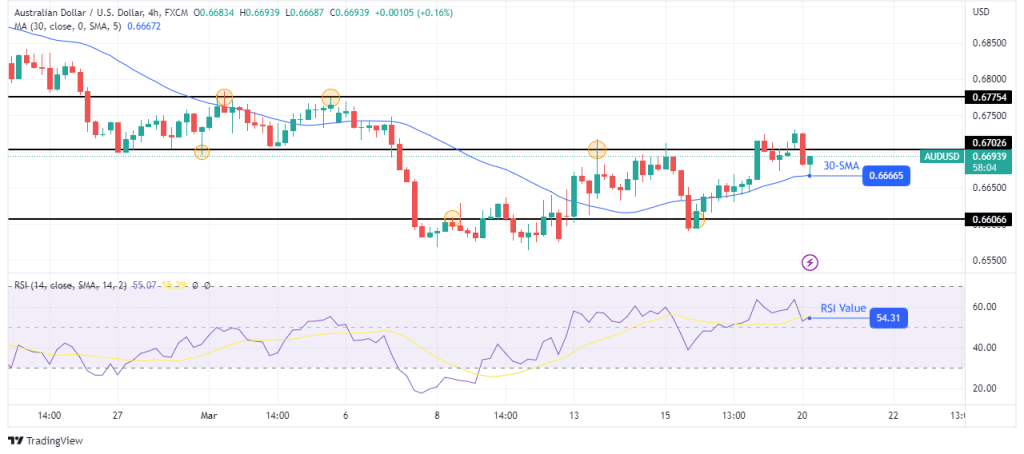

AUD/USD technical forecast: Bears weaken at the 30-SMA support

The 4-hour chart shows AUD/USD trading slightly above the 30-SMA with the RSI slightly above 50. Bulls are still in control, but bears are getting stronger, pushing the price toward the SMA. Bearish strength can also be seen in the large candle at the 0.6702 key level.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The price has reached the SMA, and we are seeing a bounce higher. The price will likely head for the 0.6775 resistance or break below the 30-SMA. A break below the SMA would likely see the price fall to the 0.6606 support. The bias will remain bullish if the price stays above the SMA and the RSI above 50.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money