- AUD/USD remains positive above 0.7500 on the day.

- Despite the better market sentiment, the price remains below the 3-day highs of 0.7518.

- The rise in commodity prices is also supporting the Aussie.

The AUD/USD outlook seems slightly bullish. However, the recent surge in demand for the US dollar may not allow bulls to make a big uptrend move.

-If you are interested in high leveraged brokers, check our detailed guide-

A new buying momentum is evident during the European session, as the AUD/USD pair rebounds to 0.7500 levels. However, the bulls seem to be lacking a continuation amid the broader strengthening of the US dollar.

Despite renewed optimism over US infrastructure spending, the pair is well below the Asian three-day high of 0.7518.

The current market sentiment, however, remains optimistic about the Australian dollar. Increasing iron ore prices in China are also contributing to Australia’s optimism.

A series of weekly industry data shows a decline in iron ore shipments to China from Australia and Brazil as the global energy crisis continues to escalate.

Additionally, due to its increased appeal as a higher-yielding alternative investment, the Aussie has also benefited from the ongoing correction in US Treasury yields from the five-month highs.

The resumption of talks between the US and China has also been well received by investors. US Treasury Secretary Janet Yellen and Chinese Deputy Prime Minister Liu He talked about macroeconomic and financial developments during their virtual phone call.

During the NA meeting, the Federal Reserve will release consumer confidence data, which will interest the pair. In advance of Australia’s Q3 CPI report, traders will also be keeping an eye on Wall Street sentiment for new trading opportunities. During the third quarter, the Reserve Bank of Australia’s (RBA) average consumer price index is projected to decline by 0.5% from 0.5% in the previous quarter.

-If you are interested in MT5 brokers, check our detailed guide-

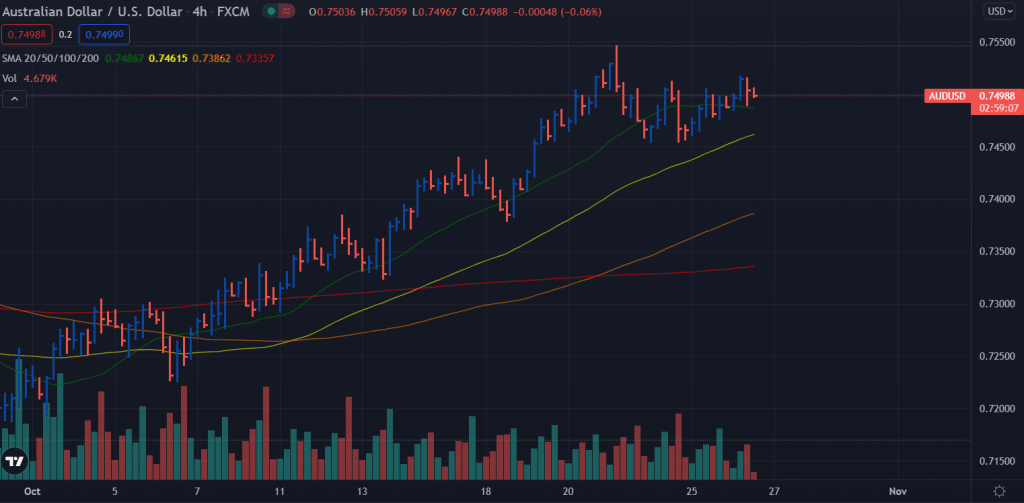

AUD/USD price technical outlook: Bulls attempting to surge above 0.7500

The AUD/USD price remains supported by the 20-period SMA. The price is wobbling near the 0.7500 handle, which is a psychological mark for the market participants. The volume is slightly in favor of bulls. Any upside attempt will face resistance around monthly highs near the mid-0.7500 area. On the downside, support levels emerge at 0.7460 ahead of 0.7400.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.