- There was no surprise rate hike from the ECB meeting.

- The dollar pushed higher after the meeting.

- AUD/USD is pushing lower ahead of US inflation.

The AUD/USD outlook got negative on Thursday as the price closed on a solid bearish candle after the ECB did as investors had expected. There was no surprise in yesterday’s meeting.

-Are you interested in learning about the best AI trading forex brokers? Click here for details-

The ECB ended its long-running stimulus scheme yesterday and promised the first rate hike since 2011 at the next meeting. The bank said it would end quantitative easing on July 1 and raise rates on July 21.

“We will make sure that inflation returns to our 2% target over the medium term,” ECB President Christine Lagarde told a news conference. She said of the moves signaled on Thursday that “it is not just a step; it is a journey.”

These events caused volatility in the dollar, pushing it higher and subsequently pushing AUD/USD lower.

AUD/USD key events today

Not much will be coming out of Australia today. So, investors will be paying attention to inflation data from the US. Investors expect a drop in the core CPI from 0.6% to 0.5%. If CPI comes in much lower or higher, we might see some volatility in the pair.

This data will guide the Federal Reserve’s monetary policy path. A cooldown in inflation would reassure those hoping that inflation had peaked in March and that the April pullback was not a one-time thing. A drop would also allow the Fed to take a less aggressive stance on raising interest rates.

The markets expect the second of three consecutive 50bps rate hikes next week, which has seen a rise in the dollar.

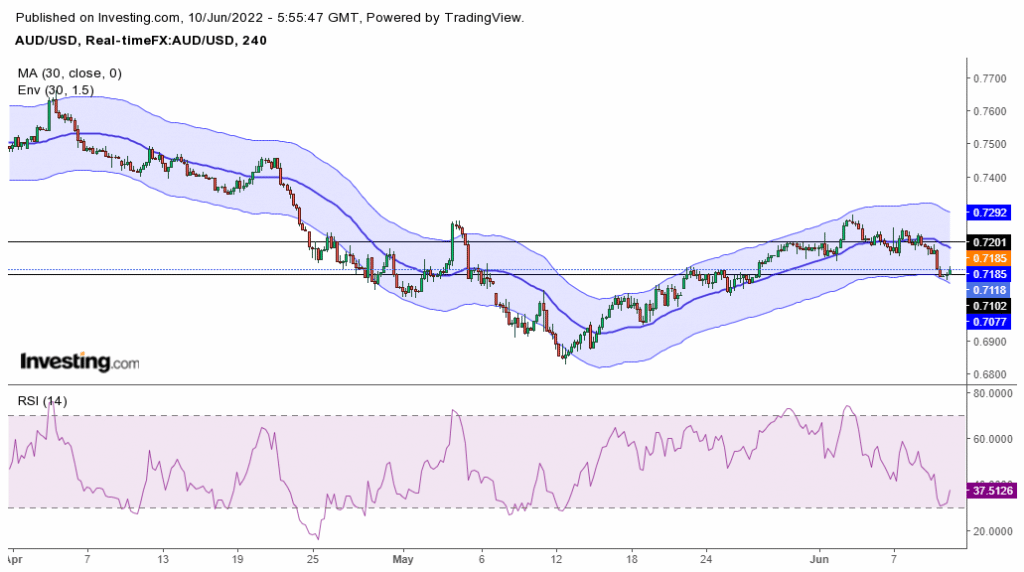

AUD/USD technical outlook: Bears keeping dominance

Looking at the 4-hour chart, the price is trading below the 30-SMA, and RSI is below the 50 level, showing a new bearish trend. The price is currently experiencing support at 0.7100. At this point, the price might break below and continue this solid bearish move, or it might bounce and push higher to retest the recently broken SMA.

-Are you interested in learning about the forex indicators? Click here for details-

A break below 0.7100 could see the price push to 0.7000, while a pullback might find resistance at 0.7150. The bias remains bearish as long as the price stays below the 30-SMA and the RSI trades below the 50 levels.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money