- AUD/USD enters the barroom brawl on the charts ahead of the RBA meeting in Asia on Tuesday.

- The positioning has favoured a bearish spot sentiment as markets look for a sustained correction in the greenback.

At the time of writing, AUD/USD is trading at 0.7117 and between a range of 0.7076 and 0.7149.

A correction in the US dollar is underway with the DXY moving to a high of 93.99 today having bottomed at 93.32.

The month of August is renowned for being a poor one for the Aussie.

In the past 9-years, AUD/USD has only risen once in August and in the past decade, the average decline is 1.29%.

In forex positioning, we continue to see sharp swings in AUD, even as the market is finding less and less interest in buying the US dollar as a safe-haven asset compared to the alternative low-yielders.

However, while there is far less chance of a rapid economic rebound for the US, the rest of the world will always catch a cold when the US sneezes.

Given the heightened uncertainty pertaining to the second or even third waves of the virus and considering that this remains a highly fluid situation for global growth, the Aussie has likely run about as far as it can for now.

When you throw in escalating tensions between China and the US and some other nations, world trade fragility is also going to be a dampener for the Australian dollar.

The unwinding of the Aussie’s net long positioning is inevitably related to a more cautious approach by markets, especially given the higher domestic woes affecting the nation pertaining to the second wave of the virus in Victoria.

Without traction n a vaccine and confirmation that indeed, a vaccine rid the world of the virus, risk assets, for which the Aussie can be classified as being, are always going to struggle in tentative risk appetite conditions.

RBA and SoMP preview

- RBA Preview: COVID running a muck? An Exy Aussie? Nah, no worries mate!

AUD/USD analysis

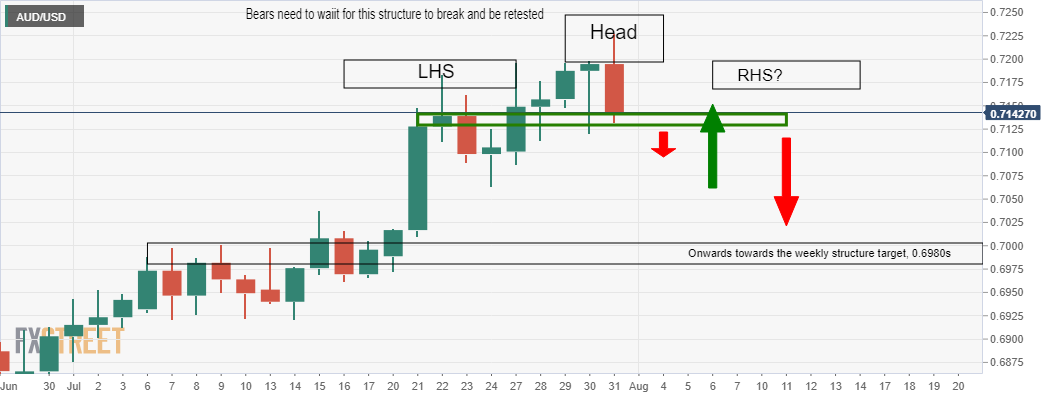

In the start of the week’s analysis, The Chart of the Week: AUD/USD toppy, H&S could be in the making, the prospects of a head and shoulders formation were marked leading up to the RBA event on Tuesday.

This was displayed in the following daily chart:

As can be seen in the price action, the head and shoulders formation and right-hand shoulder is indeed starting to shape:

We can expect consolidation for the rest of the time leading up to the meeting and unless there is an outside outcome of what is expected in the market, then the case for a downside move towards, at least, the weekly support is sound.

RSI has not confirmed the recent high and we would allow for a minor pullback,

analysts at Commerzbank argue.

We have a short term uptrend at .7074 but would allow for a slide to the 3 month uptrend at .6855. Key support is offered by .6778/74, the February high and mid-June low.