- AUD/USD is starting 2020 by retracing down below the 0.7000 handle.

- The level to beat for bears is the 0.6929 support.

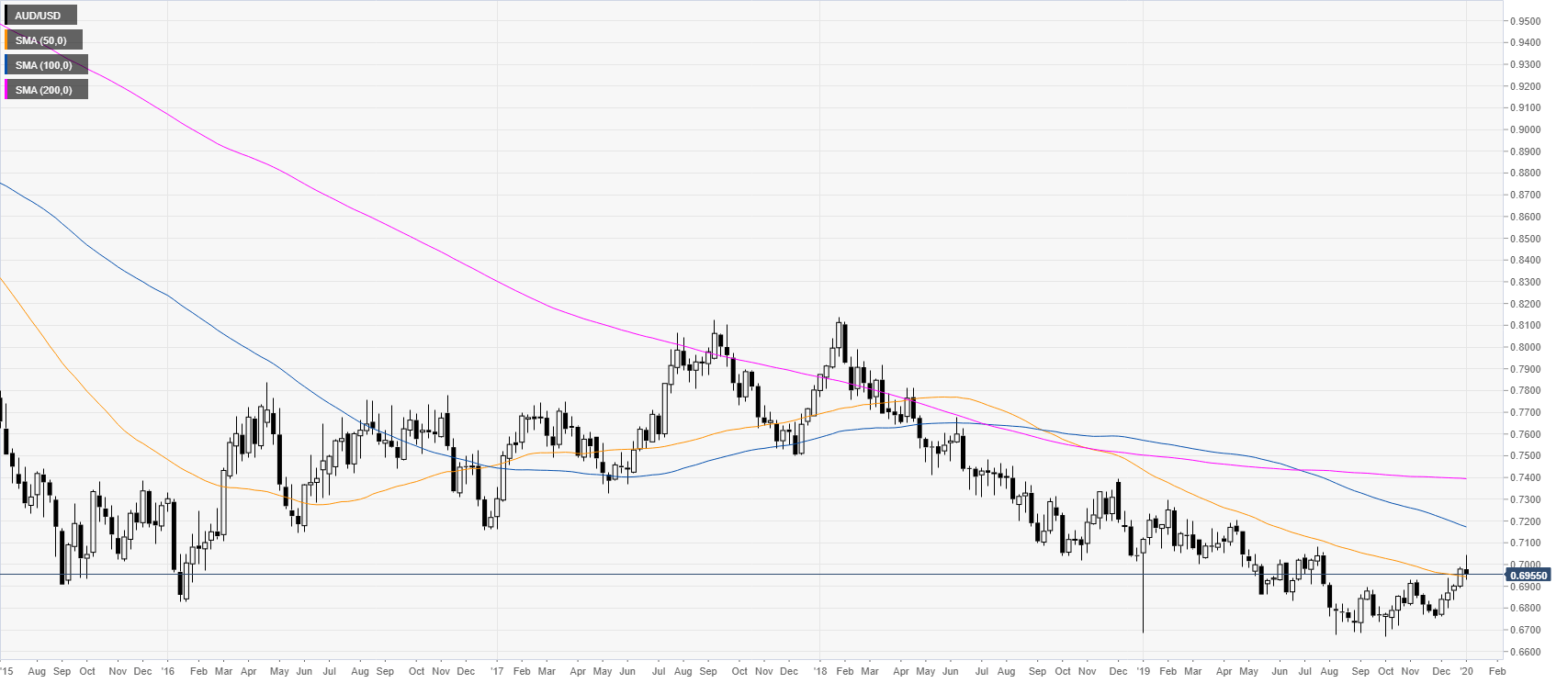

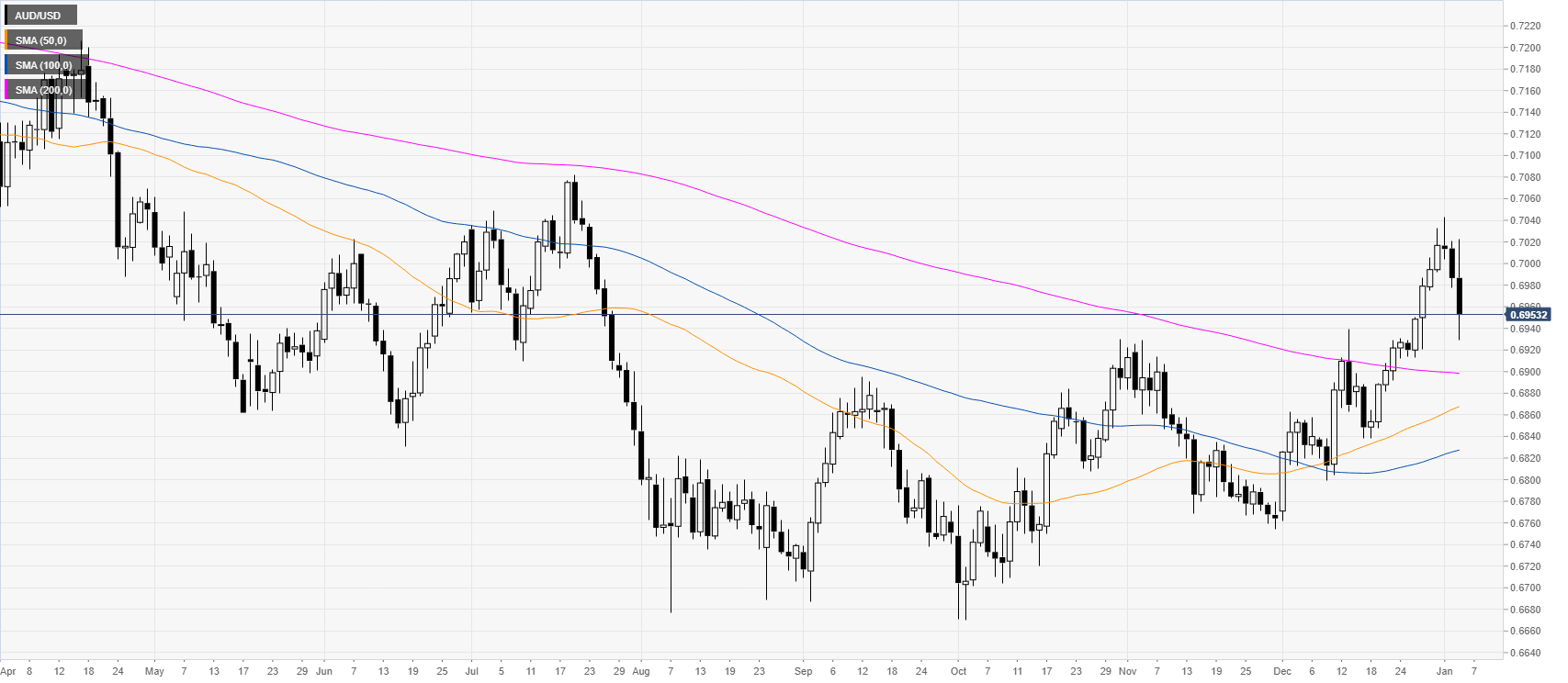

AUD/USD weekly chart

AUD/USD is starting 2020 while trading above the 0.6900 handle and the 50-period weekly simple moving average (SMA). In 2019, the market was under selling pressure in the first half of the year, however since August, the spot pulled back up. If the buyers maintain AUD/USD above the 0.6700 handle, 2020 might be sideways to up.

