- Investors were caught off guard by the 50bps rate hike, which saw the Aussie dollar push higher.

- It is the start of a tighter monetary policy for the Reserve Bank of Australia as it seeks to control rising inflation.

- The surprise rate hike has caused some panic among investors in the US and Europe over the global economy.

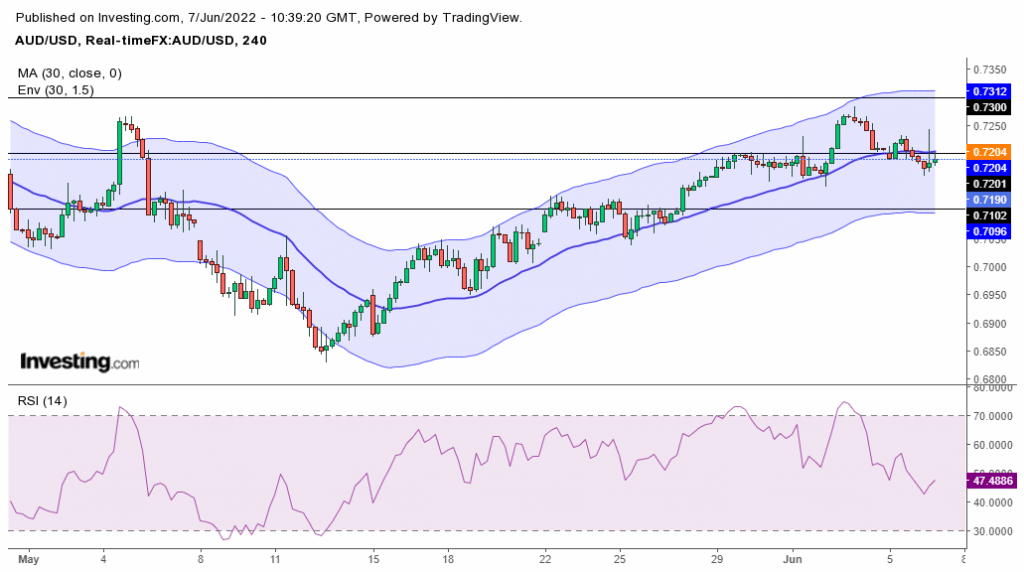

The AUD/USD forecast remains bearish as the price dropped back below 0.7200 despite the rate hike by the Reserve Bank.

-Are you interested in learning about the best AI trading forex brokers? Click here for details-

On Tuesday, the Reserve Bank of Australia surprised investors by raising rates to 0.85% higher than the expected 0.60%. It is the most the bank has raised in over 22 years, and investors should expect more tightening ahead as it tries to control the surging inflation.

“Given the current inflation pressures in the economy, and the still shallow levels of interest rates, the Board decided to move by 50bps today,” said Phillip Lowe, RBA Governor, in a statement.

“The Board expects to take further steps in normalizing monetary conditions over the months ahead.”

The Australian dollar initially went up to 0.7248, where investors took profits, pushing the pair back lower. The move by the RBA created a lot of worries ahead of US inflation data and central bank meetings in the US and Europe. This tension saw the dollar pushing higher on Tuesday.

AUD/USD key events today

After the surprising rate hike by the RBA, investors will be looking out for news releases in the US, including the trade balance for April and the EIA short-term energy outlook report.

Investors expect the trade balance to go up from 2.49B to 2.90B. This increase would point to a more significant difference in value between imported and exported goods, and a higher value could push AUD/USD lower. The reverse is also true.

AUD/USD technical forecast: Bears sustaining below 0.7200

Looking at the 4-hour chart, we see the price has broken below the 30-SMA, and RSI is trading below the 50 levels. It is clear that bears have come into this market and could keep pushing prices lower.

-Are you interested in learning about the forex indicators? Click here for details-

Price is currently trading below 0.7200, which it tried to break above but failed. This psychological level has acted as resistance for AUD/USD before and could be holding this time. If bears can show more momentum, then the next target for the pair could be at 0.7100.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money