- AUD/USD is trading modestly higher after upbeat Q2 GDP.

- The impact of Covid restrictions may appear in the third-quarter GDP figures.

- US ADP and ISM data releases may provide impetus to the market.

Despite yesterday’s pullback, the AUD/USD outlook is positive as the upbeat GDP figures provided support and Greenback weakness persists.

The AUD/USD pair is trading at 0.7327, up 0.21% at the time of writing.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

According to a Bloomberg study, the Australian dollar strengthened after its GDP grew 0.7% in the second quarter against expectations of 0.4%. The annual GDP has been revised upwards from 9.1% to 9.6%.

Since the second quarter saw early restrictions on the Covid-19 delta variant, the market was surprised by the solid result. Despite the lockdown of New South Wales (NSW’s) largest economy in June, other states have yet to follow suit.

Data on the other restrictions, especially those in Victoria, will not be available until the third quarter. However, in October, some states will surpass the 70% vaccination target, which will ease restrictions on third-quarter GDP.

As the market interpreted the lockdown’s effect on earnings season, the S&P/ASX 200 index rose slightly in response to the data. In addition, dividends paid out topped A $ 34 billion this reporting season, and share buybacks were announced.

Iron ore prices plunged yesterday after disappointing PMI data released yesterday, bucking the trend in the AUD/USD.

New Zealand reports a 75 daily increase in Covid cases after a series of smaller cases over the past few days. Furthermore, fewer Covid infections are reported in the UK and China, while West Coast deaths are worrying.

Aside from virus concerns, market sentiment is also impacted by talk of a cut in bond purchases by the European Central Bank (ECB) amid strong inflation data from the bloc and hesitation over the Fed’s next move amid mixed data.

DXY traders will be more focused on risk catalysts. Still, the August US ADP data and the ISM Manufacturing PMI could determine the market’s short-term direction ahead of Friday’s employment report.

–Are you interested to learn more about forex signals? Check our detailed guide-

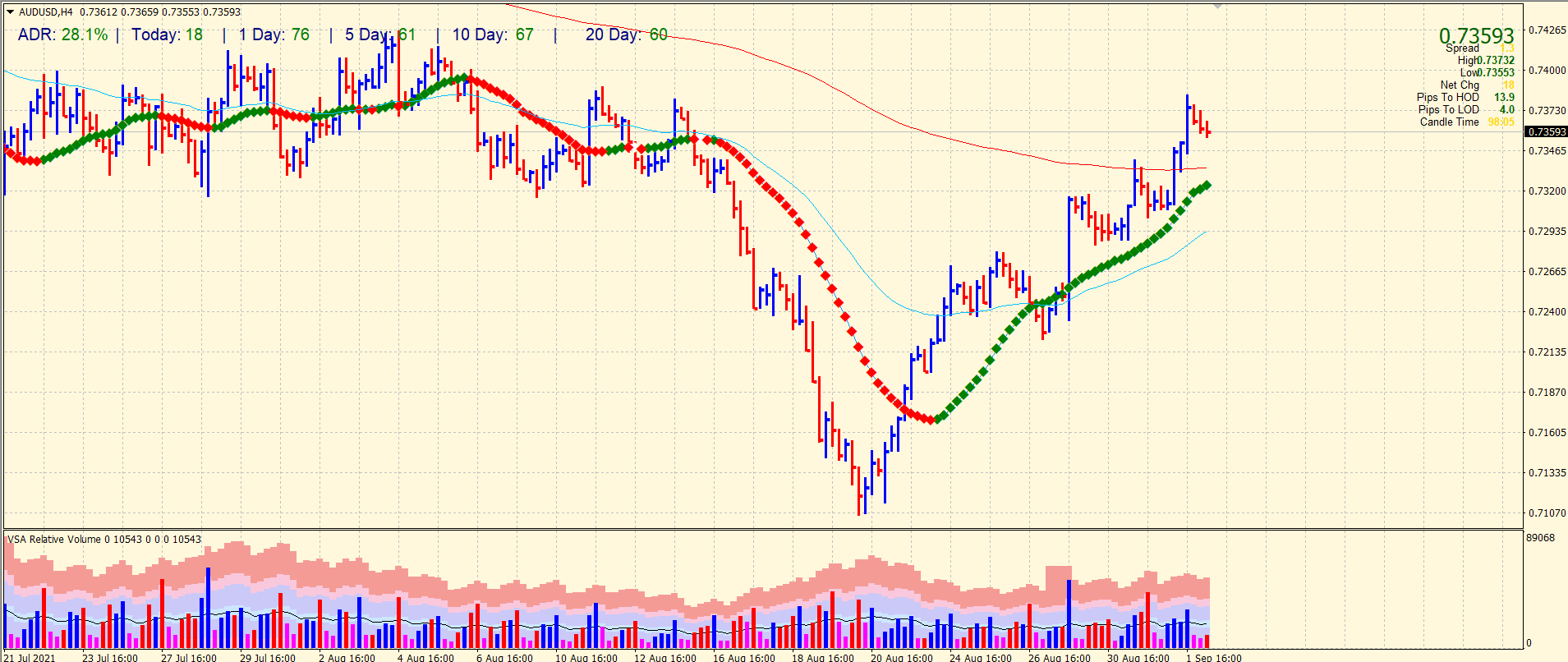

AUD/USD price technical outlook: 200-SMA capping gains

The AUD/USD price is heading towards the 200-period SMA on the 4-hour chart. Yesterday, the price could not surpass the level sandwiched between the 20-period and 200-period SMAs. Further upside can meet supply near the 0.7350 ahead of 0.7400. On the downside, the pair find demand near 0.7300 ahead of 0.7270.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.