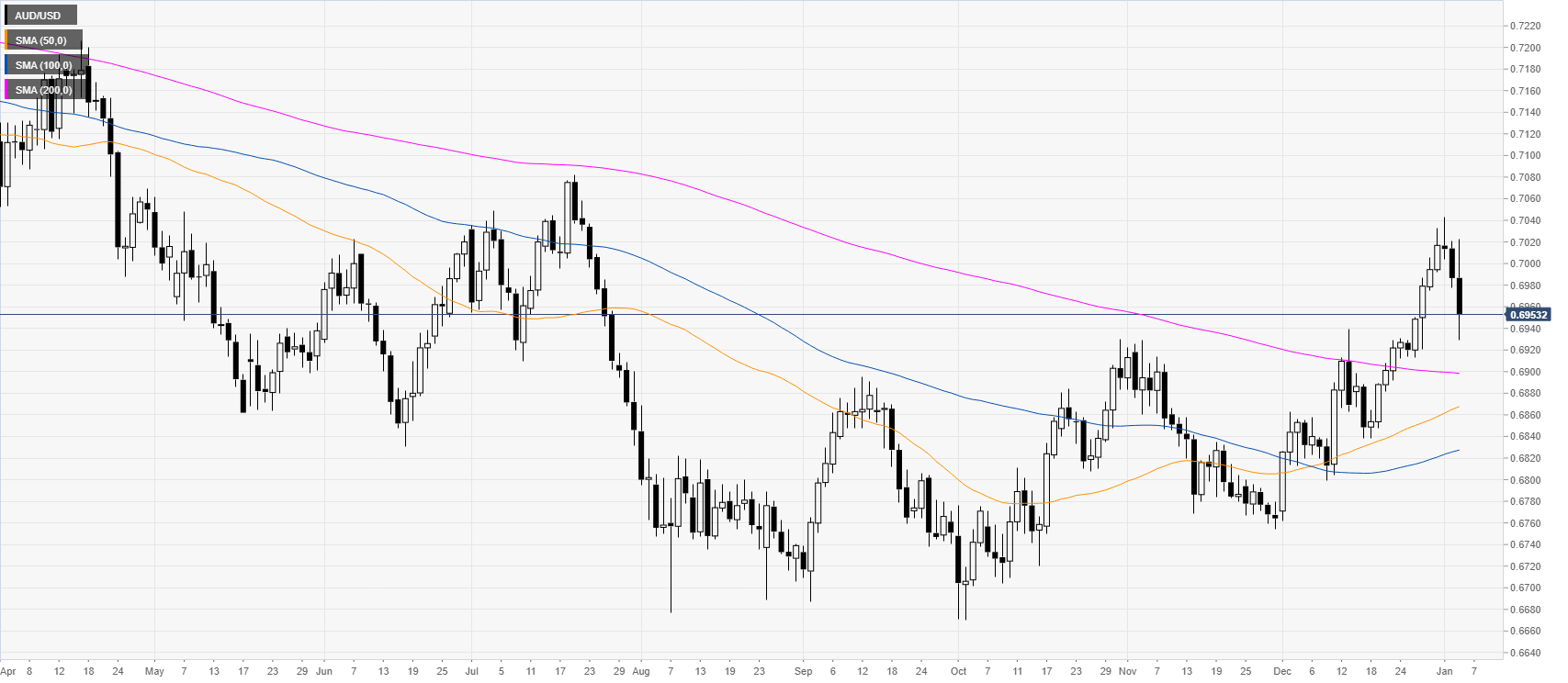

AUD/USD daily chart

AUD/USD is retracing down for the third consecutive day below the 0.7000 handle while above the main simple moving averages (SMAs), suggesting that the underlying bullish tone remains potentially bullish.

