- Australia’s inflation rose sharply in the September quarter to a 32-year high.

- Core inflation in Australia pushed beyond the forecasts to hit 6.1%.

- The RBA might be forced to resume its aggressive stance after the inflation report.

Today’s AUD/USD price analysis is bullish. The price of gas and home construction drove Australian inflation to a 32-year high last quarter. This startling development increased pressure on the country’s central bank to resume aggressive rate hikes.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

Consumer price index (CPI) data from the Australian Bureau of Statistics (ABS) on Wednesday revealed a 1.8% increase in the September quarter, exceeding 1.6% market expectations.

The yearly rate increased sharply from 6.1% to 7.3%, the highest level since 1990 and over three times the rate of wage growth. Core inflation pushed up to 6.1%, higher than the 5.6% forecast.

It is particularly unfortunate for the RBA because, after four moves of 50 basis points this month, it startled many by reducing speed to a quarter-point rate hike.

The RBA wanted to increase rates gradually to see how the sharp tightening affected consumer spending because rates have increased by a whopping 250 basis points since May.

Investors now believe that the central bank may need to make a change, possibly not at its policy meeting next week but rather in December.

Futures now indicate a slight possibility of a half-point increase in December and a peak for rates at 4.20% in July. They, however, still predict a quarter-point advance on November 1 to 2.85%.

AUD/USD key events today

Investors will pay attention to the new home sales report from the United States. It estimates the annualized number of new single-family homes sold over the previous month.

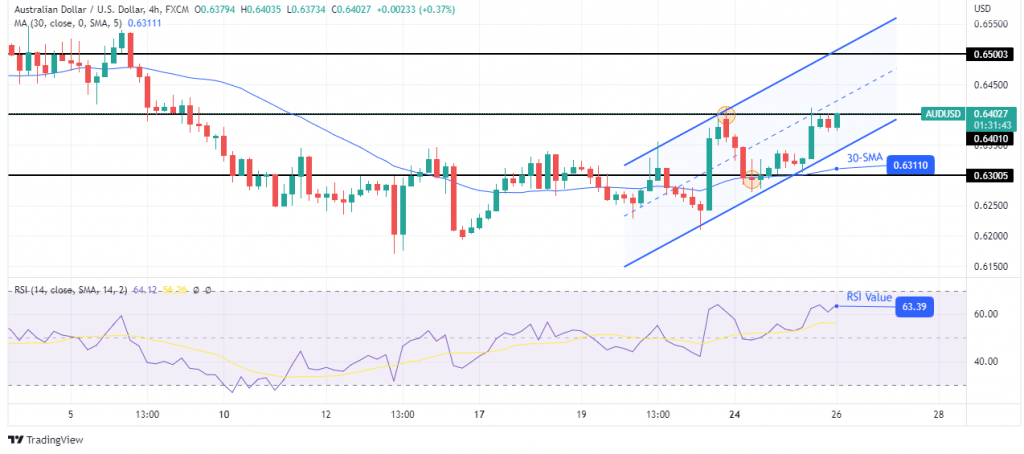

AUD/USD technical price analysis: Bulls looking to post a higher high above 0.6401

Looking at the 4-hour chart, we see the price trading well above the 30-SMA and the RSI above 50, showing bulls are in charge. The price trades within a bullish channel with clear support and resistance lines, further confirming the uptrend.

–Are you interested to learn more about making money in forex? Check our detailed guide-

Bulls have paused at the 0.6401 previous high and will likely take it out for a new high. A break above this level would allow the bulls to head for the next resistance level at 0.6500. The bullish bias will remain if the price stays above the 30-SMA.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.