- AUD/USD remains on the backfoot amid broader risk-off sentiment.

- China may lift the ban on the import of Australian coal that may provide some breather to the Aussie.

- Australian PMI data came better than expected which may slightly support the AUD.

The AUD/USD price outlook is bearish as yesterday’s gains were reversed amid deteriorated risk sentiment and Fed tapering talks that continue to lend support to the Greenback.

At the time of writing, the AUD/USD price is at 0.7212, down 0.21% on Friday.

-If you are interested in forex day trading then have a read of our guide to getting started-

Asia Pacific markets are likely to stay in a different direction after US equities ended the third quarter with their biggest monthly loss in a year. In September, the S&P 500 lost 4.76%, moving within range of a technical market correction. The stock market falls despite a temporary measure that keeps the government funded through December Congress.

In yesterday’s trade, the Australian dollar strengthened against a weaker US dollar. However, energy crises in China may drive speculative bets on the Australian dollar. China banned coal imports from Australia last year, but the energy crisis may force President Xi to ease trade restrictions. This is good news for the Australian economy, one of the world’s biggest coal exporters. Although most of China’s energy needs are met by coal, ramping up production can be difficult.

The base rate for the US government bonds fell below 1.5% on day two as investors bought the bonds as safe-haven assets. The decline in yields has put pressure on the US dollar, although the DXY has remained at its highest since November 2020. Immediately following last week’s rate decision, dollars and government bonds rose sharply, which led to further rate hikes. Bond prices usually fall when interest rates are expected to rise.

China’s vice premier Han Zheng had ordered the country’s energy companies to ensure the safety of fuel products, which led to a rise in crude oil, natural gas, and coal prices overnight. The policymakers have restricted production in factories to alleviate the problem of inadequate coal supply in China. This has increased urgent energy needs. It could lead to an energy security battle worldwide. The price of natural gas is rising in Europe and the United Kingdom.

The manufacturing PMI for Australia for September broke 56.8 this morning, according to Markit Economics. The previous reading for August was 52. Today will be an important day for Japan. The Bank of Japan is set to release its views and August unemployment data.

-Are you looking for automated trading? Check our detailed guide-

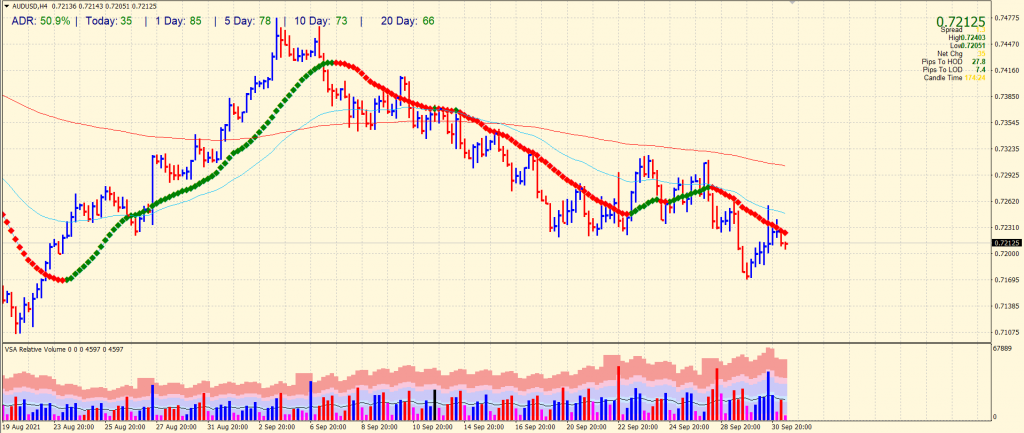

AUD/USD price technical outlook: Upthrust bar to keep bears alive

The AUD/USD price remains below the 20-period SMA on the 4-hour chart. The upthrust bar rejecting the 50-period SMA, closing well below the 20-period SMA, indicates that the bears have taken back control. Breaking below the 0.7200 mark may trigger a sell-off towards YTD lows at 0.7100.

On the upside, the pair needs to overcome the 20-period and 50-period SMAs to cope with the current selling pressure. Staying above the key SMAs may aim for 0.7300 ahead of 0.7350.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.