- The RBA decided on a smaller hike this month due to falling house prices.

- Banks believe that falling home prices in Australia will hurt consumer spending.

- Markets expect another 25bps rate hike from the RBA in December.

The outlook for the AUD/USD today is bullish because the RBA will keep raising rates to keep inflation in check. Although Australia’s central bank plans to raise interest rates further in the future, it decided on a smaller hike this month partly because of worries that declining property prices will negatively impact consumer spending.

–Are you interested in learning more about STP brokers? Check our detailed guide-

According to minutes of the November 1 policy meeting released on Tuesday, The Reserve Bank of Australia (RBA) Board again debated raising rates by either 25 basis points or 50 basis points to bring inflation back to its goal range of 2-3%. The arguments in favor of a lower increase won out.

The RBA Board noted that since May, rates increased by 275 basis points to a nine-year high of 2.85% and that a large portion of this increase had yet to be reflected in mortgage payments.

Although consumption has remained steady thus far, the tightening has hurt home prices, which the bank believes will significantly impact consumer spending.

The Board focused on getting inflation back to its objective and did not rule out going back to higher rises if the situation called for it. However, it also stated that it is willing to hold interest rates steady for a bit while assessing the status of the economy if necessary.

Market expectations point to another quarter-point increase at the next policy meeting in December, but they also imply a 25% likelihood that the RBA will hold steady.

AUD/USD key events today

Investors will pay close attention to the US Producer Price Index (PPI) report as it is a leading indicator of consumer price inflation.

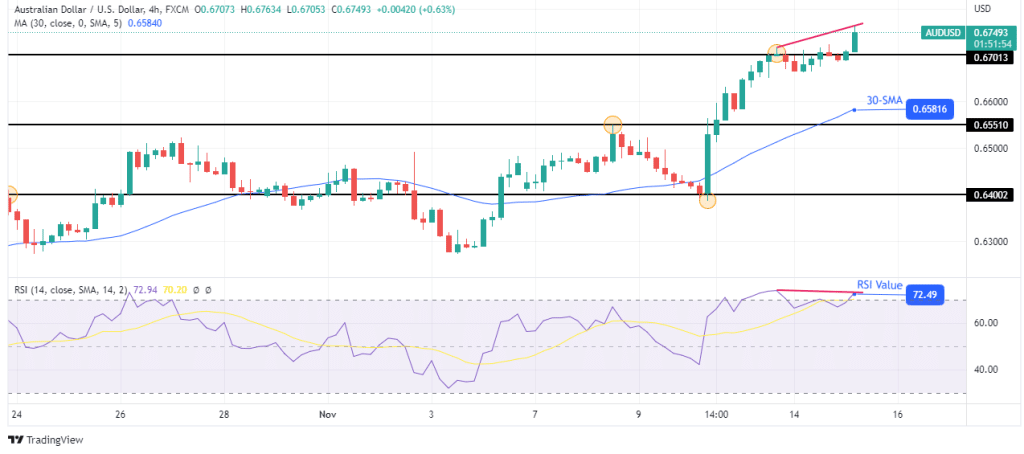

AUD/USD technical outlook: RSI showing signs of weakness

The 4-hour chart shows the price trading far above the 30-SMA and the RSI above 50. This is a sign that bulls are in control. However, a closer look shows that the bullish move might have peaked. The price is making a new high while the RSI is holding at the previous high.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

This could be an early sign of weakness that might allow bears to return. If bears come back, they will look to retest the 30-SMA in a retracement move. The bullish trend will remain if the price stays above the 30-SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.