- AUD/USD bounces amid mounting Omicron concerns in Australia.

- DXY traders remain on hold during simple trading.

- A focus on US economic data is giving new vigor to trade.

The outlook for the AUD/USD pair is slightly bearish as the price topped at 0.7260 and pared off some gains, falling for more than 40 pips. The AUD/USD pair protects smaller orders above 0.7200 and recovering modestly from the Asian session lows of 0.7213.

–Are you interested to learn more about Nigerian forex brokers? Check our detailed guide-

The bulls are losing strength due to the looming risks associated with the spread of the Omicron-Covid variant due to prevailing market reluctance.

On Wednesday, Omicron’s Covid cases skyrocketed, and hospital admissions spiked across Australia, prompting Prime Minister Scott Morrison to schedule a national emergency cabinet meeting ahead of Thursday’s deadline.

Earlier, positive news on Sino-Australian trade boosted the Australian dollar. The Chinese Ministry of Commerce announced that Beijing will increase its import quota for Australian wool to 40,203 tons in 2022. China’s recent announcement suggests that trade tensions between the two close trading partners will ease.

The Australian dollar and US Treasury bond yields remain protected due to a lack of liquidity at the end of the year, helping the pair rebound. As year-end capital flows remain in play, dollar bulls are unaware of rising inflation expectations and interest rates.

US trade data and upcoming home sales are adding new impetus to trading, which is also important to the couple. In addition, omicron updates around the world are also closely watched.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

AUD/USD price technical outlook: Bears emerging

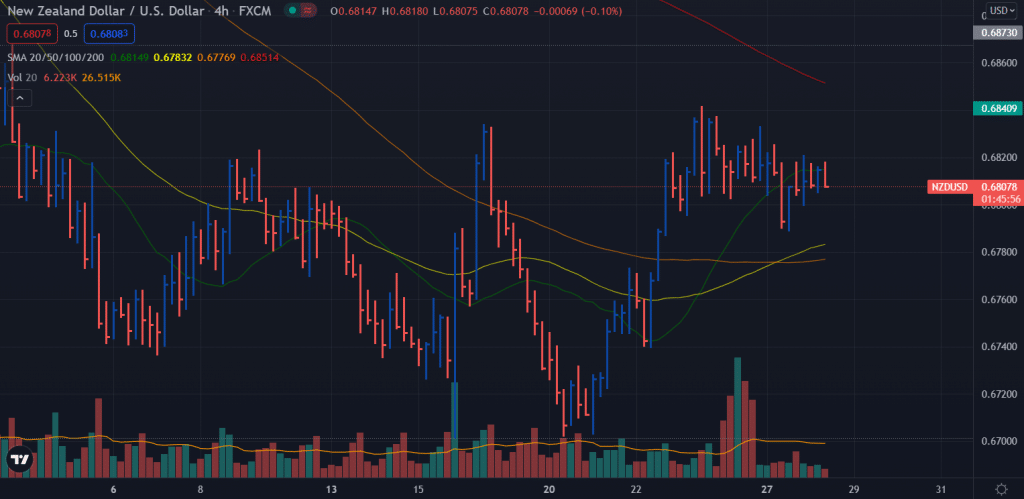

The AUD/USD price finds top at 0.7260 and is now consolidating gains just above 0.7200. However, the pair is below the 20-period SMA on the 4-hour chart. The 200-period SMA around 0.7180 may attract the price. Overall, the price stays within the rectangular pattern and may not provide any trading opportunity at the moment. The volume is quite thin and provides no clear bias at the moment. However, the widespread down bar indicates the bearishness.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.