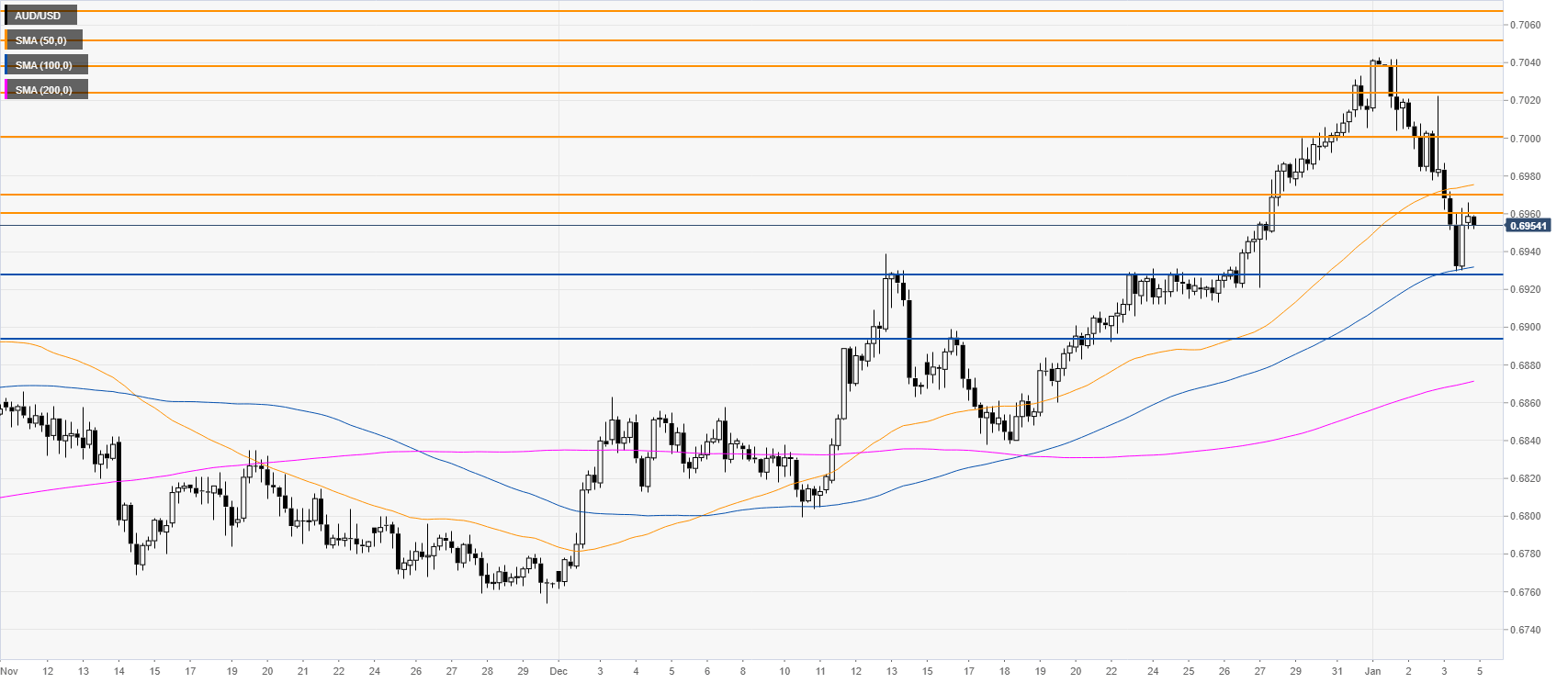

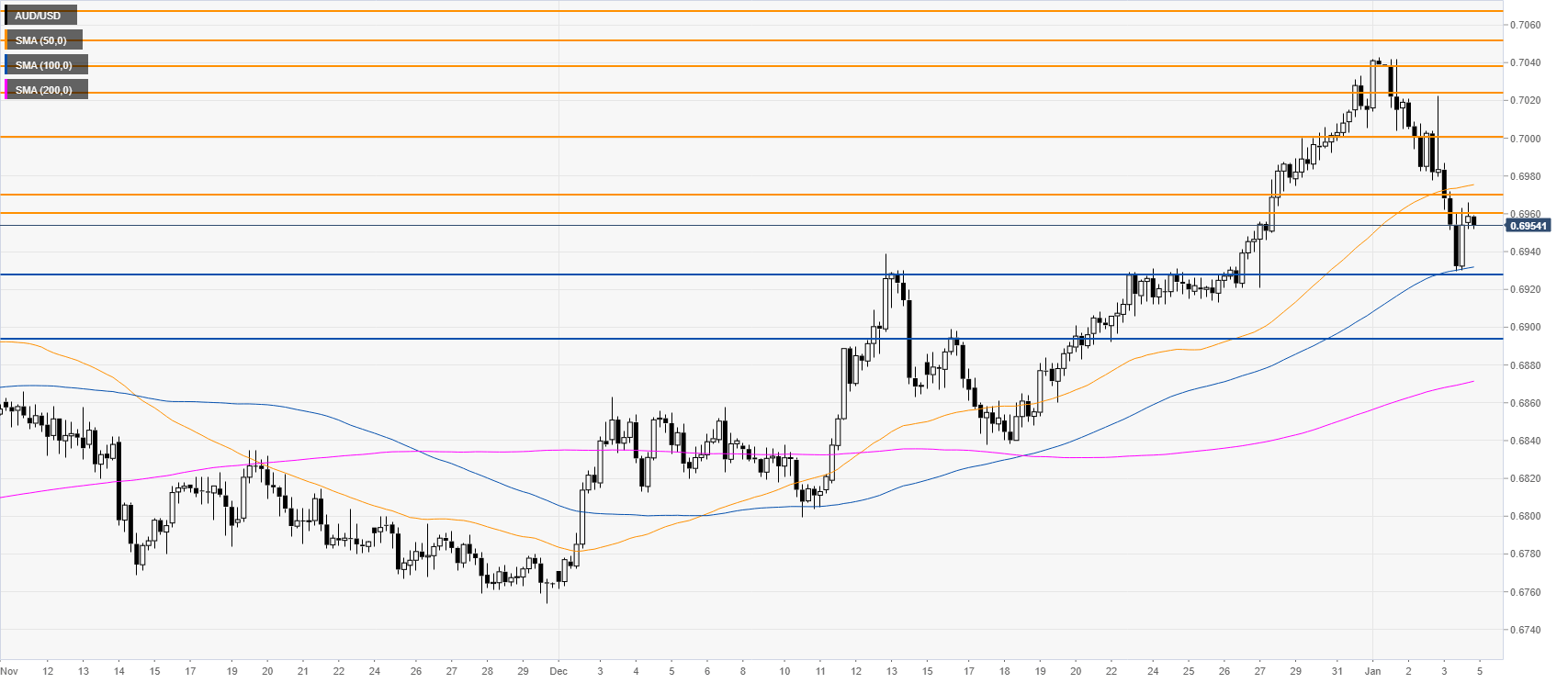

AUD/USD four-hour chart

The spot rebounded from the 0.6929 level and the 100 SMA. It is now consolidating below the 0.6970/0.6959 price zone. As the market in the last two days was steeply down, it is unlikely that the current bounce will go very far. It is more probable that the market will enter a range in the 0.6960-0.6929 zone. If bears break below the 0.6929 level, the spot could drop to 0.6893 in the medium term. However, if the bulls take the lead above the 0.6970/0.6959 price zone, then the 0.7000 handle can be back on the cards, according to the Technical Confluences Indicator.

Additional key levels