- RBA Monetary Policy Meeting Minutes: Tuesday, 1:30. The minutes will provide details of the policy meeting earlier this month. With the Aussie posting gains of over 2.0% in September, the RBA can contemplate lowering interest rates without worrying about the negative effect on the exchange rate.

- HPI: Tuesday, 1:30. The housing price index continues to struggle, having posted declines for five successive quarters. Another decline is expected in Q2, with an estimate of -1.0%.

- CB Leading Index: Tuesday, 14:30. The Conference Board index posted a sharp gain of 1.3% in June. The markets are predicting a negligible gain of 0.1% in July.

- MI Leading Index: Wednesday, 0:30. The Melbourne Institute index is an important gauge of economic activity. The index has recorded three straight declines of 0.1%. The forecast for August reading is +0.1%.

- Employment Data: Thursday, 1:30. The economy created 41.1 thousand jobs in July, crushing the estimate of 14.2 thousand. The strong reading helped boost the Australian dollar last week. Another gain is expected in August, with an estimate of 15.2 thousand. The unemployment rate has reeled off four straight readings of 5.2% and no change is expected in the August release.

*All times are GMT

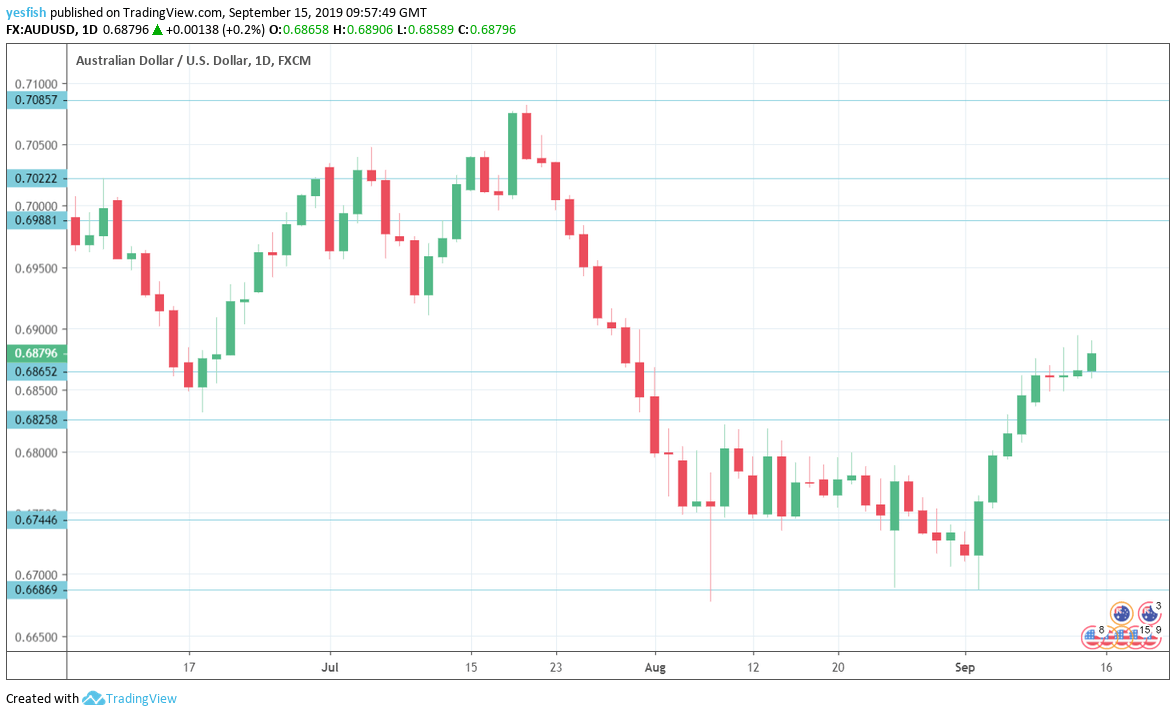

Technical lines from top to bottom:

We start with resistance at 0.7235, which has held in resistance since early February.

0.7165 has held since early April.

0.7085 was a low point in September. 0.7022 is next.

0.6988 marked the low point in April.

0.6865 remained relevant this week. Currently, the line is an immediate support line.

0.6825 (mentioned last week) has some breathing room, following gains by AUD/USD last week.

0.6744 is next.

0.6686 was a cap back in January 2000.

0.6627 has held in support since March 2009. 0.6532 is next.

0.6456 is the final support level for now.

I am bearish on AUD/USD

Can the Australian dollar continues its recent rally. As a risk currency, a drop in risk appetite could hurt the Aussie. Tensions in the Middle East remain high, although a meeting between Trump and Iranian President Rouhani could send risk appetite soaring. As well, weaker Chinese growth continues to weigh on the Aussie.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!