- AUD/USD drops on the downbeat employment report.

- Australian labor market reports a loss of 146k jobs in August against expectations of 80k.

- RBA governor has shown concerns about slow economic recovery.

The AUD/USD outlook is bearish on the day amid poor employment data and RBA’s dovish stance on rate hikes stemming from slow economic recovery.

-Are you looking for automated trading? Check our detailed guide-

The Aussie fell after disappointing employment results showed 146.3k jobs lost in August vs -80k jobs predicted by Bloomberg. In contrast to expectations, the unemployment rate fell one percentage point to 4.5%. Even though fewer workers are on the job, lower unemployment rates are likely to result from declining workers’ participation in the workforce.

Massive job losses are likely to result from a wave of bans, mostly in New South Wales (NSW) and Victoria. Risk-taking preceded data pressure, but it appears the AUD/USD has been slightly dragged down by headlines. Some economists predict sluggish growth in the third quarter because of large restrictive measures related to Covid.

-If you are interested in forex day trading then have a read of our guide to getting started-

Phillip Lowe, Governor of the Reserve Bank of Australia (RBA), expressed this view earlier this week. The RBA head said he expects the economy to contract by 2% or more in the third quarter and the unemployment rate to fall by 5%. Mr Low’s hypotheses of slowing growth are supported by this employment report. Despite market expectations for rate hikes in 2023, Lowe said that 2024 may be the starting point for hikes. This further sets back the Australian dollar against other tightly capped central banks.

However, vaccination rates are rising, so a return to normal should be expected by the fourth quarter. Australia’s policymakers have been working hard to boost vaccination campaigns. Vaccination rates for people aged 16 and over will be increased to 80% by December. Planned measures to ease travel restrictions and blockades will be lifted to a large extent. Increasing the gap could assist the RBA in increasing interest rates more aggressively. The Australian dollar will, however, face the least resistance until then.

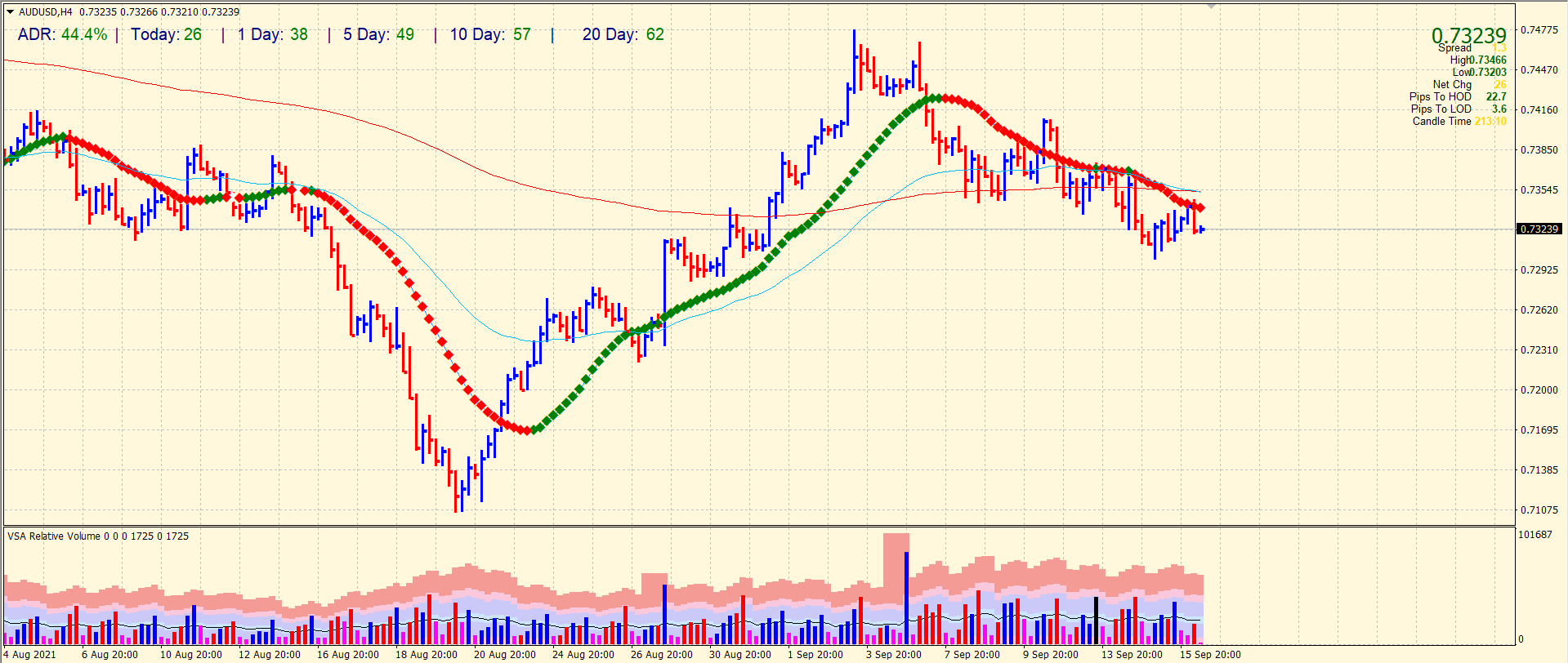

AUD/USD price technical outlook: Bearish crossover

The upside attempt found selling near the 20-period SMA on the 4-hour chart, around the mid-0.7300 area. The 50-period and 200-period SMAs are making a bearish crossover that may exacerbate the selling. The volume shows favorable conditions for the bears. Any downside attempt will face strong support at 0.7300 ahead of 0.7250.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.