- AUD/USD fell overnight as risk sentiment deteriorated.

- The Delta variant is spreading in NSW despite a strict lockdown.

- The crash in the New Zealand dollar triggered a sell-off in the Aussie.

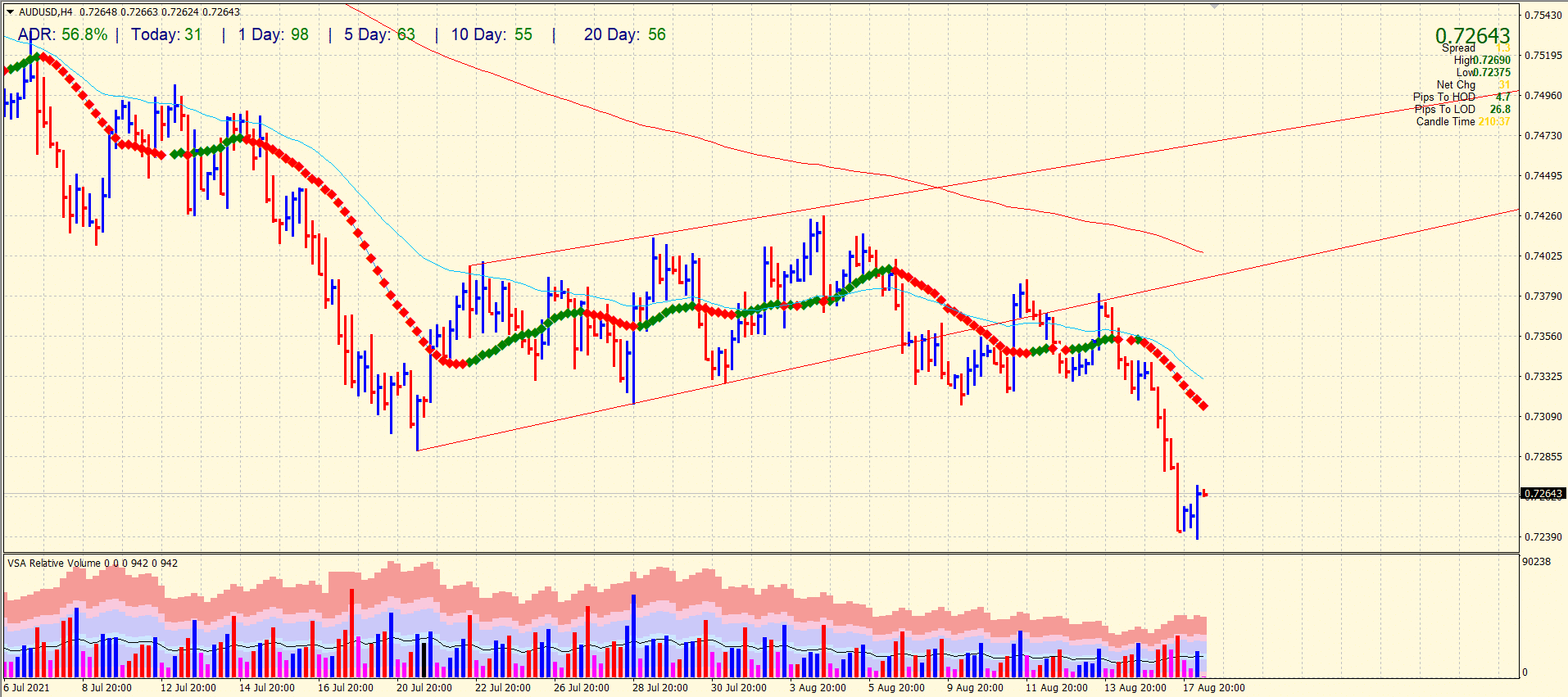

The AUD/USD price forecast is bearish amid broad risk-off sentiment. The pair is trading near 0.7260, 0.16% up so far on Wednesday.

Overnight, the risk-sensitive Australian dollar fell sharply against the US dollar. The AUD/USD has dropped more than 1% due to a widespread sense of risk aversion in global markets. Traders worldwide have been measuring their risk appetite using this currency pair since November 2020. In addition, retail sales in the US were disappointing ahead of New York’s opening the night before, which drove the market down.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Following the decline in Asia-Pacific stock markets on Tuesday, the market was already jittery. On Monday, Wall Street shares fell 0.71% at the close of New York trading, reflecting a move towards lower risks.

Likewise, investors reacted to other risky assets due to the deterioration in sentiment. For example, a fall of more than 3% was recorded in Bitcoin. As investors flee the dollar, crypto-currencies often react to setbacks in the broader market.

Most economists are concerned about the impact of Delta-Covid’s restrictive measures on global recovery with its strain on consumption. These concerns about slowing growth have been compounded by a rise in Delta variant cases reported from Asia to the United States. New South Wales (NWS), Australia’s most populous state, continues to see cases rise every day despite the lockdown.

After an Auckland resident tested positive for the virus, New Zealand was shut down across its entire population on Tuesday. It was the first case reported in the country in almost six months. The Delta variant is to blame, according to health officials. A three-day isolation period is planned. The schools will study remotely during this period, and secondary enterprises will close. As a result of the news, the New Zealand dollar fell against most of its peers.

The RBNZ kept the cash rates unchanged, which weighed on the New Zealand Dollar and eventually weighed on the Aussie because of their positive correlation.

–Are you interested to learn more about forex signals? Check our detailed guide-

AUD/USD technical forecast: Consolidating losses around mid-0.7200

The AUD/USD pair posted fresh YTD lows under the mid-0.7200 level. However, the pair managed to find some support as the Greenback retraced a little. The 4-hour up bar with a high volume indicates that the sellers liquidated their positions. However, further consolidation of losses is expected here rather than an upside correction.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.