- The AUD/USD pauses its recovery in a cautious market as the dollar rebalances.

- The S&P 500 futures are down 0.25% after Asian gains were erased.

- The RBA awaits Wednesday’s inflation data for fresh clues on the economy.

The AUD/USD price outlook remains largely negative as the US dollar bulls dominate the market amid Fed’s aggressive rate hike stance. On the other hand, RBA is likely to watch the Aussie inflation data to gauge economic performance.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

The AUD/USD price is trading around 0.7200, stalling recovery momentum in Asia ahead of Europe’s opening.

As markets turned cautious, the Aussie lost value amid renewed demand for the US dollar, reflected by a 0.25% decline in S&P 500 futures, which rose modestly amid Asian trade.

The Chinese capital Beijing has been put under lockdown following a rapid rise in Coronavirus cases. At the same time, the death toll in Shanghai is rising, threatening renewed optimism. In addition, a lockdown on China’s supply chain and growth fears is weighing on market sentiment and reinvigorating demand for safe-haven dollars.

Additionally, concerns over global economic growth persist amid aggressive Fed tightening expectations, supporting sentiment around the dollar. Additionally, investors are holding the US dollar before releasing durable goods data and the CB consumer confidence index.

Meanwhile, Australian bulls are being held back by Wednesday’s quarterly inflation report. It is expected that the year-over-year rate will reach 4.6% in the first quarter of 2019, compared to 3.5% in the fourth quarter of 2021.

The truncated average core RBA CPI is projected at 3.4%, a significant increase over the previous two, 6% and above the cap. As a result, future RBA policy decisions will be influenced by inflation data.

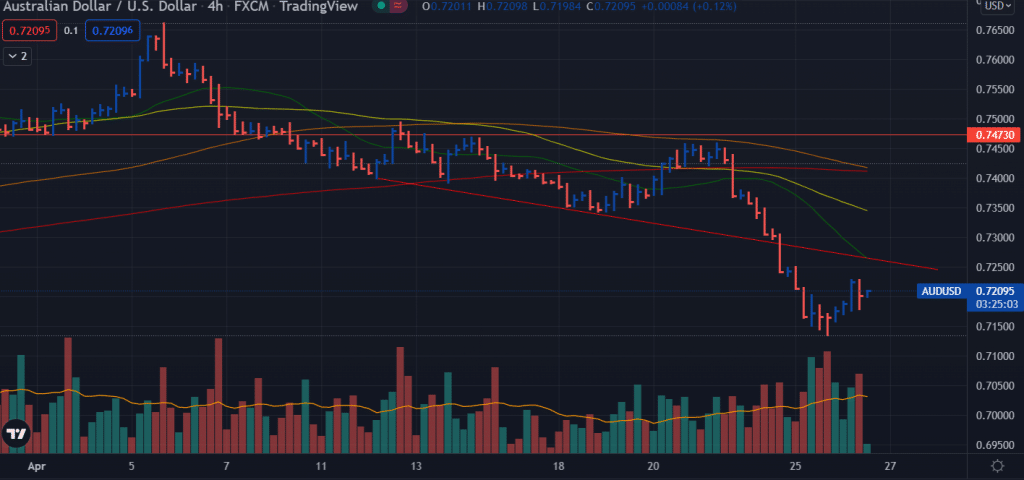

AUD/USD price technical outlook: Minor upside correction

The AUD/USD price broke down the descending trendline and went below the 0.7200 mark. However, the pair managed to recover slightly towards the 0.7200 handle. The outlook is still bearish.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

The upside correction may extend towards 0.7250, where the broken trendline and 20-period SMA create a confluence zone.

The volume data shows a rangebound behavior. The volume for the upside bars rose and fell around the average line. However, the recent down bar closing off the lows has a very high volume. It indicates a margin for the upside correction.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money