- Tuesday saw a 25 basis point increase in Australia’s cash rate.

- The RBA has raised rates by a sum of 325 basis points since May 2022.

- Australia’s core inflation increased to 6.9% from a year earlier in Q4.

- Today’s AUD/USD outlook is slightly bullish. Following the Reserve Bank of Australia’s (RBA) rate decision, the Australian dollar soared, jumping as much as 1% to an intraday high of $0.6952.

–Are you interested in learning more about forex robots? Check our detailed guide-

Tuesday saw a 25 basis point increase in Australia’s cash rate, bringing it to a decade-high of 3.35%. The central bank dropped previous guidance that it was not on a defined path but emphasized that more increases would be required.

The RBA ended its February policy meeting by stating that core inflation had been higher than anticipated and that higher rates would be required to ensure that inflation falls to its target range of 2-3%.

The market had anticipated a change of 25 basis points. However, there was a chance of a larger increase given that recent inflation data had surprised on the high side. Since May of last year, there have been nine rate increases, raising rates by a sum of 325 basis points.

According to the RBA’s most recent forecasts, inflation will reach 3% by mid-2025, over the central bank’s target range of 2-3%, after dropping to 4.75% this year.

Hopes for a pause this month were dashed by a hot fourth-quarter inflation report, which showed core inflation increasing to 6.9% from a year earlier, beyond the central bank’s previous prediction of 6.5%.

The RBA also forecasts that between 2023 and 2024, economic growth will be roughly 1.5% on average.

AUD/USD key events today

Investors will be keen on a speech from Fed Chair Jerome Powell set for later today. This speech might contain clues on future policy moves.

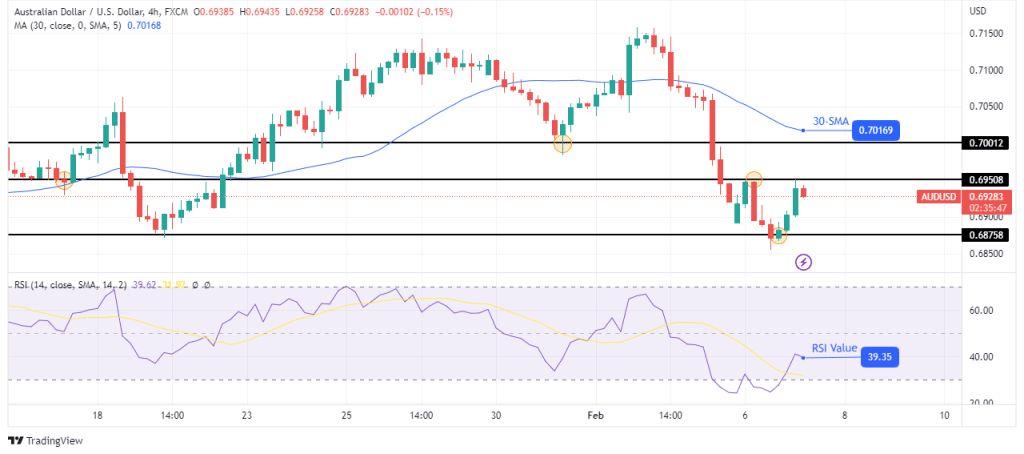

AUD/USD technical outlook: Strong bullish retracement pauses at 0.6950

The 4-hour chart shows AUD/USD trading close to the 0.6950 resistance level. This comes after bulls took over at the 0.6875 support level. However, the price still trades below the 30-SMA with the RSI below 50, showing the bearish trend is still intact.

–Are you interested in learning more about South African forex brokers? Check our detailed guide-

If bulls keep pushing the price with the same strength, we might see a break above the 0.6950 resistance with the next target at the 0.7001 resistance level. However, the price might resume the downtrend at any of these resistance levels.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money