- The AUD/USD remains sidelined near its weekly high despite its three-day uptrend.

- Government officials echoed the RBA’s statement, which says, “The end of the asset purchase program does not mean an imminent rate hike.”

- Sentiment deteriorates ahead of major weekly data/events; mixed Fed announcements contribute to sluggish moves.

On RBA Chief Philip Lowe’s cautious optimism, AUD/USD outlook disturbs as the bulls are taking a breather around a weekly high, falling to 0.7130 early Wednesday. However, the risk barometer remains firmer for the third day in a row, with a gain of 0.10% at the latest on that day.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

Gov. Low also echoes the RBA’s statement, saying, “It’s too early to conclude that inflation is within a sustainable target range.” However, bulls remain hopeful nonetheless, as the policymaker points out: “The worst economic impact of Omicrons is over.”

Announcing the end of quantitative easing (QE) on Tuesday, the Reserve Bank of Australia (RBA) expressed optimism about further improving inflation and gross domestic product. However, despite Australia’s refusal to raise interest rates immediately, comments such as “inflation have risen, but it is too early to conclude that it is well within target range” weighed at first on the AUD/USD.

Nevertheless, a weaker US Dollar Index (DXY) and bullish performance in stocks and gold appears to have supported the AUD/USD pair’s recovery.

There was some improvement in risk appetite yesterday despite mixed comments from Federal Reserve officials and stronger recent data from the US, not to mention the decision on Russia-Ukraine affairs. Similarly, the US 10-year Treasury yield reclaimed 1.80% after two days of declines, recently sluggish at around the same level. In contrast, Wall Street benchmarks rose, with S&P 500 futures around 4555.

However, the US ISM Services PMI rose in January to 57.6 from an anticipated 57.5, marking the 20th consecutive increase in manufacturing activity, allowing the Fed to maintain its hawkish stance. Fedspeak’s recent report has rattled and tested US dollar bulls ahead of Friday’s key US jobs report.

On Tuesday, Rafael Bostic, Atlanta’s Fed president, said that inflation expectations were at risk of drifting away from the Fed’s target of 2.0% to 4%. Meanwhile, James Bullard, President of the St. Louis Fed, said that it remains uncertain whether the Fed needs to take more hawkish action (i.e., raise interest rates above the 2.0-2.5% “neutral” zone).

After seeing the initial reaction to RBA Governor Low’s comments, AUD/USD traders will now turn their attention to risk catalysts for fresh impetus. The US ADP payrolls will also be notable in January, expected to come in at 207k versus 807k in December.

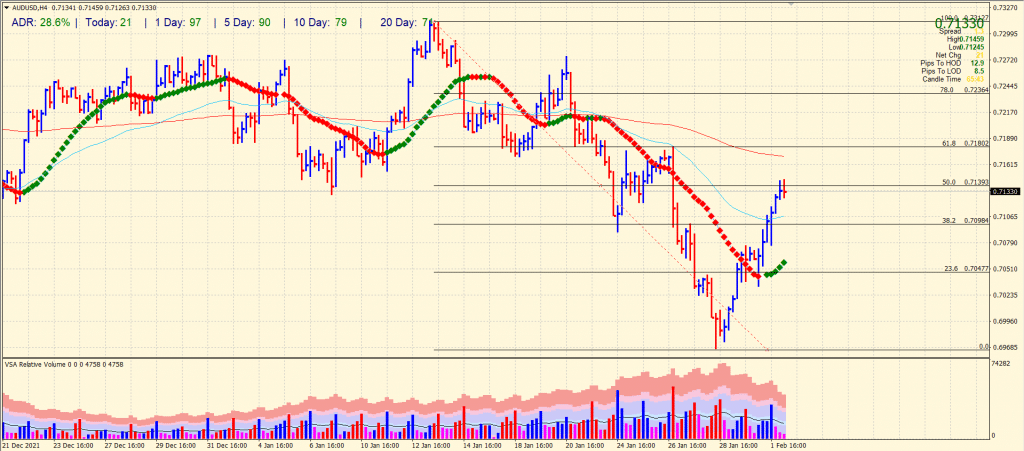

AUD/USD technical outlook: Bulls to lose momentum

The AUD/USD price managed to break above the 50-period SMA on the 4-hour chart. However, the next resistance at 200-period SMA remains intact around 0.7170. The volume for the recent bars is too low, indicating that the upside momentum may continue further. However, the bulls do not hold enough strength to break the 0.7200 handle.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

On the flip side, the pair may slide towards 0.7100 ahead of 0.7050 and then 0.6990. However, the downside potential remains stronger than the upside as a wall of resistance may not allow buyers to keep going upwards.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.