- Australia’s GDP increased by 0.6% in the third quarter, down from 0.9%.

- Australia’s annual growth rate accelerated to a dizzying 5.9%, outpacing China.

- On Tuesday, the RBA increased the cash rate by 25bps.

Today’s AUD/USD price analysis is bearish. The September quarter saw a slight slowdown in Australia’s economy as sky-high prices and rising interest rates reduced consumer spending power, showing that aggressive policy tightening is dampening demand.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

Real gross domestic product (GDP) increased by 0.6% in the third quarter, compared to 0.9% the previous quarter and just shy of predictions of 0.7%, according to data released by the Australian Bureau of Statistics on Wednesday.

The country’s annual growth rate accelerated to a dizzying 5.9%, outpacing China partly because of a one-time boom as the economy began recovering from pandemic lockdowns in late 2017.

Household consumption, which increased by 1.1% in the quarter due to spending on vacation, eating out, and new cars, was once again the main driver of growth. That, however, was the smallest advance in a year and down from a 2.1% increase in the second quarter.

The saving ratio, which peaked above 20% during the pandemic and fell to 6.9% this quarter from 8.3% the previous quarter, was another indication that consumers were tightening their purse strings.

On Tuesday, the central bank increased the cash rate by a quarter point to a 10-year high of 3.10%, totaling a shocking 300 basis points of tightening since May.

Markets are betting it is not yet over because futures indicate that rates will peak at about 3.6% in the middle of next year.

AUD/USD key events today

Investors will pay attention to Australia’s trade balance. The trade balance calculates the value difference between goods and services imported and exported during the reported time.

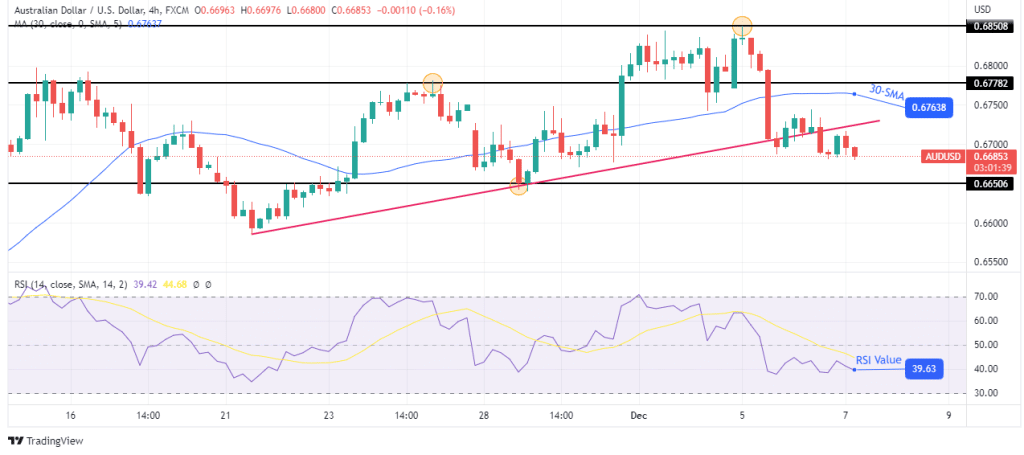

AUD/USD technical price analysis: A 0.6650 support retest is imminent

Looking at the 4-hour chart, it is clear that bears have the upper hand. The price is trading far below the 30-SMA, and the RSI favors bears as it is trading below 50. The price has also broken below a strong support trendline showing bears are strong.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

Bears need a small push from the current level to reach the next support level at 0.6650. Given the strong bearish momentum, this might happen soon. The price will also likely break below this support and trade lower.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.