- AUD/USD falls as the RBA keeps the cash rate unchanged at 0.10%.

- China’s situation and falling iron ore prices are weighing on the Aussie.

- Mixed October PMIs and real estate data are confusing for the market participants.

The AUD/USD forecast is bearish after the RBA kept the rates unchanged while the US dollar is buoyant ahead of Fed’s decisions on tapering and rates.

-If you are interested in forex day trading then have a read of our guide to getting started-

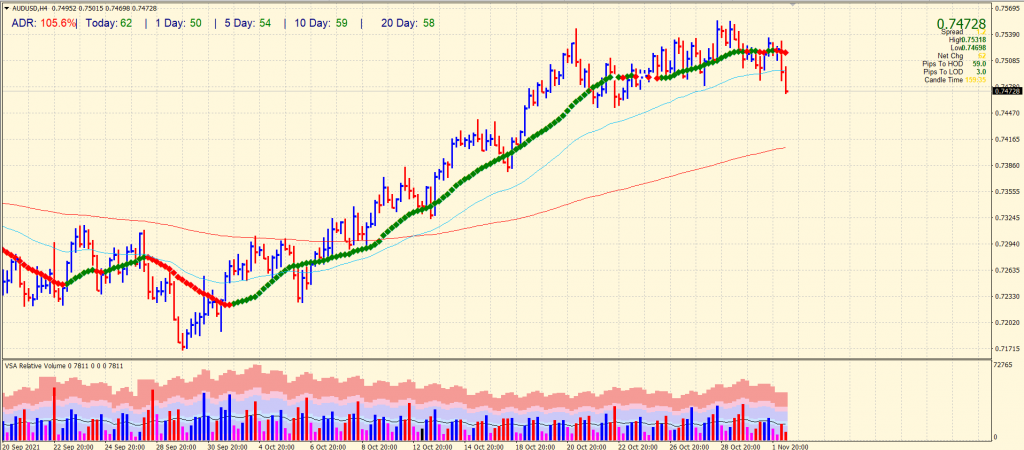

Following a late move by the Reserve Bank of Australia (RBA) on Tuesday, the Australian dollar lost more than 50 pips to 0.7500 in early Asian trade. However, quotes are currently down 0.61% intraday, while offers are near 0.7475 with an intraday low of 0.7470.

Australia’s central bank kept its key rate unchanged at around 0.10%, meeting market expectations. On the other hand, the fall in the YCC control triggered a recent run south, which confirmed the bearish picture of the rising wedge.

In addition to the RBA move, mixed economic conditions and cautious sentiment ahead of major central bank events have influenced risk appetite and bolstered demand for safe havens like the US dollar. Additionally, market fears may be fueled by under-bid equity futures despite a tighter Wall Street closing and a sluggish US Treasury yield.

AUD/USD prices have also fallen due to China’s Ministry of Commerce’s securing food supplies for the winter. Also pleasing to some sellers is the drop in iron ore prices, Australia’s most important export. The price of iron ore from Dalian fell on that day by approximately 8.0%, at the latest by 580 yuan per ton.

The rejection of US Treasury Secretary Janet Yellen from fears of reflation and the recent weakening of US inflation expectations, as measured by a 10-year break-even point from the St. Louis Federal Reserve System (FRED), are in favor of AUD/USD buyers. On the positive side, Australia’s recent decline in COVID-19 infections and stricter vaccination regulations, as well as simplified travel regulations, are welcome developments.

Further confusing for the traders are the mixed PMI for October and Australia’s latest real estate and activity data. Although PCE median inflation for the Cleveland Fed has skyrocketed recently, hawkish Fed officials can keep their hopes and infect Australian bulls.

The Fed’s sentiment may pose a future challenge to AUD/USD traders, but confirming the bearish pattern is encouraging for sellers.

-Are you looking for automated trading? Check our detailed guide-

AUD/USD price technical forecast: Bears aiming for 0.7400

The AUD/USD price plunged below the 20-period and 50-period SMAs on the 4-hour chart. It indicates the dominance of bears. The average daily range is 105% until now, which indicates that the market may see some profit-taking in the coming hours. However, any bullish attempt will be a selling opportunity if the price remains below the 0.7500 mark. The downside targets are swing low at 0.7450 ahead of 20-period SMA at 0.7405.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.