- The AUD/USD pair quickly recovered after falling to more than two-month lows this Thursday, the AUD/USD pair quickly recovered.

- With a rate hike, the RBA risked supporting a supposedly riskier Aussie.

- Now, traders are looking forward to the US Q1 GDP report, which is expected to provide fresh impetus to the market.

The AUD/USD forecast remains bearish as the Fed’s aggression keeps the US dollar bulls alive, weighing on the riskier assets.

The AUD/USD pair has staged a nice intraday recovery from the 0.7075 area, the lowest price since February 7th set earlier this week. The recovery momentum continued in the early European session, pushing spot prices to new daily highs near 0.7160 in the last hour.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

According to the Australian Bureau of Statistics, in the first quarter of this year, Australian consumer prices rose at their fastest annual rate in two decades. It has been speculated that the Reserve Bank of Australia could raise interest rates as early as next week based on the data. Along with this tendency to take risks, Aussies are seen as riskier, supporting the pair.

A softening sentiment surrounding US Treasury yields, on the other hand, led to a slight decline in the US dollar from a five-year high. Consequently, there was some intraday coverage of short positions in the AUD/USD pair due to this factor. USD strength and asset capitalization should benefit from the prospect of more aggressive Fed tightening.

Markets expect the Fed to increase rates by 50 basis points at its May 3rd and 4th meeting and again in June and July, eventually raising rates to around 3.0% by year’s end. Further, the deteriorating global economic outlook favors bulls of the US dollar, so caution needs to be exercised before anticipating further gains for the AUD/USD pair.

What’s next to watch for the AUD/USD forecast?

Traders are now anticipating US economic reports, particularly the release of the first-quarter GDP report and the usual weekly Initial Jobless Claims report. In addition, the US Dollar’s price will be impacted by the yield on US bonds and overall market risk sentiment. This, in turn, should create some short-term opportunities for the AUD/USD pair.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

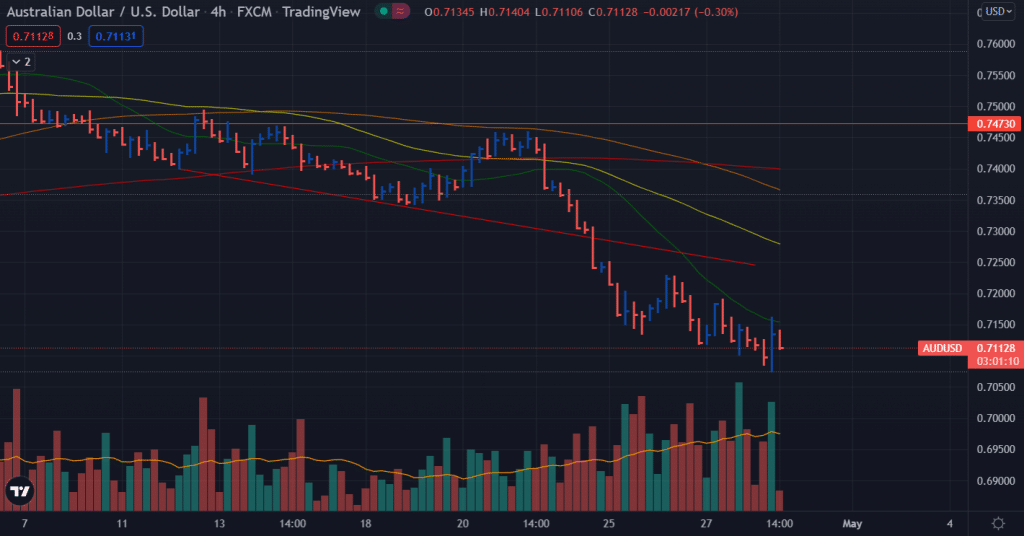

AUD/USD price technical forecast: Gains capped by 20-SMA

The AUD/USD price recovery stalled around the 20-period SMA and moved back towards the 0.7120 area. The outlook remains bearish as the price remains well below the key SMAs on the 4-hour chart. However, the volume bars suggest a probability of an upside correction.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money