- CPI figures from the United States revealed a 0.1% reduction last month.

- There’s more speculation that the Federal Reserve will scale back its rate hikes.

- Financial markets factored in a 25 basis point rate increase at the next Fed meeting.

Today’s AUD/USD price analysis is bullish. The dollar fell versus the Australian dollar following data showing a decline in US inflation on Thursday, fueling speculation that the Federal Reserve will scale back its rate hikes going forward.

–Are you interested in learning more about forex robots? Check our detailed guide-

Consumer price index (CPI) figures from the United States revealed a 0.1% reduction last month, the first drop since May 2020, when the economy was in shambles due to the first wave of COVID-19 infections.

The CPI went up 6.5% in the year that ended in December. It came after a 7.1% increase in November and was the weakest since October 2021. The annual CPI reached its highest point in June, peaking at 9.1%, the highest increase since November 1981. However, the Fed’s 2% target for inflation still needs to be reached.

Fed policymakers said that the central bank’s target rate was still expected to increase above 5% and remain there for some time despite market bets to the contrary. They expressed relief that price pressures were lessening, clearing the way for a potential halt in interest rate hikes.

The Federal Reserve last year increased its policy rate by 425 basis points, bringing it to a range of 4.25% to 4.50%, the highest level since late 2007.

According to CME’s FedWatch Tool, financial markets have already factored in a 25 basis point rate increase at the Fed’s meeting on January 31–February 1.

AUD/USD key events today

Investors will continue to focus on the US inflation report since no significant economic releases from the US or Australia are slated for today.

AUD/USD technical price analysis: Buyers set to go beyond the 0.6980 level

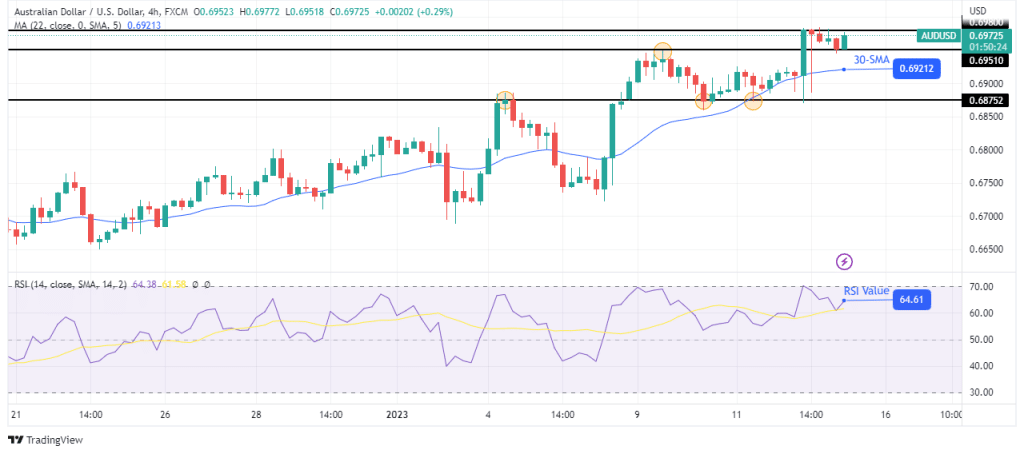

The 4-hour chart shows AUD/USD in a bullish trend, with the price trading above the 30-SMA and the RSI above 50. The price broke above the 0.6951 resistance level with a strong bullish candle, making a new high around the 0.6980 level.

–Are you interested in learning more about South African forex brokers? Check our detailed guide-

Bears came in at this level to try and push the price below the 30-SMA but failed to close below the 0.6951 key level. From here, bulls are getting ready to retest and possibly break above the 0.6980 level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money