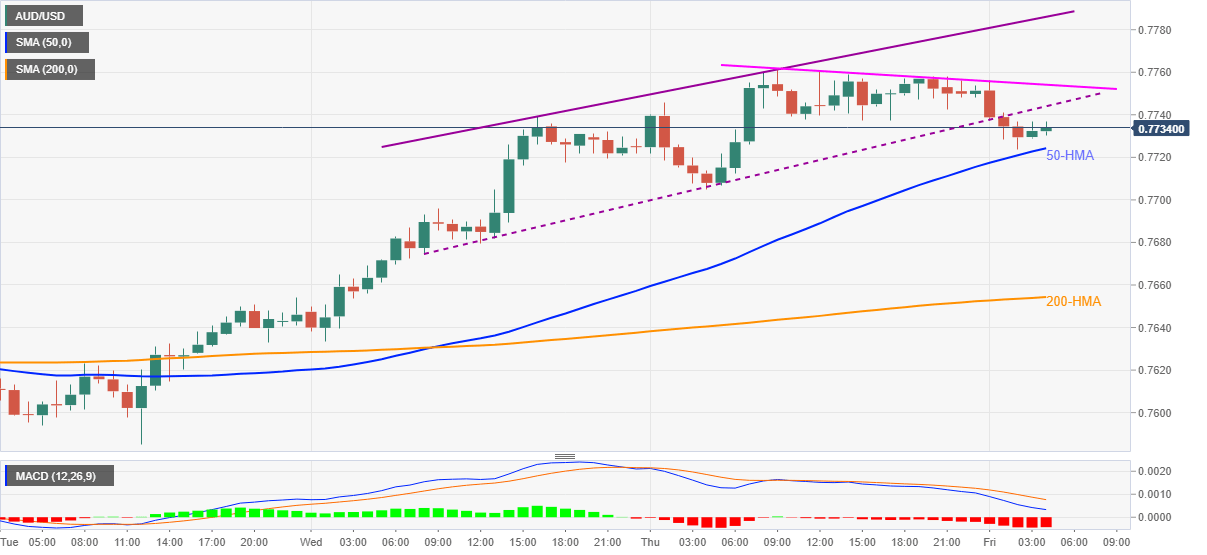

- AUD/USD struggles to keep bounce off 50-HMA amid bearish MACD.

- Two-day-old rising channel break also favors sellers, descending trend line from recent tops add to upside filters.

AUD/USD trims intraday losses while picking up bids to 0.7735, down 0.25% on a day, amid the early Friday.

The pair recently dropped below an upward sloping trend channel formation from Wednesday. However, 50-HMA triggered the latest corrective pullback.

Even so, the bearish MACD signals and the pair’s sustained breakdown of the stated bullish chart pattern backs AUD/USD sellers eyeing a downside break of 50-HMA level of 0.7724 to revisit the 0.7700 threshold.

It should be noted that the pair’s sustained weakness below the 0.7700 round-figure may not hesitate to challenge the 200-HMA level near 0.7650.

Alternatively, corrective pullback beyond the stated channel’s support line, at 0.7745 now, will have to cross a descending resistance line from the previous day, around 0.7755.

Though, the channel’s upper line near 0.7785 and March’s top near 0.7850 will be the tough nuts to crack for AUD/USD buyers beyond 0.7755.

AUD/USD hourly chart

Trend: Further weakness expected