- AUD/USD finds bids after the Fed showed a cautious tone.

- The Aussie jobs report came better than expected, lending support.

- RBA reiterated a rate hike after achieving full employment.

The AUD/USD outlook seems positive as the Fed remained cautious amid the emergence of the Omicron variant while Aussie jobs data remained upbeat too.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

In early Thursday trading, positive signals surfaced in Australia’s November employment report that led the AUD/USD to climb to 0.7172 and continue gains after the close of trading. In addition, the mixed concerns about the US and Omicron incentives and the market’s preparation for the European Central Bank (ECB) policy meeting may have contributed to the pair’s success.

Under the market consensus, the unemployment rate in Australia fell to 4.6%, below projections of 5.0% and 5.2%, respectively, whereas the change in employment was expected to be +200k and decreased -46.3k to 366.1k. Moreover, the participation rate also exceeded market expectations of 65.5% and 64.7%, with 66.1%.

Philip Lowe, Governor of the Reserve Bank of Australia, stated, “I am ready to keep rates low if the domestic economy calls for it.” “I want full employment and a 4% wage hike,” Lowe added.

Additionally, the Commonwealth Bank of Australia (CBA) released preliminary PMI data for December. The manufacturing index increased from 57.1 to 57.4 but fell short of the 59.2 previously measured according to the activity indicators. Moreover, the Services PMI decreased from 55.7 to 55.1, increasing the composite PMI from 55.7 to 54.9 compared to the market consensus of 53.7.

As a stronger Australian employment report sustained expectations of an RBA rate hike, Lowe said, “if other central banks tightening makes us more likely to follow suit,” the AUD/USD bulls will control the market at press time.

AUD/USD prices also benefit from hopes for US stimulus and a moderate supply of S&P 500 futures. In the meantime, preparations will likely be made so that US dollar bulls regain control following the ECB meeting.

As well as the ECB, preliminary measured values for the monthly PMIs and Omicron updates will be monitored for a clearer picture of the direction in the future.

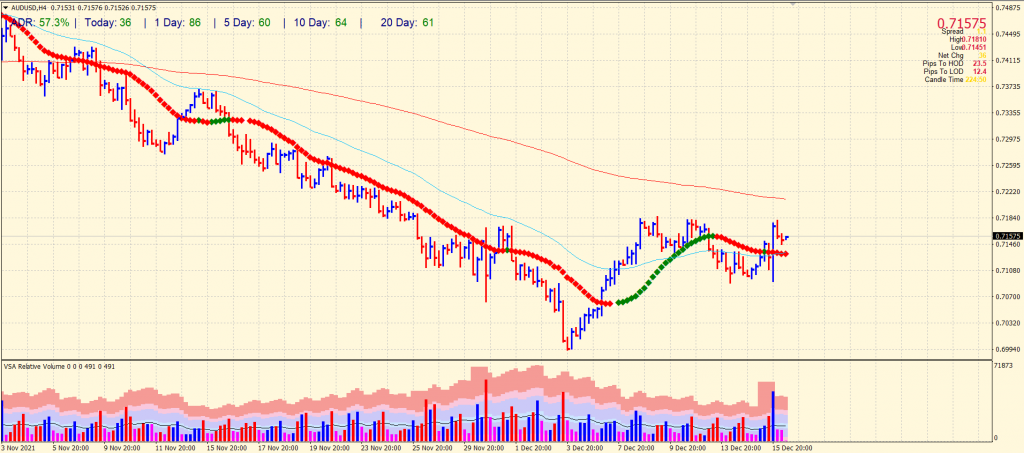

AUD/USD price technical outlook: Buyers look positive

The AUD/USD price found strong support at 0.7090 and surged to 0.7180 forming a triple top. The price found rejection from the resistance. However, the price is still supported above the 20-period and 50-period SMAs on the 4-hour chart. Another important resistance is the 200-period at 0.7210.

–Are you interested to learn more about Forex demo accounts? Check our detailed guide-

The pair is likely to stay in the broad range of 0.7090 to 0.7180. However, the upthrust bar shows the potential for breaking the triple top and testing the 200-period SMA.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.