- AUD/USD stages an impressive recovery from multi-month lows.

- The aussie is struggling to recapture 100-DMA as RSI stays bearish.

- All eyes remain on the NFP data amid a quiet Good Friday.

AUD/USD remains on the front foot for the third straight session, having recovered Thursday’s sell-off to four-month lows of 0.7531.

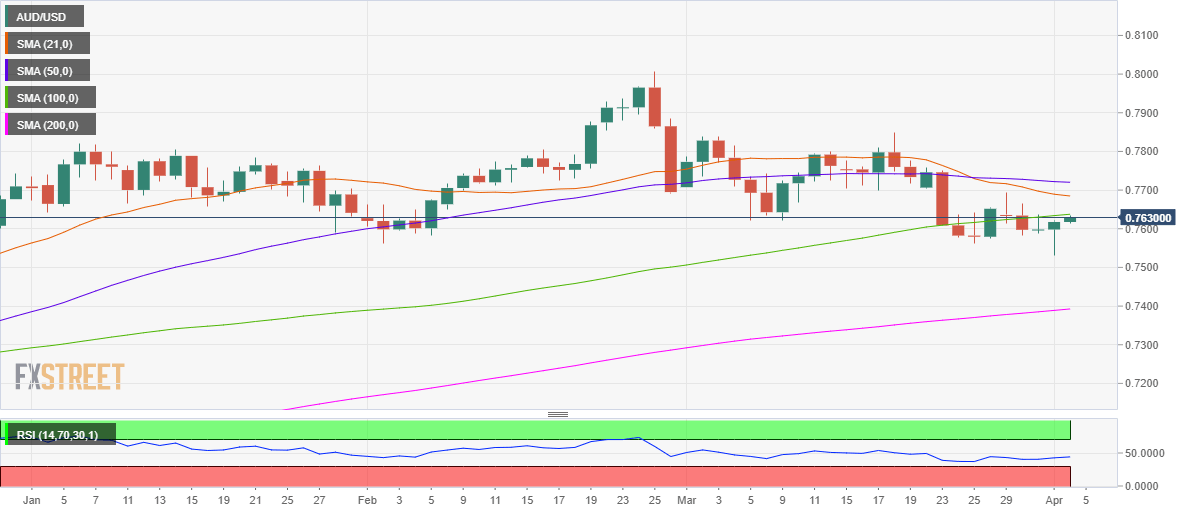

The 100-daily moving average (DMA) at 0.7635 is offering strong resistance to the AUD bulls, as they look to build on to the recovery moves beyond the 0.7600 barrier.

A firm break above the latter could expose the downward-sloping 21-DMA at 0.7685, with the next upside target aligned at 0.7700.

However, with the relative strength index (RSI) still trending below the midline, the recovery is likely to remain short-lived, as the sellers could regain control.

AUD/USD: Daily chart

A drop back towards the yearly lows cannot be ruled if the 100-DMA barrier fails to give way.

Further south, the 0.7500 support could be challenged, opening floors for a test of the December 21 low of 0.7461

AUD/USD: Additional levels