- AUD/USD updates the intraday high, continuing its recovery from the two-week low.

- The market sentiment remains negative amid mixed concerns over Ukraine-Russia peace talks and concerns about the Fed.

- New momentum depends on Powell’s efforts to offset rate hikes, US retail sales, and risk catalysts.

The AUD/USD forecast remains bearish despite the recent slight gains. The market’s focus primarily lies on the risk catalysts and the Fed.

In the Asia-Pacific session on Wednesday, the AUD/USD broke through the 0.7200 line to hit intraday highs. However, the market is concerned over the upcoming Federal Open Market Committee (FOMC) meeting and the negotiations between Ukraine and Russia, refraining the pair from rallying.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Covid in China

Upbeat domestic data also supports AUD/USD rates in addition to equities. Nevertheless, Australia’s Westpac Index of Leading Companies improved to -0.15% from -0.3% previously.

Hong Kong and China’s stocks lead the Asia-Pacific region as China’s daily Covid readings are weaker. In China, 1,952 new Coronavirus cases were reported on March 15, down from 3,602 the day before.

In other markets, S&P 500 futures are down 0.25% to 4250, while US Treasury yields (which are on a seven-day uptrend close to their highest since June 2019) have fallen by 2.145 % at this point.

Russia-Ukraine peace talks

A mix of signals about the Russia-Ukraine peace talks, misdirected by their respective leaders, can be cited as the most important bearish catalyst. US data and inflation expectations are also bearish catalysts.

Reuters reported that the Russian president said Kyiv was not serious about finding a mutually acceptable solution, despite Ukrainian President Volodymyr Zelenskyy saying Ukraine’s and Russia’s positions in the peace talks sound more realistic. In addition, the Wall Street Journal (WSJ) reports that Ukraine is likely to request additional arms aid from the US, approved by US President Joe Biden. Therefore, traders reading about the Russian-Ukrainian crisis continue to be concerned about the lack of progress in the negotiations and mixed comments.

What’s next for AUD/USD forecast?

Producer prices in the US grew by 10% year-over-year, but the New York State Manufacturing Index fell by the most since May 2020. In addition, after hitting a record high, the St. Louis Federal Reserve (FRED) interest rate fell for the second straight day.

The US February Retail Sales data, which are expected to fall to 0.4% from the previous 3.8%, will be one of the risk catalysts for short-term moves in the AUD/USD, but the focus will remain on the Fed Lie verdict.

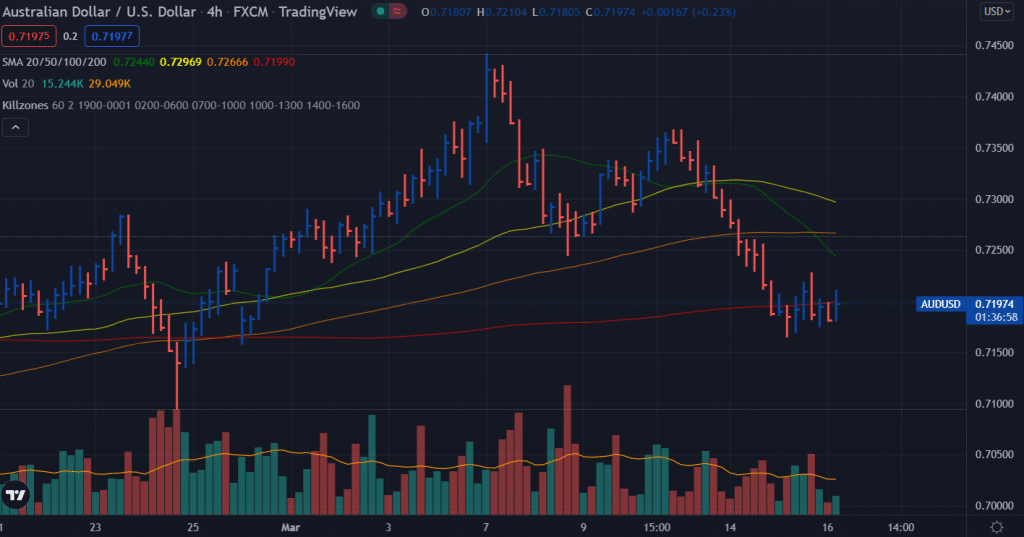

AUD/USD price technical forecast: Bears dominating

The AUD/USD price is consolidating minor gains around the 0.7200 area. The technical outlook for the pair is still shaky as the price broke below the 200-period SMA on the 4-hour chart. However, the Aussie remains supported by the key horizontal level of 0.7170.

The volume data shows a bearish bias too. However, a sustained breakout of 0.7200 area will gain positive traction and test 0.7250 ahead of 0.7300.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

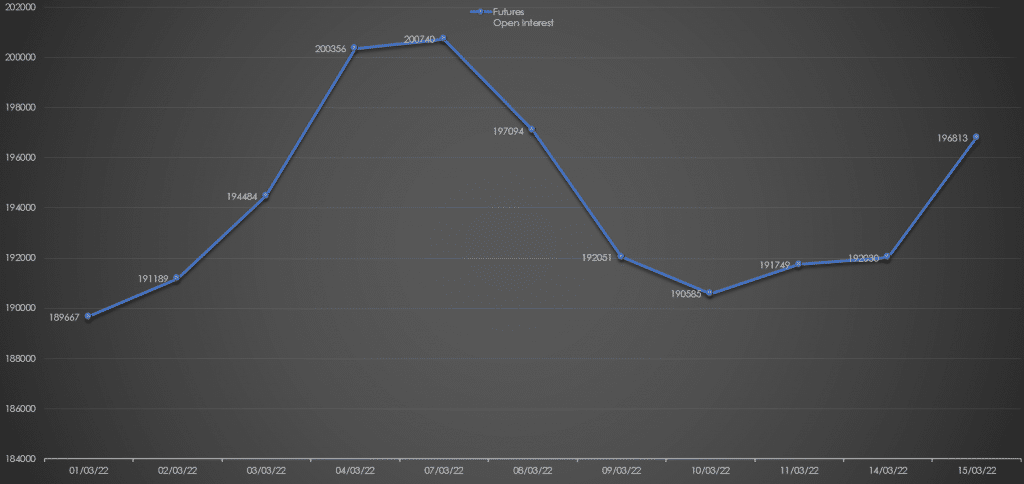

AUD/USD forecast via daily open interest

The AUD/USD dropped yesterday and closed the daily price in red. Meanwhile, the open interest significantly rose. It shows a strong bearish bias for the pair.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money