- AUD/USD is gradually recovering from a two-year low while pulling back from a daily high amid mixed signs.

- China is pushing for more employment for students to improve the situation with the Coronavirus.

- While US yields and stock futures are firm, the DXY is recovering from pre-Michigan CPI intraday lows.

The AUD/USD outlook remains bearish despite the price bounces near 0.6890, trying to contain a rebound off a 23-month low in early Asian trade. Australia and China have been making headlines recently, contributing to the Australian dollar’s recent decline.

–Are you interested in learning more about STP brokers? Check our detailed guide-

After an initial bounce, a pause in US Treasury and stock futures yields has brought the US Dollar Index (DXY) to a daily low of around 104.60. In addition, markets could be worried about Michigan consumer sentiment data for May, which is expected to show a reading of 64 rather than 65.2.

AUDUSD bulls have previously benefited from China’s push to create more college student jobs and hopes for zero conditions in Shanghai after mid-May. In a similar vein, residents stayed at home for three days to tame the Covid threat in Beijing. However, the recent warning by Australia’s defence minister and talk of Taiwan dampen optimism in Asia.

The recovery of DXY may also be influenced by Senator Rand Paul’s objections to the US aid package for Ukraine. Finally, as the global economy faces renewed inflationary concerns, demand for the US dollar as a safe haven increases.

Nevertheless, the cautious comments from Fed Chair Jerome Powell and San Francisco Fed Chair Mary Daley will keep the US dollar under pressure, helping AUD/USD buyers.

The US 10-year Treasury yield shows a corrective pullback after hitting a two-week low the previous day, at around 2.89% at press time, while the S&P 500 futures are down 1% and have increased about 1.0%.

Traders monitoring the AUD/USD pair will need to watch US data and risk catalysts, primarily related to China and Russia.

–Are you interested in learning more about making money with forex? Check our detailed guide-

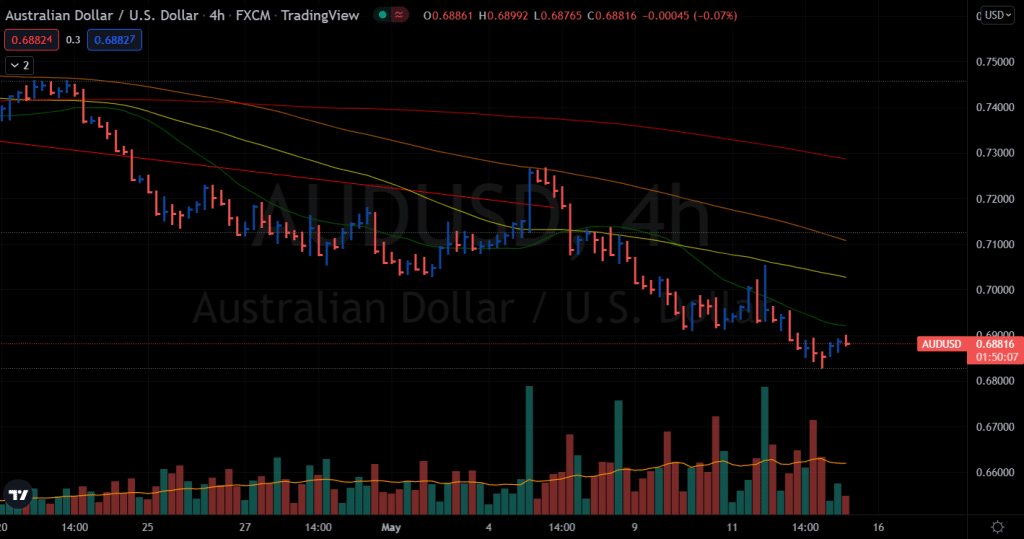

AUD/USD price technical outlook: Buyers lack conviction

The AUD/USD price remains well below the 20-period SMA on the 4-hour chart. The volume data also shows no support for the buyers. The recent gain of more than 70 pips lacks follow-through momentum for the buyers to continue. The bearish momentum may gather further traction and push the prices towards 0.6800. Further softness may result in breaking the level and aiming for 0.6750.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money